United States Economic Outlook

By: Mikhail Patrovani – Economic Analyst, First Citizens Economic Research Unit

Insights

Current Developments

This year the United States (US) economy is set to expand by up to 1.3% in real GDP terms or contract by 0.2% according to projections announced by the staff at the Federal Reserve Bank (Fed) following the presentation of March’s monetary policy meeting. The range is developed based on expectations put forward by the Fed’s staff, particularly the Federal Reserve Board members and the Fed presidents and is based on their individual assumptions of the projected monetary policy path. This forecast range falls in line with growth rates projected by rating agencies such as Fitch Ratings (1.0%), S&P Global Ratings (0.7%) and 1.4% projected by the world’s most notable financial institution, the International Monetary Fund (IMF).

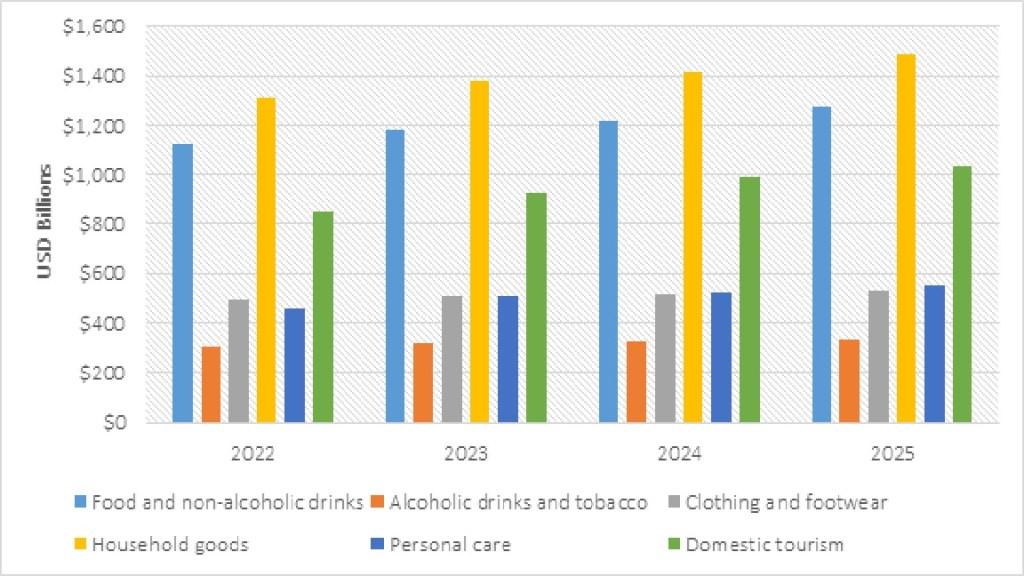

Consumption continues to drive the American economy (worth an estimated 70% of GDP) with preliminary data such as total household spending expanding by 5.62% in 2023 to be worth an estimated USD 18.035Tn compared to USD 17.076Tn in 2022. Although inflationary conditions remain tilted upward measuring 6.0% y-o-y in February 2023, household consumption will remain positive due to support from the nation’s tightening labour market that motivates employers to hike wages as well as substantial government support. Over the course of the Covid-19 lockdowns, household savings rates increased markedly reaching as high as 20.4% of disposable incomes in Q121 but, rapidly declined to 3.9% by Q422 as lockdowns were removed and pent-up demand for goods and services were being utilised. Household spending will remain positive in the coming years despite persistently rising costs for goods and services as well as housing due to the pass-through of Fed funds rates to consumers through increases in mortgage rates. Unemployment is relatively low at 3.5% and based on data for March 2023, average hourly earnings are 4.2% higher than in March 2022 and will bolster household consumption.

Figure 1. Selected components of household spending in the United States

Source: Fitch Ratings

According to the Bureau for Labor Statistics employment gains continue in sectors such as leisure and hospitality, government as well as professional and business services however employment in sectors such as mining, quarrying, oil and gas extraction, construction and manufacturing show scant month on month change. To support consumption, the government signed the Inflation Reduction Act which lowered the prices of numerous prescription drugs, ramped up investment in domestic energy production and advocated for greater adoption of clean energy. Student loan debt forgiveness will reduce debt for around 43 million borrowers and eliminate student loan debt entirely for an estimated 20 million people providing further support to consumer spending in the years 2023 and 2024 once successfully implemented. Fiscal support measures, tightening labour market and growing average wage rates will keep total household spending rates positive over the medium to long-term at 3.35% and 5.37% in the years 2024 and 2025.

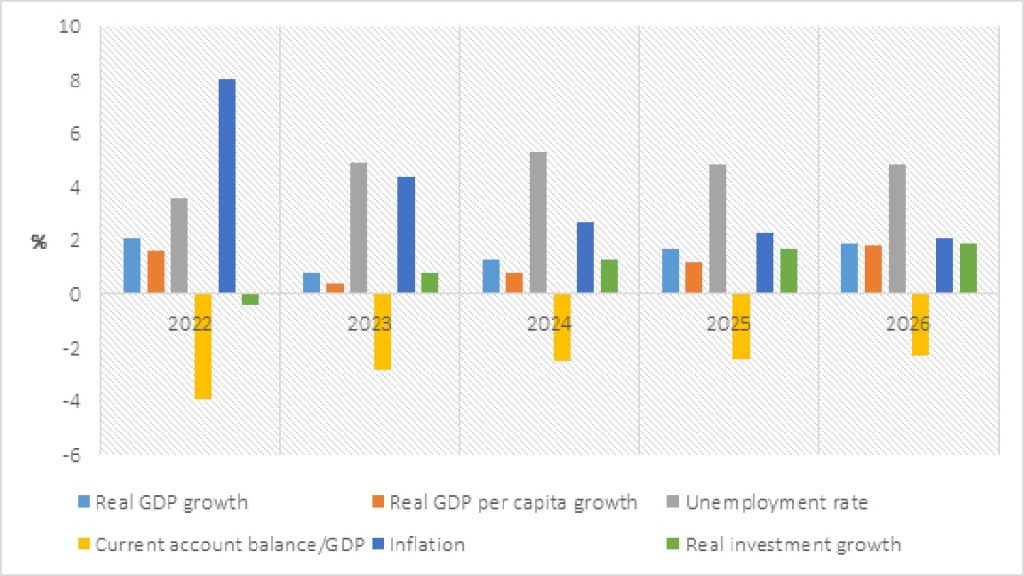

Figure 2. United States Selected Economic Forecasts

Source: S&P Global Ratings

Monetary Conditions

The banking sector is healthy and resilient to economic shocks due to improved capital buffers, robust regulations and sturdy supervision. In 2023, client loans will slow to 4.5% from 12.0% in 2022 as private demand for credit weakens owing to mounting inflation and rising central bank rates. Throughout 2022, the Fed funds rate was lifted successively following each monetary policy meeting from the range 0-0.25% in January 2022 to 4.25-4.50% at the end of the year in December. In 2023, the Fed slowed the pace of rate hikes with the range moving to 4.75-5.00% at the end of its March monetary policy meeting as the rapid rate hikes began to dampen consumer and investor confidence in the economy. Subsequent to the policy announcement, the Fed’s economic projections were released and the Fed funds rate is calculated to reach as high as 5.9% in 2023 or remain near 5.1%. Signals of the unemployment rate nearing the Fed’s target of maximum employment and abating economic growth persuaded the Fed to minimise its rate hikes.

The short-term outlook for credit growth is tilted to the downside due to these factors along with the collapse of the US’ 16th largest bank, Silicon Valley Bank. The bank collapsed as a myriad of customers withdrew large deposits eventually causing a run on the bank along with rising interest rate risks that adversely affected costumers’ investment portfolios. Following the bank’s collapse, the government reaffirmed citizens that the banking sector is highly insured with the aim of preventing further runs on banks due to diminished levels of confidence in the banking sector. Despite these factors the US banking system will remain profitable in the coming years given favourable metrics such as the return on equity of domestic banks measuring 10.2% as at December 2022 and a net interest income to average earning assets ratio of 2.8%. The sector is well funded and stable with a total consolidated asset base of 95.4% and a loan to deposit ratio of 50.7% in 2022. At 76.4% of GDP in December 2022, household debt remains elevated but declined from its peak of 80.0% in 2020 and may continue this trend as households draw down on savings instead of increasing their debt appetite.

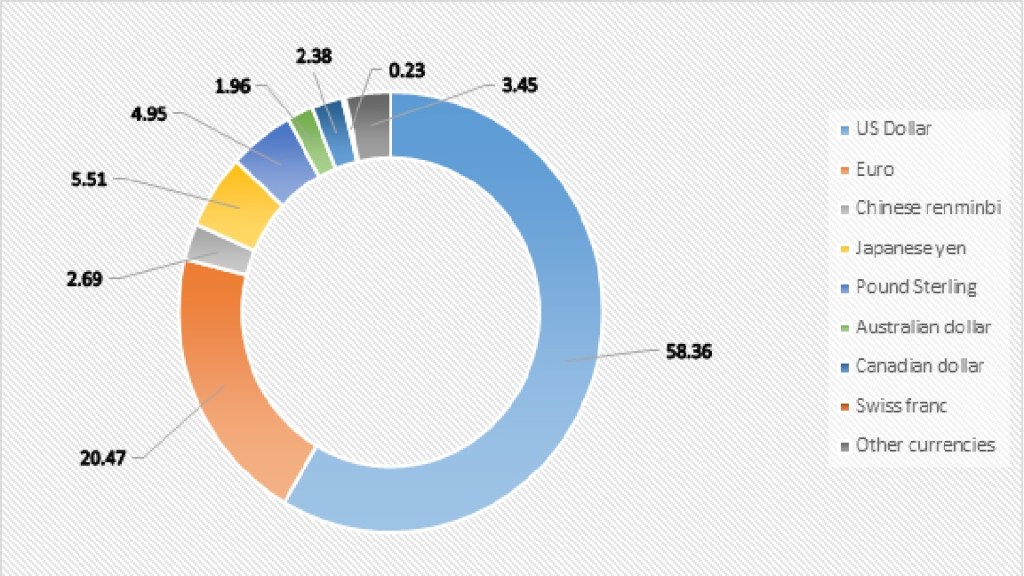

Figure 3. World Currency Composition of Official Foreign Exchange Reserves as at Q422

Source: International Monetary Fund

Outlook

The economy will remain strong and continue to return positive growth in the coming years albeit at a slower momentum due to the lingering effects of higher energy commodity prices which inflated costs such as transportation and utilities for consumers. The US dollar will retain its global reserve currency status in the coming years as it accounted for over 58% of total allocated reserves at the IMF for the past decade. At the end of Q422 the share of US dollar reserves slid to 58.36% from 59.79% in Q322 as the share of other currencies such as the Euro, Australian dollar and Japanese yen edged up marginally. At 20.47% of total foreign exchange reserves the Euro holds the position of the second largest reserve currency followed by the Japanese yen at 5.51% at the end of Q422.

According to S&P Global Ratings the economy will expand on average by 1.75% annually over the medium-term between 2024-2027 on the basis of firm labour demand, job growth and consumption. Major infrastructure projects such as the resurfacing of road networks in several states, construction of major bridges such as the Gordie Howe International Bridge (connecting the City of Detroit to Windsor, Ontario) and climate change related projects will provide further support to the economic momentum.

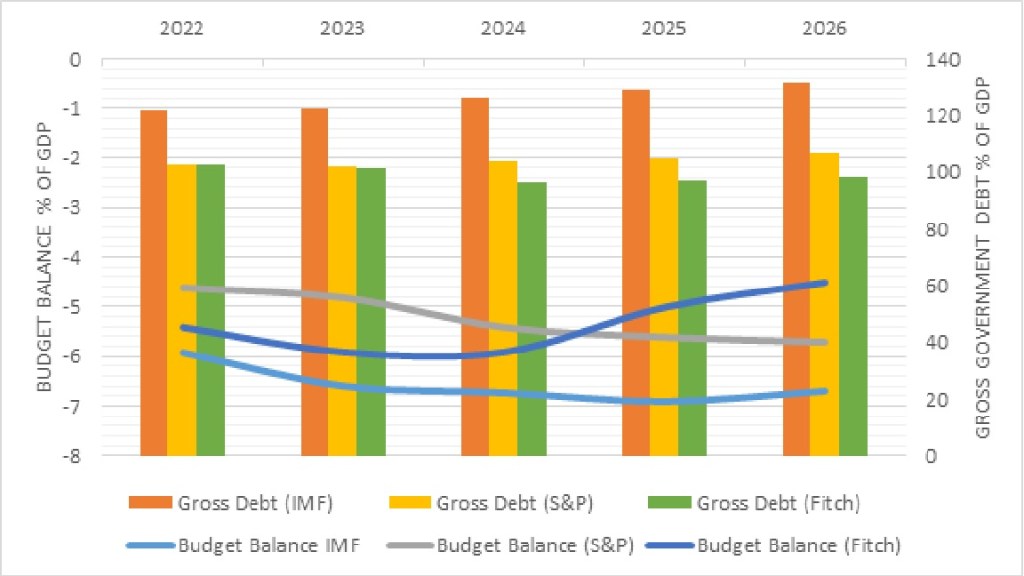

In January 2023, the government reached the statutory debt limit but since then the Treasury undertook several extraordinary measures to keep debt below the limit until the Congress passes legislation to raise the debt ceiling yet again. This year the budget deficit will increase modestly to 4.8% of GDP from 4.6% in 2022 as spending on easing inflationary conditions persist. In the coming years the budget deficit will remain above 5% of GDP as student loan debt forgiveness is written off by the government and climate change related spending widens. These sustained budget deficits will lead to an immediate reversal of the debt reduction trend following the end of fiscal stimulus support stemming from the pandemic with gross debt moving to 106.8% of GDP by 2026 from 102.0% in 2023.

Figure 4. Projected Fiscal Metrics

Source: S&P Global Ratings, Fitch Ratings, International Monetary Fund

Over the medium-term monetary conditions will improve based on projections for a reduction in the Fed funds rate to 4.7% in 2024 dipping to a low of 2.6% by 2026 barring any upticks in inflation rate projections. Inflation which rose to 8.0% in 2022 on an annual basis will decline to 4.2% in 2023 and further to 2.4% by 2024 as energy prices decline as supply conditions normalise. Declines in the Fed funds rate will prove beneficial to households and the corporate sector as borrowing costs are reduced prompting increased consumption supporting the economy even further in the medium to longer-term. Downside risks to the economic outlook stem from growing financial market volatility and rising geopolitical tensions that may hinder trade.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.