First Quarter of 2023 Review

By Maritza Ferreira Ramdeen – Manager, Investment Research

Insights

The exuberance and optimism that characterized financial markets in the last quarter of 2022 continued into the new year, bolstered by investor sentiment based on China’s re-opening and cooling inflationary pressures. In January 2023, after nearly three years closed off to the world, China abandoned its zero COVID policy and slowly reopened their economy. This decision was welcomed by many economies around the world, notably emerging markets, as China is the world’s largest consumer of many goods and services. Pent up demand of the Chinese consumer is expected to have a positive impact on the world’s economic growth and international trade.

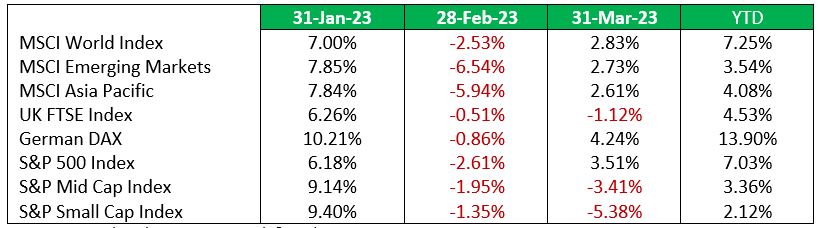

Consumer prices continued to ease in the first month of 2023 in many developed countries. In the US, consumer prices, as measured by the consumer price index (CPI), fell from 7.1% in December 2022 to 6.5% in January 2023, UK’s CPI declined from 10.5% in December 2022 to 10.1% in January while the Euro Area’s CPI slowed to 8.6% in January 2023, down from 9.2% in the prior month. The tempering of inflationary pressures around the world increased investors’ expectations for slower interest rate hikes from the central banks. As a result, risk appetites picked up that led to robust gains in stock markets in the month of January, as returns ranged from 6.18% to 10.21%.

In February 2023, investor optimism quickly turned negative following stronger-than-expected economic data, which together with sticky core inflation, forced central banks to tighten monetary policy further, dashing hope for a pause in the interest rate hikes. In the month of February, while the US Federal Reserve maintained their interest rate hikes, the pace of the increase slowed to 25 basis points (bps) from 50 bps. The European Central Bank and the Bank of England each raised their key interest rates by a further 50 bps. Investor confidence was further shaken after a US fighter jet shot down a suspected Chinese spy balloon, further adding to geopolitical tensions between the two countries that has been increasing for some time. Consequently, the gains that were achieved in January were eroded, with several stock markets posting losses for the month of February.

The month of March was extremely volatile. On March 7, the Federal Reserve Chairperson Jerome Powell testified in front of the US Congress where he signalled a more aggressive path for monetary policy as the economic data and inflation demonstrated more resilience than expected, increasing investors’ expectations for how high the Fed rates would rise in 2023.

One day later, the first of three regional US banks failed, with the other two collapsing within days of each other. One of the banks was Silicon Valley Bank (SVB), which was the second largest banking failure in US history. This banking sector stress appeared in Europe one week later as one of Switzerland’s largest banks – Credit Suisse, needed a lifeline to stay afloat. The turmoil in the financial sector led to a major sell-off in the US and European markets.

Regulators were able to act swiftly, halting bank runs in the US by extending emergency liquidity. In Europe, the Swiss authorities coordinated the forced takeover of Credit Suisse by UBS, stopping any financial contagion. The timely and decisive action by the authorities provided a degree of comfort for investors that boosted confidence and allowed modest gains in the month of March.

International Stock Indices

Source: Bloomberg, FCIS Research & Analytics

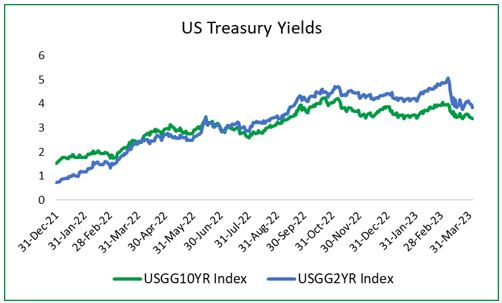

US Treasuries

For the first two months of the year, the yield on the benchmark US 2 and 10 year Treasuries maintained its upward trajectory and increased by 39 bps and 4 bps respectively at the end of February 2023, propelled by greater monetary policy uncertainty, elevated geopolitical risks and slowing growth momentum. For the month of March, the 2 year and 10 year Treasuries rose to highs of 5.07% and 4.05% as market volatility spiked following the bank failures.

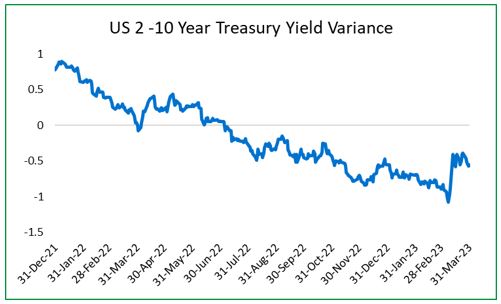

The 2 year-10 year spread, while its inversion continued into 2023, which occurs when short-term interest rates are greater than long-term interest rates, the spread between the two yields narrowed. During the period January to March 2023, the 2 year treasuries yielded more than 10 year maturities, ending the quarter at -55 basis points, down from -107 basis points that occurred in early March.

US Treasury Yields

Source: Bloomberg, FCIS Research & Analytics

US 2-10 Year Treasury Yield Variance

Source: Bloomberg, FCIS Research & Analytics

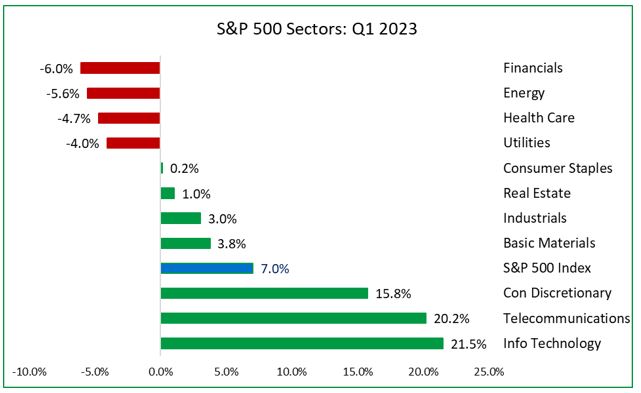

US Sector Performance

From a sector perspective, as expected, the Financial Services sector was the worst performing sector in Q1 2023, with a quarterly loss of 6%, followed by Energy (5.6%) and defensive sectors – Healthcare (4.70%) and Utilities (4.0%). Cyclical sectors were the outperformers for the quarter, with Information Technology posting the largest gain of 21.5%, followed by Telecommunications with 20.2% and Consumer Discretionary 15.80%.

US Sector Performance

Source: Bloomberg, FCIS Research & Analytics

Local Market Review

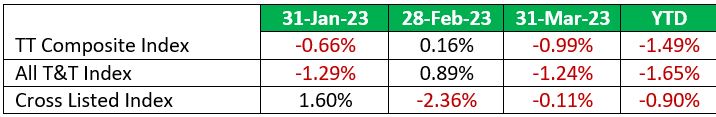

The local stock indices maintained its downward trend in the first quarter of 2023, led by the All T&T Index that posted a loss of 1.65%, followed by the T&T Composite Index with 1.49% and the Cross-Listed Index with 0.90%.

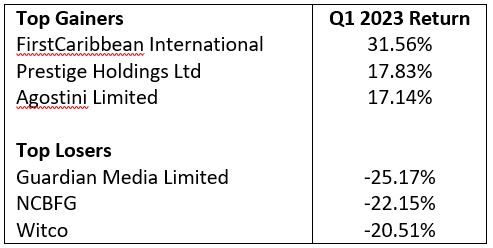

The stocks with the largest share price gains over the three-month period ending March 2023 were FirstCaribbean International Bank (FCI), Prestige Holdings Limited (PHL) and Agostini’s Limited (AGL) with returns of 31.56%, 17.83% and 17.14% respectively. Leading the declines were Guardian Media Limited (GML), NCB Financial Group Limited (NCBFG) and West Indies Tobacco Company (WCO) with losses of 25.17%, 22.15% and 20.51% respectively.

Local Stock Indices

Source: TTSE, FCIS Research & Analytics

Top Gainers and Losers YTD Basis

Capital Markets Outlook

For the second quarter of 2023, China’s economy is expected to maintain its expansionary path, supported by its Covid reopening. As a result, the global economy should benefit from such spillover effects in terms of trade. However, growth prospects may be dimmed by the recent banking sector crisis which will likely lead to tighter bank lending standards. Coupled with the high interest rate environment, it is probable that the demand for credit and in turn, consumption and investment activity may fall in the near to medium-term. Depending on the extent to which commercial banks tighten their lending standards, central banks may be forced to pause or slow down their interest rate hikes as economic activity slows and inflation falls.

As uncertainty remains, investors should seek to have a balanced portfolio, focusing on quality in both equity and bond allocations. With the likelihood of an economic slowdown, investors should seek out companies with strong fundamentals, liquidity and earnings prospects. Such companies will be better equipped to withstand a slowdown in sales and lower profit margins and thus avoid any credit downgrades and defaults.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.