Market Review: Fourth Quarter of 2025

Insights

International Market Review

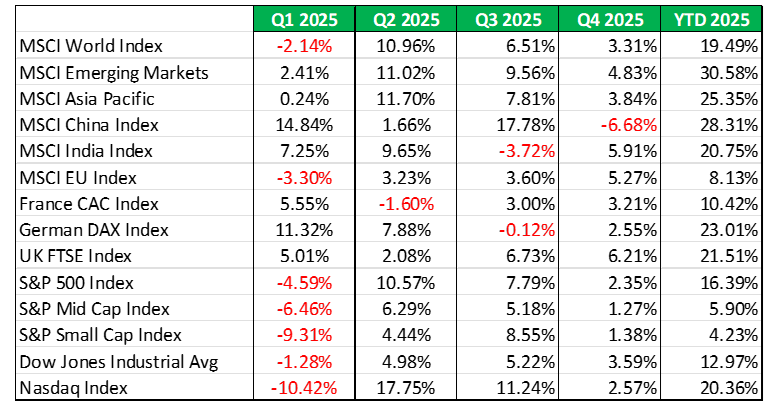

Global equities extended their rally in the last quarter of the year, supported by expectations of lower interest rates, solid earnings and easing US-China trade tensions. For the quarter ending December 2025, the MSCI World increased 3.31%, bringing the year-to-date return to 19.49% while Emerging Markets gained 4.83%, up a staggering 30.58% for the year, significantly outperforming their advanced peers.

U.S. Stocks

The slowdown in market momentum that began in the third quarter of 2025 carried into the final quarter of the year. Despite two interest rate cuts by the U.S Federal Reserve, it was not enough to fully offset disappointing corporate earnings and heightened geopolitical and economic uncertainty.

The quarter opened with a 43-day shutdown of the U.S. federal government, the longest in the nation’s history. This shutdown was caused by political gridlock in Congress over funding legislation, which led to the suspension of many non-essential government services.

One major consequence of the shutdown was the delay of critical economic data releases. The absence of this data created what investors refer to as a “data vacuum,” making it difficult to assess the true health of the economy. This lack of clarity increased market uncertainty and led to greater price swings. Additionally, many government employees were furloughed, meaning they were temporarily sent home without pay, further weighing on economic sentiment

Investor confidence was further shaken by disappointing earnings from leading artificial intelligence companies, particularly Nvidia. While the company disclosed heavy capital expenditures (capex), its return on investment (ROI), which measures how much profit those investments generate, fell short of expectations. As a result, Nvidia’s outlook for future growth, known as forward guidance, was weaker than anticipated. Similar cautionary guidance on earnings for peers such as AMD and Broadcom raised concerns that the rapid expansion of the AI sector may be slowing due to market saturation. These developments fuelled fears that the so-called “AI bubble,” which had powered much of the stock market’s gains in 2025, might be at risk of deflating.

As investors struggled with incomplete information and rising volatility, many chose to reduce risk, leading to periods of selling. Consequently, between October and December 2025, major U.S. stock indices, the S&P 500, the Dow Jones Industrial Average and the Nasdaq Composite recorded only modest gains, a noticeable step down from the stronger performance seen in the previous quarter.

Europe

European equity markets remained sluggish in the fourth quarter of 2025, with most major indices posting only modest gains. In France, the CAC 40 rose 3.21%, little improved from the previous quarter, as investor confidence was weighed down by political tensions following Prime Minister Sébastien Lecornu’s resignation and reappointment. Concerns were compounded when S&P Global Ratings downgraded France’s sovereign credit rating to A+, reflecting ongoing political instability and the potential for higher borrowing costs.

Germany’s equity market posted a modest rebound in Q4 2025, gaining 2.55% after a slight decline in Q3. The recovery was driven by a €500 billion-plus infrastructure stimulus to upgrade roads, railways, and green energy, which lifted industrial and construction stocks. Investor sentiment was further supported by a temporary easing of U.S. tariff threats, stabilizing export demand to the U.S. and China.

In contrast, the U.K. market outperformed, with the FTSE 100 reaching a record high, supported by higher energy prices and a relatively dovish stance from the Bank of England. Confidence was also boosted by regulatory changes, the Financial Conduct Authority exempted individual short sellers, investors who profit when share prices fall, from public disclosure, aligning with U.S. practice. This move was seen as enhancing market liquidity and the competitiveness of U.K. financial markets

Table 1: International Stock Indices Performance (Local Currency Returns)

Emerging Markets

Emerging market equities continued to outperform developed markets in the fourth quarter of 2025, supported by a weaker U.S. dollar and generally resilient economic conditions. However, this leadership masked growing divergence within the asset class, as strong performances in fast-growing economies such as India contrasted sharply with weaker and more volatile outcomes in China.

The U.S. dollar fell roughly 9% against major currencies in Q4 2025, giving a boost to emerging market returns by increasing the value of dollar-denominated assets in local currencies. Strong economic fundamentals further supported performance, with India leading the way at 8% growth, driven by higher government spending, targeted tax cuts, and robust technology exports. Southeast Asian economies also benefited from rising demand in electronics and manufacturing as global firms diversified supply chains, supporting regional growth and corporate earnings.

By contrast, Chinese equities faced sharp volatility and ended the quarter lower. Rising U.S.–China trade tensions, including threats of new tariffs and tighter controls on rare earth exports, reversed September’s stimulus-driven rally. Economic momentum also slowed, with GDP growth dipping to 4.8% year-on-year, the slowest since late 2024, amid trade pressures, a prolonged property slump and weak consumer spending. Retail sales grew at their slowest pace in a year, and unemployment remained near a six-month high, casting doubt on the durability of the recovery.

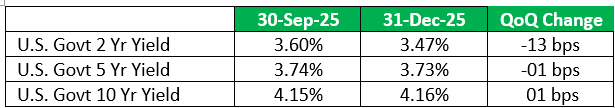

U.S. Treasury Yields

U.S. Treasury yields declined across short- and medium-term maturities in Q4 2025, reflecting a steepening yield curve as short-term rates fell more sharply following two Federal Reserve rate cuts and softer economic data. The 2-year yield dropped about 13 basis points, while the 5-year yield fell just 1 basis point, reflecting expectations of further monetary easing.

By contrast, long-term yields were more resilient. Investors remained cautious about inflation and the U.S. government’s rising fiscal deficit, pushing the 10-year yield up 1 basis point and the 30-year yield up 11 basis points. The Fed’s preferred inflation gauge, the PCE Price Index, rose to 2.8% year-on-year in September, above the 2% target, prompting investors to demand higher returns for holding long-term debt amid elevated borrowing and inflation risks.

Table 2: U.S. Treasury Yields

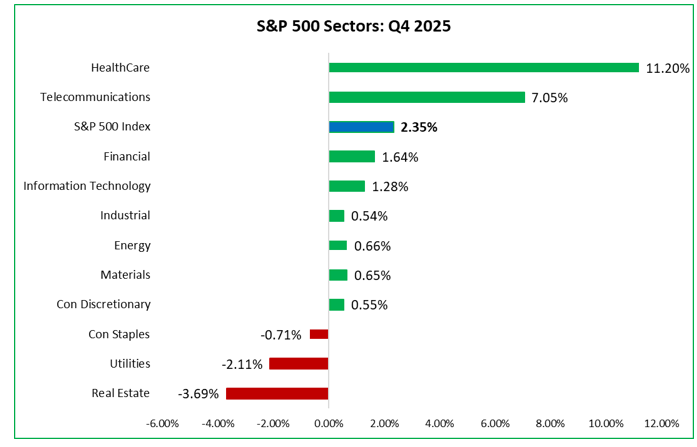

US Sector Performance

The Information Technology sector lost its leadership in Q4 2025 as several high-profile AI companies reported weaker-than-expected earnings, prompting investors to shift toward more stable sectors.

Health Care emerged as the top performer, with an 11.20% quarterly return, driven by policy clarity and optimism around blockbuster drugs. Pharmaceutical and biotechnology stocks benefited from President Trump’s Most Favoured Nation executive order, which linked Medicare reimbursements for select high-cost medicines to the lowest prices in peer countries, reducing pricing uncertainty and restoring confidence for research and development, fuelling investor enthusiasm.

Figure 1: U.S. Sector Performance: Q4 2025

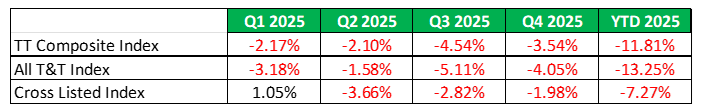

Local Market Review

The deep weakness that defined much of 2025 persisted into the final quarter, with all major indices remaining firmly in negative territory. The steepest decline was recorded by the All T&T Index, which fell by 4.05% over the quarter. This was followed by the Composite Index, down 3.54%, and the Cross Listed Index, which declined by 1.98%. On a full-year basis, losses were even more pronounced, with the All T&T Index, Composite Index, and Cross Listed Index ending 2025 down 13.2%, 11.8%, and 7.3% respectively.

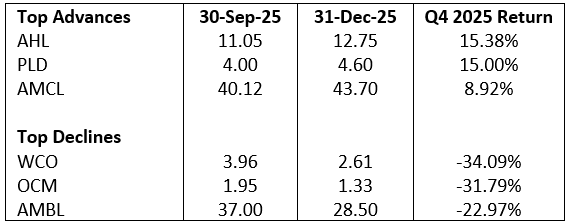

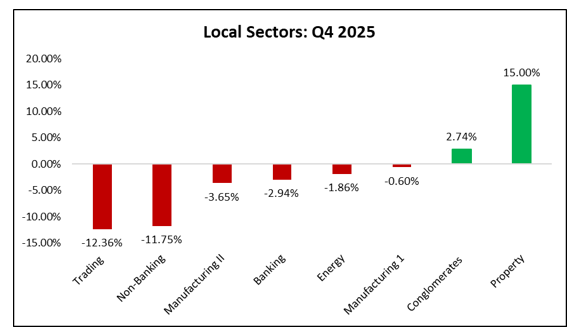

Market weakness was broad-based, as only five stocks recorded positive returns during the quarter. Angostura Holdings Limited (AHL) and Plipdeco (PLD) were notable exceptions, each gaining about 15%. At the sector level, the Property sector stood out with a strong 15% advance, while Conglomerates posted a modest gain of 2.74%, supported by ANSA McAL (AMCL). In contrast, sharp declines in AS Bryden (ASBH), ANSA Merchant Bank (AMBL), and JMMB Group (JMMBGL) dragged the Trading and Non-Banking Financial sectors down by more than 10%, reinforcing the overall negative tone across the market.

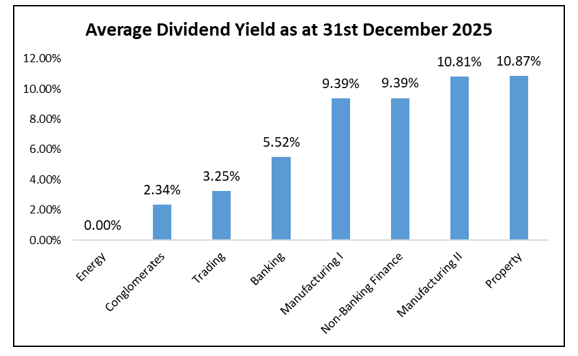

Despite a contraction in TTSE market indices, the average dividend yields as of December 31, 2025, showcase encouraging opportunities across sectors. Property and Manufacturing II led impressively in excess of 10%, followed by Non-Banking Finance and Manufacturing I at 9%. The Banking sector provided a solid 5.52%, while Trading and Conglomerates offered foundational yields at 3.25% and 2.34%%, underscoring selective income potential for investors navigating broader market challenges.

Table 3: Local Stock Indices Performance

Table 4: Top Advances and Declines: Q4 2025

Figure 2: Local Sector Performance: Q4 2025

Figure 3: TTSE Average Dividend Yield

Equity Markets Outlook

Global equities face a cautiously optimistic outlook for 2026, tempered by formidable headwinds that could disrupt steady progress. Uncertainty around US central bank leadership, rising geopolitical tensions, and a crowded global political calendar suggest that market progress may be uneven and volatility elevated.

A key focus is the U.S. Federal Reserve, as Chair Jerome Powell’s term expires in May 2026. Markets are wary that political pressure for deeper rate cuts could undermine the Fed’s independence, raising the risk of overly accommodative policy and renewed inflation. Geopolitical strains, intensified by U.S. actions in Venezuela and heightened rhetoric toward Colombia, Cuba, Mexico, and Greenland, add to instability, threatening supply chains, energy prices and trade flows.

Political risk is further amplified by U.S. midterm elections in November and presidential contests in Hungary, Brazil, and Colombia. Together, these factors may foster a risk-off environment, where investors favour safer assets over higher-risk investments. While opportunities remain, navigating 2026 will require close attention to policy signals, geopolitical developments and election outcomes worldwide.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.