OPEC

By Nicketa Rattan – Investment Analyst, Research & Analytics

Commentary

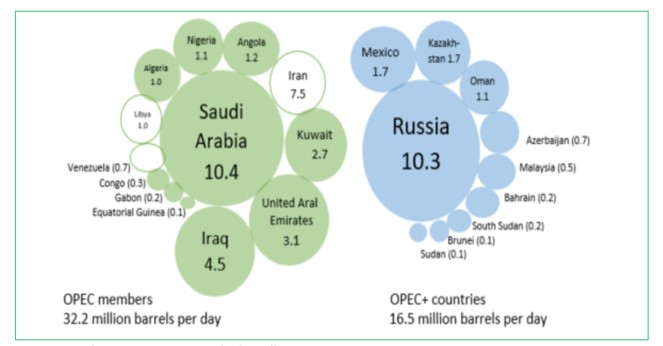

Many of the largest oil-producing countries in the world are part of an alliance known as the Organization of the Petroleum Exporting Countries (OPEC). OPEC is an intergovernmental organization consisting of 13 member countries that control a significant portion of the world’s oil reserves and production, giving them considerable influence on global energy markets. The member countries are Algeria, Angola, Congo, Equatorial Guinea, Gabon, Iran, Iraq, Kuwait, Libya, Nigeria, Saudi Arabia, United Arab Emirates (UAE) and Venezuela. Founded in 1960, OPEC was formed to coordinate and unify policies of its member countries in the oil industry with the objective of ensuring stable oil markets and fair prices for both producers and consumers alike.

In 2016, the original member countries of OPEC and a group of non-OPEC oil-producing nations that include Russia, Kazakhstan, Azerbaijan, Bahrain and Mexico formed OPEC+. The OPEC+ alliance was formed due to several reasons, with the primary driver being oil price volatility. Oil prices fell significantly in mid-2014 owing to oversupply and sluggish global demand. Such low prices prevailed for a prolong period of time which negatively impacted oil-producing nations. Shortly thereafter, OPEC+ agreed to cut production by 1.8 million barrels per day (bpd), which helped to reduce the global supply glut which boosted oil prices.

Another driver of the formation of OPEC+ was the rising influence of countries who had become significant players in the global oil market, with their production levels and market dynamics impacting global oil prices. Engaging these large non-OPEC producers would ultimately benefit OPEC producers as they strive to manage production levels and stabilize prices.

Since then, OPEC+ has continued to implement production cuts, albeit with some fluctuations and adjustments along the way. Over the years, OPEC+ has emerged as a dominant force in the energy industry, with its decisions and policies having a significant impact on the global economy.

OPEC and its Influence on the Energy Industry

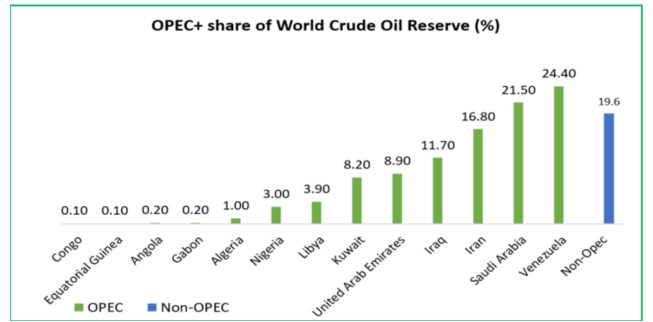

OPEC has a significant impact on the global energy economy due to its control over oil production and reserves. According to Energy Information Administration (EIA), the organization produces roughly 40% of the world’s oil, and their exports make up around 60% of global petroleum trade. In 2021, OPEC member countries held approximately 80.4% (1.2 billion barrels) of the world’s proven crude oil reserves and accounted for approximately 37% of the world’s crude oil production, making it a dominant player in the global oil market.

The organization influences the supply and price of oil in the international market by coordinating production levels among its member countries, with the aim of preventing extreme price fluctuations.

OPEC+ actively engages in price management through its production quotas. The organization sets production targets for its member countries, limiting the amount of oil they can produce and export to the global market. By controlling the supply of oil, OPEC aims to maintain stable prices and prevent excessive price volatility. When OPEC countries collectively reduce their production, it leads to a decrease in the global supply of oil, which can result in higher oil prices. Conversely, when OPEC countries increase their production, it can lead to oversupply and lower oil prices. Such actions seek to maintain price levels within a desired range, thus ensuring stability and sustainability in the energy industry.

FIGURE 1: OPEC+ Total oil production (million barrels per day) 2022

Source: EIA Short-Term Energy Outlook April 2023

FIGURE 2: OPEC+ percentage share of world Crude Oil Reserve, 2021

Source: OPEC Annual Statistical Bulletin 2022

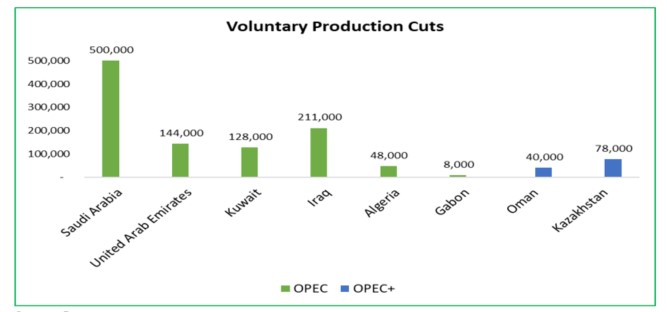

Near-Term Outlook for Energy Prices

In April 2023, Saudi Arabia and other OPEC+ oil producers announced further oil production cuts of around 1.16 million barrels per day (bpd), with the voluntary cuts commencing in May 2023 and lasting until the end of the year. The latest reduction in output came as a surprise to the market, as in October 2022, OPEC+ agreed to an output cut of 2 million bpd starting November 2022 until the end of 2023. According to OPEC+, their decision to reduce production levels was a precautionary measure aimed at supporting stability in the oil market in case of any possible reductions in demand given the global recessionary pressures. According to Reuters, this oil cut brings the total volume of cuts by OPEC+ to 3.66 million bpd which equals to about 3.7% of global demand.

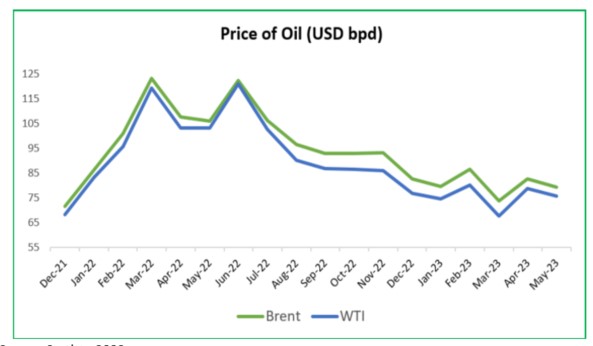

In March 2023, Goldman Sachs forecasted that by the end of the year, Brent crude oil prices could increase to a high of USD107 per barrel if OPEC stood by their production targets. The price of Brent crude oil at that time was around USD84 per barrel. They also stated that higher demand from China following the lifting of its COVID-19 restrictions and little increase from non-OPEC production this year could prompt OPEC to increase their production target at their June meeting, which could result in prices for Brent crude oil, hovering around USD90. However, Goldman Sachs has since revised its projection for Brent oil price from USD90 to USD95 per barrel by the end of the year.

According to EIA, Brent crude oil fell from an average of USD85 per barrel in April 2023 to close at USD73 on May 4, 2023. They expect seasonal increases in oil consumption and a drop in OPEC crude oil production to put some upward pressure on crude oil prices in the coming months. They also forecast an increase in global liquid fuel consumption by 1.6 million bpd in 2023 and by 1.7 million bpd in 2024. EIA also expects this demand growth will bring the global oil market into balance between Q3 2023 and Q1 2024 and push the Brent price from current levels back to between USD75 per barrel and USD80 per barrel.

In November 2022, after OPEC announced its first production cut, oil prices fell from a high of USD97.92 in November 2022 to USD77.99 in December 2022. Oil prices for the month of March 2023 fell to USD73.79 a barrel, the lowest it has been since December 2021. On April 2, 2023, OPEC+ announced an unexpected supply cut, which immediately caused a USD7 barrel increase in North Sea Brent crude oil to USD85 per barrel. However, the rally seemed to be temporary as prices reverted to its previously declining trend. On May 16, 2023, the price of Brent crude oil was USD75.95 per barrel, while the price for Western Texas Intermediate (WTI) oil stood at USD71.98.

FIGURE 3: OPEC Voluntary Production Cuts (bpd), 2023

Source: Reuters

FIGURE 4: Crude Oil Prices

Source: Statista 2023

OPEC Decisions and the Impact on Investments

OPEC+’s influence does not only affect economies, but also financial markets. The most direct impact of the bloc’s actions will be felt by companies that operate in the energy sector. Changes in oil production levels and in turn prices usually have a significant impact on the profitability and earnings of companies that operate in the energy sector. OPEC+’s decision to further lower production levels in April 2023 can positively impact companies in the energy sector as profitability may rise, enhancing their financial strength and investor sentiment.

Industries that are heavily reliant on energy such as transportation, airlines and manufacturing are also impacted by OPEC+’s actions. Price fluctuations directly affect their input costs, and in turn profitability and overall business viability. Higher expected oil prices in the near future due to the production cuts by OPEC+ can increase transportation cost for many companies and negatively impact logistics companies, the automobile industry and airlines.

With energy being a significant input to several industries in the form of transportation and production cost, energy prices play a crucial role in consumer prices. The production cuts may lead to higher energy prices that can further stoke inflationary pressures and potentially keep interest rates higher for longer. At the start of 2022, inflationary pressures were fuelled by high energy and commodity prices following Russia’s invasion of Ukraine. To temper the rise in consumer prices, several central banks adopted a tighter monetary policy posture and aggressively hiked their benchmark interest rate, with the objective of taming overall demand. Given the inverse relationship between interest rates and bond prices, higher energy prices may encourage central banks to continue increasing interest rates, negatively impacting the pricing and performance of bonds.

Given OPEC’s wide-ranging reach, it is important for investors to stay informed on the decisions made by the organization and analyse the potential impact on their investment portfolio. The decisions are often not immediate, hence investors may have time to understand and interpret the information and pivot accordingly.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment, or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.