Mexico: Survivor or Victim?

Insights

Overview of Mexico Economic Position

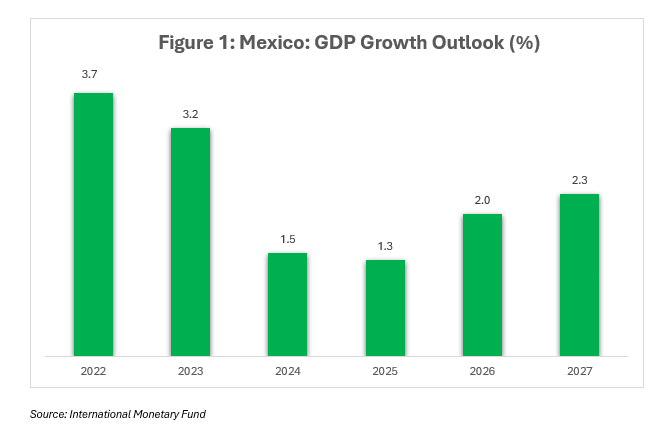

Mexico’s economic performance in 2024 was marked by volatility, with a brief revival in the third quarter followed by a sharp contraction in the final months of the year. The unexpected surge in GDP during Q3 prompted the Bank of Mexico to revise its annual growth forecast upward from 1.5% to 1.8%. However, weaker-than-expected activity in Q4 tempered these gains, resulting in an annual GDP growth rate of 1.5%.

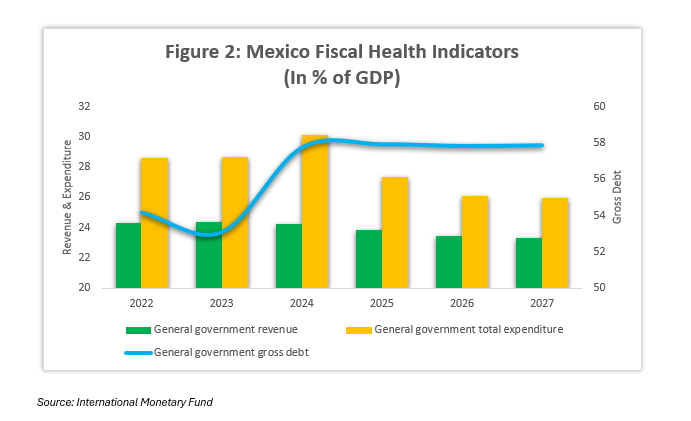

Meanwhile, Mexico’s fiscal position deteriorated significantly, with the fiscal deficit exceeding 5% of GDP due to structural challenges such as rising expenditures and a constrained revenue base. Government debt is projected to climb from 40% of GDP in 2023 to over 45% by 2025, with further increases likely in subsequent years. In response, the government has introduced a fiscal consolidation strategy aimed at reducing the deficit below 3% of GDP over the medium term, though analysts remain sceptical about its feasibility given plans to expand universal pensions.

Regarding monetary policy, the Bank of Mexico made a decisive move on March 27, 2025, cutting its benchmark interest rate by 50 basis points to 9%. This decision was driven by slowing economic growth and uncertainties surrounding external factors such as U.S. tariffs on Mexican goods. While the rate cut aims to stimulate economic activity and address inflationary pressures, Banxico has adopted a cautious stance regarding further reductions, emphasizing vigilance in monitoring inflation and external risks. The central bank’s efforts reflect broader challenges facing Mexico’s economy, including balancing growth ambitions with fiscal and trade uncertainties as it navigates an increasingly complex global landscape.

Nearshoring – A lifeline for Growth?

According to Moody’s, nearshoring refers to the strategic relocation of production facilities and investments to regions in closer proximity to key markets, with the aim of ensuring a reliable supply of inputs and reducing production costs. In Mexico, the origins of nearshoring can be traced back to the 1960s with the inception of the Maquiladora Programme. This initiative was designed to attract foreign investment and stimulate employment by enabling foreign companies, predominantly from the U.S., to establish factories in Mexico. These firms benefited from duty-free imports, lower labour costs, and access to a skilled workforce, thereby making production considerably more cost-effective.

A pivotal moment arrived in 1994 with the implementation of the North American Free Trade Agreement (NAFTA), which eliminated tariffs on most goods traded between the U.S., Canada, and Mexico. NAFTA catalysed a nearshoring boom, particularly among U.S. firms in industries such as automotive manufacturing, electronics, and consumer goods. These companies relocated operations to Mexico to exploit lower production costs and enhanced supply chain efficiencies, transforming Mexico into a vital manufacturing hub for sectors such as automotive, aerospace, and electronics.

However, by the early 2000s, Mexico faced intensifying competition from China, which rapidly emerged as a dominant force in global manufacturing. In 2004, China accounted for less than 9% of global manufacturing output but surpassed the European Union by 2011 to become the world’s largest manufacturer. Despite this challenge, Mexico retained its competitive edge due to its geographical proximity to the U.S., skilled labour force, and robust trade agreements.

From 2020 onwards, nearshoring has witnessed a resurgence driven largely by the disruptions caused by the COVID-19 pandemic. The crisis exposed significant vulnerabilities in global supply chains—particularly those reliant on China—prompting many businesses to reassess their dependence on distant manufacturing hubs. Consequently, firms began reshoring production to Mexico to shorten supply chains, mitigate risks, and ensure greater stability. This renewed interest in nearshoring has reinforced Mexico’s position as a strategic manufacturing hub within North America.

Tariffs – Are they a double-edge sword?

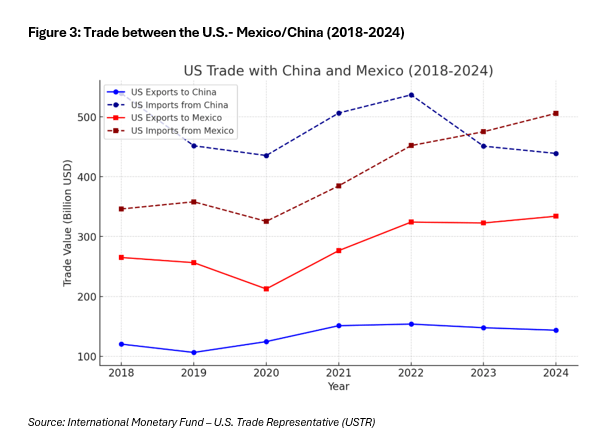

Trade with the U.S. is of paramount importance to Mexico, as in 2023, the nation surpassed China to become the foremost trading partner for the U.S. According to the U.S. Department of State, bilateral trade in goods reached an impressive USD807 billion, eclipsing trade with China, which totalled USD576 billion. Furthermore, data from the U.S. Census Bureau reveals a steadily widening trade deficit between the two nations.

In 2024, the Office of the U.S. Trade Representative reported that total goods traded between the U.S. and Mexico surged to USD839.9 billion. Of this, U.S. goods exports to Mexico amounted to USD334 billion—a 3.5% increase (USD11.3 billion) compared to 2023. However, the U.S. goods trade deficit with Mexico expanded significantly, reaching USD171.8 billion in 2024—a 12.7% increase (USD19.3 billion) from the previous year.

Sectoral Impact of Tariffs

Automotive Industry

The automotive sector in Mexico has been profoundly impacted by the recent imposition of U.S. tariffs. As a critical export hub for vehicles and parts destined for the U.S., Mexico plays a pivotal role in global automobile manufacturing, ranking as the seventh-largest producer worldwide in 2023, behind major economies such as China and the U.S. In 2024, Mexico exported over 3.5 million vehicles, with the industry contributing approximately 4.7% to the nation’s GDP and accounting for 18% of its manufacturing GDP.

On April 2, 2025, U.S. President Donald Trump enacted a 25% tariff on imported cars and light trucks, a policy that has sparked significant concern in Mexico. While vehicles compliant with the U.S.-Mexico-Canada Agreement (USMCA) are subject to tariffs only on non-originating portions, this measure is expected to elevate manufacturing costs substantially. The resulting price increases could burden U.S. consumers and may compel automakers to reconsider production strategies, including relocating operations to mitigate tariff-related expenses.

Electronics and Machinery

Mexico has emerged as a vital hub for electronics manufacturing, playing a key role in the global supply chain, particularly for U.S. firms reliant on semiconductors and assembly components. In 2023, electronics exports from Mexico reached approximately USD103 billion, with 86% destined for the U.S., highlighting the sector’s importance to both economies. Contributing 2.5% to Mexico’s GDP and nearly 30% of total exports, the industry is a cornerstone of the nation’s economic framework. The semiconductor market, a major growth driver, generated USD47.12 billion in revenue in 2024 and is projected to grow annually by 10.27%, potentially reaching USD76.83 billion by 2029. With over 1,100 companies employing approximately 330,000 workers, Mexico’s skilled workforce underpins its competitiveness in global manufacturing.

However, recent U.S. tariffs pose significant challenges to Mexico’s electronics sector. Elevated production costs may prompt American firms to restructure supply chains or shift investments to alternative locations, threatening Mexico’s competitive edge and potentially impacting GDP growth and export revenues. In response, Mexico is pursuing strategies to diversify trade partnerships, strengthen domestic manufacturing capabilities, and enhance infrastructure to safeguard its position in global electronics manufacturing.

Agriculture and Food Exports

The imposition of 25% U.S. tariffs on Mexican agricultural imports has significant repercussions for both Mexican farmers and U.S. consumers. Mexico, a leading exporter of avocados, tomatoes, and beef to the U.S., saw exports of these goods reach USD3 billion, USD1.97 billion, and USD2.9 billion respectively in 2023. These tariffs are expected to raise production costs for Mexican farmers, reducing their competitiveness in the U.S. market and potentially leading to higher consumer prices in the U.S.. This price increase could affect purchasing decisions and overall food expenditure, particularly as nearly 90% of U.S. imports of avocados, berries, and tomatoes originate from Mexico.

The agricultural trade relationship between the two countries is substantial, with the U.S. importing USD33 billion worth of agricultural goods from Mexico in 2020 while exporting USD18 billion to Mexico. The imbalance underscores Mexico’s critical role as a supplier to the U.S. market. However, these tariffs may prompt Mexico to retaliate with trade measures targeting U.S. agricultural exports, further disrupting the trade balance and exacerbating economic challenges for both nations’ agricultural sectors.

Impact of Tariffs on Nearshoring in Mexico

Nearshoring has consistently served as a cornerstone of Mexico’s economic development, with Foreign Direct Investment (FDI) playing a pivotal role in driving growth. While FDI has experienced a notable decline—from its peak of 3.8% of GDP in 2013 to 1.7% in 2023—it remains an essential contributor to economic activity, particularly in bolstering the manufacturing sector. Industries such as automotive, electronics, and aerospace have reaped substantial benefits from increased capital inflows and expanded production capacities, cementing Mexico’s status as a manufacturing hub.

Mexico’s enduring appeal as a nearshoring destination stems from its geographical proximity to the U.S., competitive labour costs, and the advantages conferred by trade agreements such as the U.S.-Mexico-Canada Agreement (USMCA). However, the imposition of tariffs has posed challenges to Mexico’s nearshoring prospects, manifesting in several key ways:

- Erosion of Cost Advantages: Tariffs diminish Mexico’s competitive edge in low-cost production, prompting some firms to explore alternative locations such as Southeast Asia.

- Reconsideration of Manufacturing Strategies: Concerns over tariff risks have led certain companies to reassess their plans for expansion in Mexico, opting instead for reshoring or diversifying supply chains.

- Impact on FDI: Uncertainty surrounding trade policies and potential future tariffs has made investors more cautious about committing capital to Mexico.

Mexican Government and Business Response

The Mexican government and businesses have implemented several strategies to mitigate the negative effects of tariffs and sustain economic stability. One key approach is trade diversification, where Mexico is actively strengthening trade relationships with Europe, Asia, and South America to reduce its heavy reliance on the U.S. market. In 2023, Mexico signed a Memorandum of Understanding (MoU) with the European Union to expand industrial cooperation, and by 2024, trade with China increased by 15%, according to Mexico’s Secretariat of Economy. By expanding export destinations, the country aims to create new opportunities for growth and lessen the impact of U.S. trade restrictions.

Additionally, incentives for domestic investment have been introduced to encourage growth in key industries, ensuring that Mexico remains an attractive destination for manufacturers and investors despite tariff challenges. The Mexican government allocated USD4.5 billion (approximately MXN76.5 billion in 2024) in tax incentives to boost domestic production in the automotive, electronics, and energy sectors. These incentives include tax breaks, subsidies, and regulatory support to stimulate local production and maintain competitiveness.

Furthermore, Mexico is focusing on infrastructure and policy adjustments to enhance its nearshoring appeal. In early 2025, the government announced a USD7 billion (MXN119 billion) investment in infrastructure projects, including improvements to ports, rail networks, and highways, to support trade efficiency. The Port of Veracruz, one of Mexico’s largest, is undergoing a USD1.2 billion (MXN20.4 billion) expansion, scheduled for completion in late 2026, to handle increased export volumes. By reinforcing these critical areas, Mexico seeks to maintain its position as a preferred manufacturing hub, even in the face of increasing trade barriers.

Economic Outlook for 2025

Looking ahead to 2025, economic growth is expected to slow, with a projected GDP growth of 1.35% in 2025 from 1.45% in 2024, according to the International Monetary Fund (IMF). In contrast, the Organization for Economic Cooperation and Development (OECD) forecasts that Mexico is likely to enter a recession, with its economy expected to contract by 1.3% in 2025 and decline further by 0.6% in 2026.This subdued outlook is underpinned by waning private investment amidst heightened uncertainty in both domestic and international spheres. Key factors dampening investor sentiment include global economic headwinds, trade policy ambiguities, and cautious business confidence amid evolving regulatory landscapes. However, there may be a bright light with the new political leadership.

On January 13, 2025, Mexico’s first female Prime Minister, who assumed office on October 1, 2024, unveiled an ambitious economic blueprint designed to elevate the nation into the upper echelons of the global economy. According to the October 2024 edition of the World Economic Outlook, Mexico currently ranks as the 15th largest economy by nominal GDP. With bold ambition, Prime Minister Sheinbaum has set her sights on propelling Mexico into the top 10 economies by 2030.

To realise this vision, Prime Minister Sheinbaum’s administration has outlined several transformative measures:

- Enhancing Manufacturing and Investment: The government aims to increase investment to 28% of GDP by simplifying bureaucratic processes, generating 1.5 million new manufacturing jobs, and fostering local sourcing to reduce reliance on Chinese imports.

- Expanding Renewable Energy Capacity: Mexico aspires to have 45% of its energy grid powered by sustainable energy sources, underscoring a commitment to environmental stewardship.

- Preserving Hydrocarbon Reserves: The administration has pledged to maintain the hydrocarbon reserves-to-production ratio for at least the next decade.

- Boosting Domestic Production: Efforts will focus on increasing local sourcing within key industries such as textiles and automotive manufacturing. Additionally, support will be extended to Mexican steel producers in their protracted trade dispute with China.

These initiatives are part of a broader strategy leveraging trade agreements, tariff policies, and enhanced customs enforcement to strengthen Mexico’s economic position. The timing is particularly strategic as Mexico navigates trade tensions with the re-elected Trump administration and confronts the looming threat of U.S. tariffs.

Conclusion

While nearshoring remains a cornerstone of North American trade, U.S. tariffs have introduced new economic pressures that could reshape investment and production strategies in Mexico. The nation’s ability to retain its nearshoring advantage will depend on its capacity to address tariff-related challenges, diversify trade partnerships, and strengthen domestic manufacturing capabilities. These measures are essential to preserving Mexico’s competitive edge as a key player in global supply chains.

Looking ahead, the stability of trade policies and the success of ongoing negotiations will be pivotal in determining Mexico’s long-term position within the evolving landscape of nearshoring. By leveraging its geographic proximity, skilled workforce, and established trade agreements such as USMCA, Mexico has the potential to adapt and thrive despite external pressures. However, the country must also confront structural challenges, including infrastructure deficits and resource constraints, to fully capitalise on nearshoring opportunities and sustain economic growth.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.