Commodities Review and Outlook

By Maritza Ferreira Ramdeen – Manager, Research & Analytics s

Insights

Review of the Commodities Market

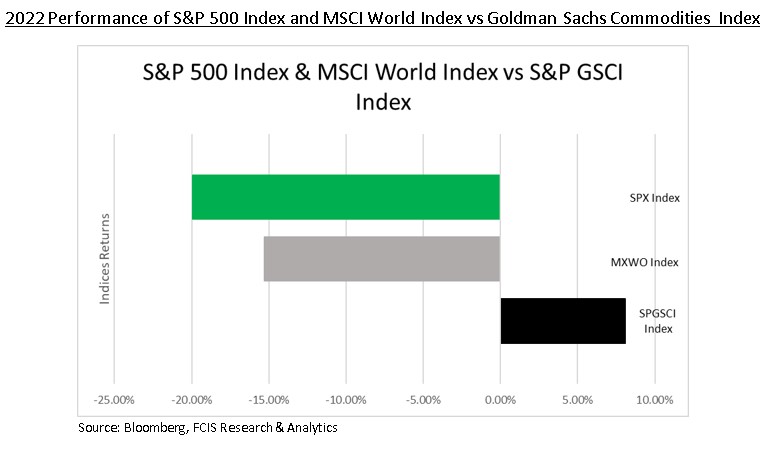

The commodities market distinguished itself as one of the few exceptions in 2022, continuing the gains it made in 2021 and becoming the best-performing major asset class for two years in a row, while other markets trended downwards in 2022. Commodities are raw materials that are used as inputs in the manufacturing process for goods and include agriculture products such as wheat, energy products such as oil and natural gas and precious metals such as gold and silver. Commodities are mass-produced and standardized in terms of quality and quantity, thus they are priced the same regardless of who or where they are produced.

2022 Performance of S&P 500 Index and MSCI World Index vs Goldman Sachs Commodities Index

Energy Commodities – Crude Oil

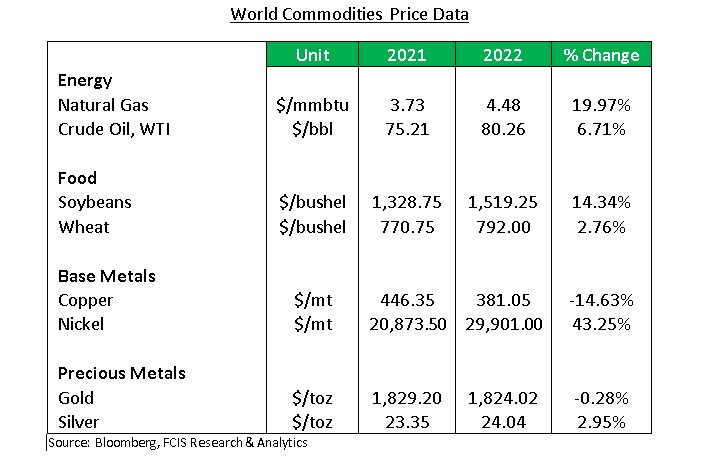

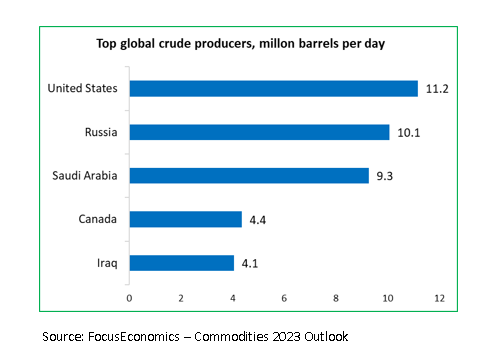

Crude oil prices initially soared in the first quarter of 2022, peaking to roughly USD 130 per barrel in March—a level not seen since 2008, driven by the geopolitical tensions surrounding Russia’s invasion of Ukraine that occurred in the prior month. Prices remained elevated until June, easing thereafter owing to a gloomier economic outlook caused by the tighter monetary policy adopted by several central banks. The decline was somewhat cushioned by the Organizational of the Petroleum Exporting Countries (OPEC) and their allies’ decision in early October 2022 to cut crude oil production by 2 million barrels per day. For the period between June and the end of December, crude oil prices fell by approximately 32%, from around USD 114 per barrelto USD 80 per barrel. For the year, crude oil posted a return of 6.71%.

For 2023, headwinds are expected to persist as Europe steps up its efforts to reduce Russia’s fossil fuel export revenue that is funding the Ukraine conflict. On February 5 2023, the European Union’s (EU) ban on Russia’s oil product exports took effect and comes two months after the Group of Seven nations (G7) implemented a price cap on Russian oil on December 5 2022. In response, Russia announced that they will cut oil output by 500,000 barrels per day in March 2023 which is roughly 5% of Russia’s latest crude oil output.

The reduction in Russia’s oil output, coupled with China’s easing of the COVID-19 restrictions and the subsequent re-opening of their economy are expected to create upward pressures on energy prices in 2023.

Agricultural commodities – Wheat

The agriculture sector faced many supply-chain challenges in 2022 including extreme weather conditions, rising cost of fertilizers and other input costs and Russia’s invasion of the Ukraine. Against the backdrop of a surge in consumer demand following the worldwide relaxation of COVID-19 restrictions, agricultural commodities prices soared in 2022.

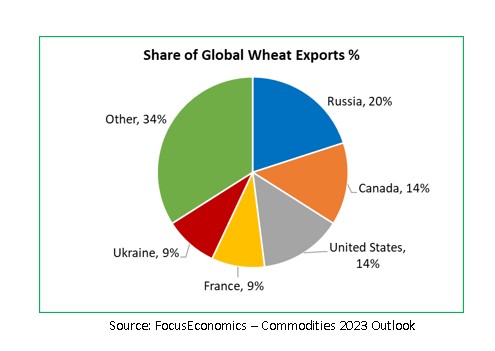

Russia’s conflict and invasion of the Ukraine severely crippled the supply of key agriculture products including wheat as both countries are key exporters of critical agricultural commodities. The war resulted in the destruction of farmlands in the Ukraine and closure of manufacturing and industrial facilities, significantly disrupting supply chains. In response, agriculture prices including wheat soared by March 2022.

Two months later, volatility increased again following India’s decision to ban wheat exports in May 2022 due to inclement weather conditions that led to a disappointing domestic crop. In July 2022, led by the United Nations and Turkey, a deal (the Black Sea Grain initiative) was made between Ukraine and Russia, allowing the resumption of grain exports from three Ukrainian ports that contributed to the normalization of wheat prices in the latter half of the year.

As long as the war persist, the agriculture sector will be vulnerable to wide swings in output and prices, further reducing the export potential for two of the largest agricultural producers in the world.

As it pertains to the Black Sea Grain initiative deal, there is a high probability that Russia may not fully honour the terms of the agreement, having temporarily reneged on the deal in October 2022 and re-joining a couple days later. Russia can opt to leave the deal again which would raise global food prices.

Another risk to agricultural commodities is the continuance of extreme weather conditions that plagued many grain exporting nations in 2022, which may negatively affect crop production levels. Further adding to the volatility is the anticipated demand from China, the world’s largest consumer of vegetable oils and pork, with the lifting of citywide quarantine orders and other restrictive measures. Grains are the key input for vegetable oils while soybeans are used as animal feed. This significant additional demand can push up food prices.

Base Metals Commodities – Copper

Copper began the year trading at USD 9,720.50 per metric ton and soared to USD 10,674 per metric ton by March 2022 due to the war. Global uncertainty surrounding the base metal increased as Russia is the seventh largest copper country in the world by production. Copper prices thereafter fell steeply by the second half of the year on concerns of a global economic slowdown due to the tighter monetary stance that negatively impacted construction activity and consumer spending.

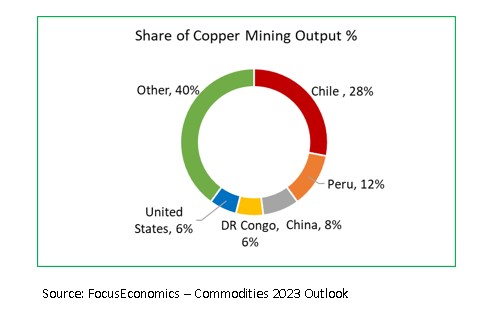

In the last quarter of 2022, copper prices rebounded on the anticipation of the relaxation of the COVID-19 restrictions implemented by China earlier. Prices were also bolstered by supply disruptions arising from labour unrest in Peru and lower production levels by Chile due to low ore quality and drought conditions.

The re-opening of China’s economy is expected to have a material impact on copper as China accounts for around half of global copper consumption. Risks however remain as further disputes at Peruvian mines can create some instability.

Precious Metals Commodities – Gold

Russia’s attack on the Ukraine was the catalyst for gold as prices peaked slightly above USD 2,000 per troy ounce in March 2022. Investors often move into safe-haven assets like gold in times of global uncertainty such as any geopolitical or financial crisis.

The gains achieved in the first quarter was short-lived however, as gold prices fell to a 2-year low to USD$1,620.30 per troy ounce in September as rising bond yields, fuelled by the hikes in global key interest rates, reduced the attractiveness of gold as an investment. The strengthening of the US Dollar also created downward price pressure on gold as it made purchasing gold more expensive, effectively reducing demand. Gold and the US dollar tend to have an inverse relationship, thus when one increases, the other falls.

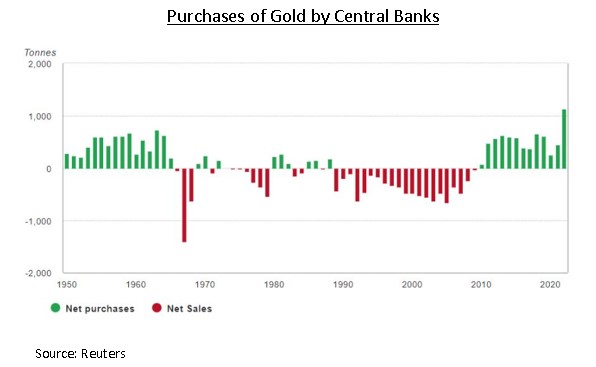

Gold prices began to recover in November 2022 and ended the year at USD 1,831.00 per troy ounce due to stronger demand that was underpinned by market turbulence, rising recession expectations and an increase in gold purchases from central banks. According to the World Gold Council (WGC), emerging market central banks including Turkey, China, Russia, Egypt and Qatar, added 1,136 tonnes of gold worth some USD 70 billion to their stockpiles in 2022 – the largest increase in history. In turbulent times, gold is an effective store of value and allows central banks to diversify their investment portfolio away from traditional assets such as US Treasuries.

Gold prices are estimated to continue its upward trajectory in 2023, supported by the geopolitical developments in the Ukraine and US-China tensions surrounding Taiwan. China is the number one consumer of gold jewellery. The recent changes to their zero-tolerance COVID-19 stance and the re-opening of the economy may positively impact the demand for gold.

Commodities Outlook

Supply risk was the primary driver for many commodities in 2022 that led to increased volatility and elevated prices and is anticipated to remain a challenge in 2023. The war in the Ukraine is abound with risk, driven by Russia’s willingness to use energy as a weapon against any country who intervenes and the subsequent retaliatory sanctions by those who oppose the war. Any escalation in the war remains a credible threat to energy and food markets while changes in climate conditions will continue to threaten agricultural commodities.

On the demand side, the re-opening of China’s economy is expected to facilitate a faster-than-expected rebound in economic activity that may have a material impact on commodity demand as China is the world’s largest consumer of commodities.

Based on the aforementioned, commodities prices are projected to remain high in 2023. However, investors should be aware of the risk to this optimistic outlook. The rebound in the dynamism in the Chinese economy may create upward pressure on global commodity prices. As a result, inflation may remain stubbornly high, resulting in tighter monetary policies that may lead to a slowdown in global economic activity.

To Invest or not to Invest in Commodities?

Despite such headwinds, investors should benefit by investing in commodities as they provide critical diversification benefits to portfolios. Commodities are real physical assets, as such they react differently to changing economic conditions when compared to traditional assets like stocks and bonds and is evident by their low to negative correlation, which is the degree to which two variables change together.

Commodities are also effective inflation hedges. As the price of goods and services rises, the inputs used in the manufacturing process also rises, thus acting like a hedge against inflationary pressures. In contrast, rising inflation tends to lower the value of future cash flows paid by traditional assets, like dividends from stocks and coupon payments from bonds.

Investing in physical commodities is impractical for most investors. Exposure to commodities may however be achieved through indirect ways such as purchasing commodity-based equities and exchange traded funds (ETFs). There are numerous ETFs that track different commodities, including base metals, precious metals, energy, and agricultural goods. Precious metals like gold and silver are popular ETFs because the underlying commodity can’t go bad or spoil. The SPDR Gold Shares and iShares Silver Trust are two of the largest gold and silver ETFs. Investors can also increase diversification through diversified commodities ETFs such as the iShares MSCI Global Agriculture Producers ETF. However, just like with any investment, commodity ETFs carry risk and are by no means a guarantee of profit.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.