At the Crossroads: France’s Potential EU Exit

Insights

France stands at a pivotal moment in its modern history, with growing political instability and economic challenges reigniting debate over its future in the European Union (EU). Once seen as an unwavering architect of continental unity, the nation now finds itself torn between its foundational role in the EU and rising nationalist momentum pushing for a potential exit—a scenario widely referred to as “Frexit”. Against the backdrop of populist voices, government turmoil, and public discontent with European bureaucracy, France’s deliberations have sparked profound divisions at home and spread uncertainty throughout Europe. As one of the union’s largest and most influential members, the possibility of Frexit threatens to reshape the political, economic, and social balance across the entire region.

Historical Context of France’s Membership in the EU

France has been a founding member of European integration since the establishment of the European Coal and Steel Community in 1951, alongside Belgium, Germany, Italy, Luxembourg, and the Netherlands. As a key architect of the 1957 European Economic Community, the precursor to the modern European Union, France has progressively deepened its integration through joining the Schengen Area in 1995 and adopting the euro in 1999. Today, France remains central to EU governance, with Paris serving as one of the Union’s primary decision-making hubs.

France operates as a major political and economic force within the EU. As a semi-presidential republic, it maintains substantial representation across key EU institutions including the European Parliament and various advisory committees. Economically, France ranks as the EU’s second largest economy, contributing approximately 16% of the bloc’s total GDP. With a population exceeding 68 million in 2024, France is also the EU’s second most populous member state, deeply integrated through extensive trade networks, migration flows, and cultural exchanges, making any potential exit profoundly consequential for both France and the broader European project.

Despite its foundational role, French public opinion toward deeper integration has been uncertain. In 2005, when asked to approve a new European Constitution, French voters decisively said no, revealing deep concerns about losing national control, cultural identity, and frustrations with EU bureaucracy. Leaders like Jacques Delors have championed the idea that Europe’s diversity is a strength to cherish, but bringing this vision to life at home has proven difficult.

President Emmanuel Macron initially brought fresh energy and a pro-European spirit to French politics, pushing for reforms and greater cooperation. In 2024, he renewed France’s commitment to the EU, insisting that “Europe that protects is not a vague promise but an imperative for our future.” Still, ongoing political and economic pressures continue to challenge national unity over Europe’s path forward.

Reasons for considering Frexit

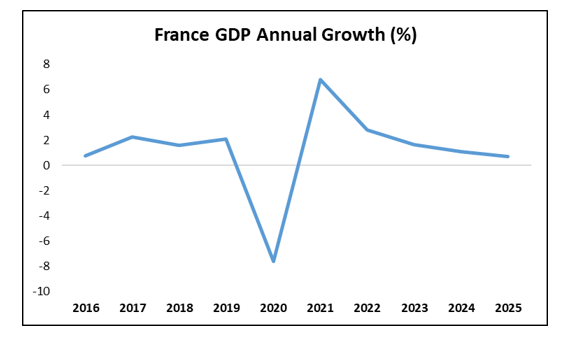

Rising Frexit sentiment in France stems from intertwined economic, political and social factors. Economic frustrations have grown as France’s GDP averaged only 1.1% annually between 2015 and 2024, lagging behind the UK’s post-Brexit growth, while public debt exceeded 110% of GDP. Many citizens perceive EU fiscal rules and bureaucratic oversight as restrictive, limiting France’s ability to implement independent economic policies, which fuels discontent. Political instability, including consecutive government collapses from 2024 to 2025, has further weakened trust in national institutions and intensified calls for change.

Populist and Eurosceptic groups, which are political movements that are critical of the EU and skeptical about the merits of deeper European integration, have tapped into public frustrations, especially the far-right National Rally led by Marine Le Pen, which now calls for a referendum on France’s EU membership. These movements argue that Brussels threatens French sovereignty, emphasizing anxieties about immigration, strict EU rules, and the protection of national identity. While most French people still support remaining in the EU, polls in 2025 reveal that about 30% would prefer to leave, showing that the call for Frexit has become louder and more present in public debate.

A Frexit would have far-reaching consequences for France and Europe alike. Politically, it would diminish France’s leadership in the EU and could spur other countries to reconsider their own membership, endangering the stability of the entire bloc. At home, such a move would likely stoke rifts and sharpen divisions over national direction.

A French exit from the European Union would present profound economic tradeoffs. Proponents argue that France could reclaim its annual EU contribution of approximately 9 billion euros and, if also abandoning the euro, regain independent monetary policy control to respond to domestic economic conditions. However, analytical research suggests these gains would likely be overshadowed by substantial costs. France’s economy, which grew modestly at 1.1% in 2024, could face significant headwinds: Brexit-style market reactions would likely trigger global equity selloffs, while UK Government analyses indicate that similar exits have stunted economic growth by 2-8% over at least 15 years. French businesses, deeply integrated into EU supply chains, would confront new trade barriers and tariffs with their largest trading partners, while loss of single market access would undermine the competitiveness of French exports. The net economic calculation thus appears unfavorable; the recovered contributions and policy autonomy would constitute a fraction of the potential GDP losses and trade disruptions that characterized Britain’s post-Brexit experience.

Figure 1: France GDP Growth

Figure 2: France Net Debt to GDP

Implications for the European Union

France’s departure from the European Union would fundamentally reshape the bloc’s political and economic landscape. As one of the EU’s largest economies and a key military power, France plays a critical role in shaping collective financial policies and providing leadership. Its exit would significantly amplify Germany’s influence, potentially disrupting the careful equilibrium between northern and southern member states and creating new divisions within the union. Economically, losing France would undermine the Eurozone’s financial stability, diminishing the scale and appeal of the single market and weakening the EU’s position on the global stage.

Politically, a Frexit could embolden Eurosceptic movements across member countries, increasing the risk of further withdrawals and weakening trust in the EU’s future. Moreover, the loss of France’s diplomatic weight would impair the EU’s ability to act decisively on global issues such as security, climate change, and trade negotiations. This shift could also trigger a reevaluation of EU governance structures, as remaining members reassess the balance of power and integration strategies to maintain cohesion. Ultimately, the departure would pose a profound challenge to the European project, jeopardizing decades of efforts toward deeper unity and cooperation.

Comparison with the UK’s Brexit Experience

The United Kingdom (UK) 2016 Brexit referendum stands as a cautionary tale for France. Driven by populist appeals to sovereignty and anti-elite sentiment, Brexit exposed deep divisions in British society and triggered years of political and economic upheaval. France now faces echoes of that unrest, but with far stronger institutional and cultural ties to the European Union, making any Frexit far more complicated and potentially more damaging.

In recent years, France has seen political turbulence, unpopular fiscal policies, and mounting public frustration, fueling renewed talk of an EU exit. Still, President Emmanuel Macron remains firmly pro-European, urging closer cooperation even with the post-Brexit UK. Opinion polls suggest that while many French citizens are disillusioned, most continue to support EU membership, wary of the chaos and costs that would accompany departure.

The lessons from Brexit are stark. Britain endured trade disruptions, investment slowdowns, and higher living costs, with London losing some of its financial dominance to European cities like Paris and Frankfurt. Yet the overall toll was steep. For France, whose economy and influence are deeply interwoven with the EU, leaving the bloc would risk even greater economic shock and geopolitical fallout.

Conclusion: What to Expect?

While the idea of Frexit is still only a possibility, the rise of Eurosceptic attitudes has made France’s place in the European Union a major political and economic concern. The UK’s experience with Brexit showed that leaving the EU led to serious economic problems, lost access to the single market, unstable currency values, and difficult political changes. Because France is even more closely woven into EU structures, leaving would likely bring similar or even greater challenges.

For investors, talk of Frexit fuels uncertainty, making France less attractive and potentially causing money to leave the country and markets to become much more volatile. However, sound policies and France’s underlying economic strengths could help soften some of these effects if managed carefully.

Beyond economics, Frexit is about national identity, sovereignty, and the future of European unity. If it ever happens, it would mark a major turning point for France, the EU, and global financial markets, bringing complex and far-reaching consequences that would unfold over time.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment, or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.