Global Interest Rate Outlook

Insights

The global economy has struggled to find a stable footing since the COVID-19 pandemic, facing persistent challenges with which policymakers continue to grapple. The role of monetary policy globally has become increasingly important in light of trade policy uncertainty, and geopolitical tensions. After a period of interest rate syncds hronization to address the pandemic related economic downturn, and the surge in inflation as global economies recovered, policy uncertainty now pervades. A large part of the uncertainty comes from the tariffs implemented by the US since April 2025 – which have altered inflation and growth expectations drastically for the US and the wider global economy. As a result, central banks now face more challenges in adjusting their interest rates to balance renewed inflation risks, and the possibility of slower economic activity in an increasingly volatile global environment.

Understanding Interest rates

Why is the Policy Interest Rate important?

In its simplest form, the policy interest rate is a tool which the monetary authority of a country, typically a central bank, uses to exert its influence on the economy. Adjustments to the policy interest rate influence consumption and investment to achieve overall monetary policy goals. The policy interest rate also affects the financial markets by influencing the rate at which financial institutions lend and borrow money. The monetary authority monitors the performance of the economy and a Monetary Policy Committee (MPC) votes on the necessary adjustment needed to meet its specific goals, which can vary by country. Some of the objectives of monetary policy are stable prices, maximum employment, and economic growth or a combination of these.

Factors which are considered by the MPC of a central bank can be both internal and external developments, including:

- Domestic economic activity

- Global economic dynamics

- Current inflation, as well as inflation expectations

- The unemployment rate

US Interest rates

The US Federal Reserve’s (Fed) policy interest rate, the federal funds rate, is one of the most influential interest rates in the world given the size and influence of the US on the global economy. The federal funds rate is the interest rate that US commercial banks can borrow overnight from each other.

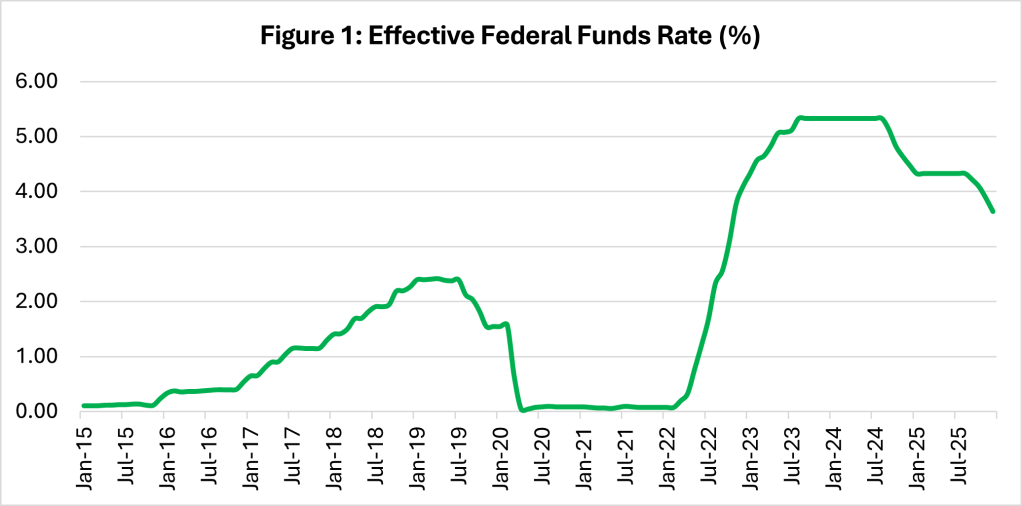

Additionally, the federal funds rate affects the yields at which US Treasury Bills and Notes are issued and traded for on the market, serving as a guide for other sovereign and corporate bonds since US Treasuries are considered risk-free assets. The Fed adjusts its rate based on its dual mandate of achieving maximum employment and price stability, with the latter being a medium-term inflation target of 2%. The rate adjustment is determined by the Federal Open Market Committee (FOMC) – a 12-member committee – which considers domestic and global economic trends. Since 2022, the Fed has been battling to limit the effects of inflation on the US economy, hiking interest rates to record levels following a surge in consumption and inflation, before beginning a rate-cutting cycle from September to December 2024 as inflation started to cool somewhat.

After five consecutive meetings of keeping the interest rate steady, the FOMC resumed its interest rate cutting cycle in a similar fashion to 2024, with three consecutive interest rate cuts in the final quarter of 2025. The federal funds rate was cut by a combined 75bps to its current range of 3.50% – 3.75%, with one of the three cuts implemented without data from the Bureau of Labour Standards (BLS) due to the US government shutdown. The rate cuts came as inflation remained above the Fed’s target, and unemployment worsened. The pass-through of tariffs into inflation in the US has been gradual, due to US imports surging by 22.7% year-on-year in Q1’25 according to data from the US Bureau of Economic Analysis (BEA). In its first release since the 43-day government shutdown, the BEA estimated annual inflation at 2.7% for November 2025, a result which may draw some hesitancy from markets since comparative data for October 2025 is unavailable. The unemployment rate on the other hand continues to worsen, coming in at 4.6% in November 2025, the highest level since September 2021. Though the October 2025 unemployment rate is unavailable, the increased rate in November continues an upward trend which started in July 2025.

Forecasts from Business Monitor International (BMI) indicate that inflation is expected to work its way down to the Fed’s 2% target, forecasted to average 2.5% in 2026 and 2.2% in 2027. The unemployment rate will remain elevated at an average of 4.5% in 2026 but will decline slightly to 4.3% in 2027.

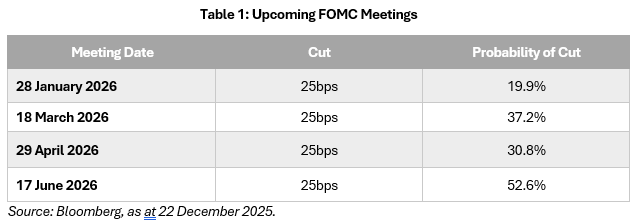

Forecasts from Bloomberg suggest relatively low chances of the Fed reducing rates in its first three meetings in 2026, with rate-cut expectations picking up slightly in the middle of the year. Part of this is due to current Fed chair Jerome Powell’s term coming to an end in May 2026.

EU Interest Rates

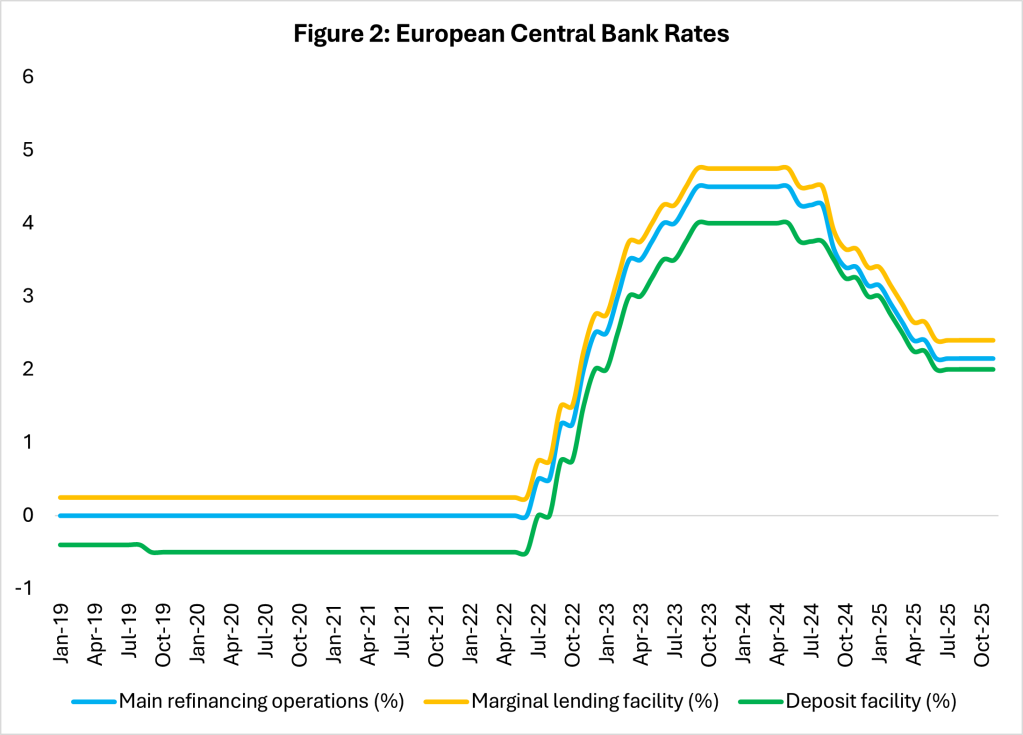

In the European Union (EU), the policy interest rate is set by the European Central Bank (ECB), via three key rates:

- Deposit facility: This is the primary rate which the ECB uses to guide its monetary policy stance as it affects commercial bank overnight deposits at the central bank. This rate serves as a floor for interest rates in the EU and guides economic activity as higher rates encourage commercial banks to keep more deposits with the ECB, lowering liquidity and lending.

- Main refinancing operations: This interest rate affects what commercial banks pay to borrow funds from the ECB on a weekly basis. To borrow the funds from the ECB, commercial banks require collateral, which usually takes the form of highly rated corporate securities, or government/central bank securities. The rate on the main refinancing operations is slightly above the deposit facility.

- Marginal lending facility: This rate is closely related to the main refinancing operation rate. It has a similar function in that it provides funds but requires collateral, however, funds are lent overnight (one day). This line is typically used in emergency situations when banks in the EU require emergency funding. The rate on this facility is the highest of the three.

Source: European Central Bank (ECB)

The ECB has adopted a more accommodative stance when compared to the US Fed, cutting rates by a total of eight times since June 2024 as the bloc’s inflation rate converged towards its 2% target faster than in the US. This momentum has slowed as prospects for the bloc’s performance are mixed. The tariffs from the US may decrease the demand for European commodities, weakening already fragile economies, particularly the bloc’s three largest economies – Germany, France, and Italy. In its Autumn 2025 update, the European Commission forecasted that inflation in the euro area will remain close to its 2% target, averaging 1.9% for 2026, and 2% for 2027. It is unlikely that the ECB will cut rates further as the chair, Christine Lagarde, has noted in previous meetings in 2025 that the rate is at a “good place” to manage shocks to the global economy.

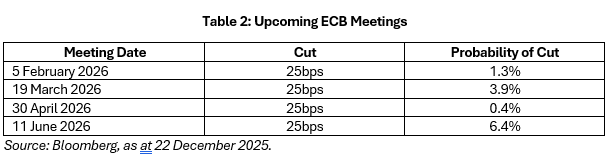

Considering the aforementioned, it is likely that the ECB cutting cycle has levelled off at its current rate of 2% for the deposit facility. Forecasts from Bloomberg support this, with very low expectations of adjustments at their 2026 meetings at the time of writing:

Conclusion

Markets are currently faced with their highest level of uncertainty since the COVID-19 pandemic, with geopolitical conflicts, and changing trade policy all driving uncertainty. Monetary policymakers have a difficult task ahead, balancing policy decisions against this environment and developments in their domestic economies. In the US, rates are expected to remain steady until June 2026, though this may change should actual data indicate the need for earlier cuts. In the EU, with inflation reaching the target level in June 2025, and the expectation that it will remain within target, it is likely that the ECB will keep its interest rate steady throughout 2026.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment, or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.