What are ETFs?

By Adrian Mohammed – Senior Investment Analyst, Research & Analytics

Commentary

Definition and Characteristics

An Exchange Traded Fund (ETF) is an investment product that offers investors a way to pool their money into a fund that invests in various securities such as stocks, bonds, currencies, options or a blend of assets. It is designed to track the performance of a specific index, sector, commodity, or asset class and are bought and sold on stock exchanges, just like individual stocks, and their shares can be traded throughout the trading day at market prices.

Brief History of ETFs

ETFs emerged out of the index investing phenomenon in the late 1980s and early 1990s as a way to provide access to passive, indexed funds to individual investors. The first attempt to establish an ETF was the launch of the Index Participation Shares in 1989, which was set to track the S&P 500 index. However, due to legal obstructions, it never made it to an exchange. In 1990, another attempt was made to launch an ETF to track the Toronto Stock Exchange but this was not successful as well. The first successful launch of an ETF was in January 1993 when the firm State Street piloted the SPDR S&P 500 ETF with USD6.5 million in assets.

Growth and Performance of ETFs

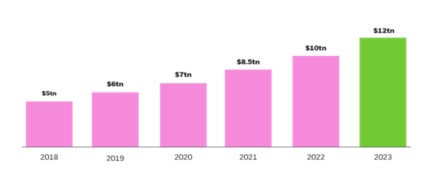

Since the launch of the first ETF in 1993, the industry has experienced exponential growth. The total Assets Under Management (AUM) of the ETF market in the US and Europe is estimated to be approximately USD6.7 trillion as at December 2022. Globally, AUM is approximated at USD10 trillion.

Some of the largest ETFs by AUM are managed by Black Rock Financial Management (USD2.23 trillion), Vanguard (USD1.90 trillion), State Street (USD926.66 billion), Invesco (USD329.13 billion) and Charles Schwab (USD262.17 billion)1. Globally, ETF AUM is expected to grow to USD12 trillion by the end of 20232 and up to approximately USD15 trillion by 20273

Growth of the ETF Market

Source: BlackRock Global Business Intelligence

1 Data as at 11 January 2023

2 BlackRock Global Business Intelligence

3 PWC 2021 Global ETF Survey

Types of ETFs

Investors can select from a myriad of ETFs in the market. Some ETFs are passively-managed funds that seek to achieve the same return as a particular market index (often called index funds), while others are actively managed funds that buy or sell investments consistent with a stated investment objective. The following graphic displays common types of ETFs:

Common Types of ETFs

Source: Intuit Mint

Advantages and Disadvantages of ETFs

The structure of an ETF has multiple advantages in relation to other investment vehicles that make them appealing to an investor. The nature of ETFs allows for the construction of well-diversified portfolios that may be focused on a given part of the market or offer broad exposure to major asset classes. ETFs also affords flexibility as investors can buy and sell ETFs on an exchange for the duration of the trading day. ETFs can be purchased on margin, sold short and allow for the use of limit and stop orders. ETF investors can use stop-loss and sell stop-limit orders to ensure they lock in profits and limit severe drawdowns in the event of a sharp market decline.

ETFs typically have lower expense ratios (cost to operate and manage the fund) as client service-related expenses such as monthly statements, notifications and transfers are passed onto brokerage firms. Investors in an ETF can benefit from lower capital gains taxes as taxes are only payable upon sales of the ETF versus mutual funds which incur capital taxes throughout the life of the investment.

While there are benefits for investing in an ETF, there are some associated disadvantages. One such disadvantage is the potential for tracking error. Although ETFs are designed to track the performance of a specific index or asset class, there can be a slight discrepancy between the ETF’s performance and the actual returns of the underlying index. This discrepancy is termed tracking error and can occur due to factors like management fees, transaction costs, and the timing of portfolio rebalancing. It’s important for investors to compare an ETF’s historical performance with its underlying index to evaluate its tracking accuracy.

Unlike individual stocks where investors can select the specific securities or tailor their holdings for a particular investment strategy, this flexibility is not offered in ETFs. ETFs are designed to track specific indices or asset classes thus the investment securities will mirror the particular index or asset class. As a result, investors cannot pick and choose specific securities or customize the ETF’s holdings to their preferences.

Since its inception into the investing world in the early 1990s, ETFs have revolutionised the market and have quickly become a staple choice for investors. ETFs are a great investment vehicle for varying economic conditions as fixed income ETS can be utilized for recessionary periods whereas equity ETFs can be used for boom cycles. The ability to provide a low cost, tax efficient and diversified option to investors would continue to make ETFs a highly attractive investment vehicle and propel its growth well into the future. It’s important to note that while ETFs offer these benefits, investors should still carefully evaluate each ETF and consider factors such as the fund’s objective, underlying assets, expense ratios, and historical performance before making investment decisions

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.