Tourism in the Caribbean

Insights

The Caribbean has a very diverse culture as a result of the region’s rich history. Countries are home to many historical man-made attractions such as forts and colonial era structures, as well as many natural attractions, primarily pristine beaches all complemented by a warm tropical climate. It is no surprise that many countries in the region have sought to capitalize on these features by promoting the tourism industry, attracting visitors from around the globe. The tourism industry, primarily international tourism (by air and cruise), has become a vital part of Caribbean economies with many being heavily dependent on the sector not only for driving economic activity but also to generate much needed foreign exchange. Inter-regional tourism, while present, does not contribute on the same scale because of deficiencies in air connectivity in combination with a prohibitive relative ticket cost. Limited number of flights along with high taxes, fees, and charges (TFCs) on regional flights make it cheaper for travelers to fly outside of the region.

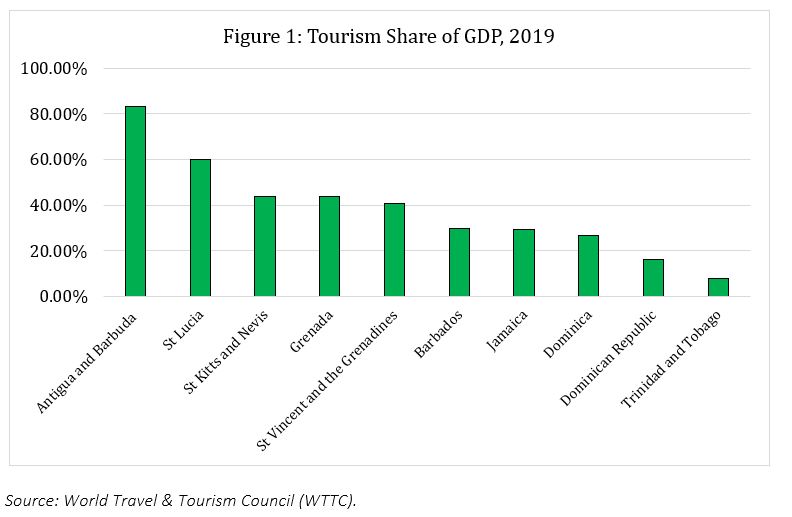

The World Travel & Tourism Council (WTTC) notes that eight out of the ten countries most dependent on tourism are from the Caribbean. Tourism contributes approximately 13.9% of GDP for the entire Caribbean, the highest share of any region in the world. The contribution of travel and tourism towards GDP for Caribbean countries is shown in Figure 1.

The reliance on the tourism sector has made the economies of the Caribbean very vulnerable to shocks in the global economy as well as the environment. The tourism sector is highly dependent on international conditions as was proven with the COVID-19 pandemic. Major source markets for the region are the United States of America (US), United Kingdom (UK), Canada, and France, making up 70% of all travelers entering the region in 2019 according to the WTTC. In the height of the pandemic, strict lockdown measures were introduced in these major markets, driving Caribbean economies to a virtual standstill.

Further to this, the Caribbean is also highly susceptible to natural disasters. According to the OECD, the Caribbean is the second most environmental hazard-prone region in the world, with natural disasters and climate change causing major economic and infrastructural damages. Recent examples of natural disasters that have struck the region are Hurricane Dorian in 2019 that made landfall in The Bahamas, causing roughly USD3.4 billion (over 25% of GDP) in damages; Hurricane Maria in 2017 which ravaged Dominica, destroying roughly 90% of the island’s infrastructure and costing an estimated USD1.3 billion (226% of GDP).

Tourism Industry Recovery

The tourism industry came to a standstill in the height of the COVID-19 pandemic, with lockdown measures and strict travel restrictions being imposed by governments to curb the spread of the virus. International travel was generally restricted to only what was absolutely necessary for 2020 and only eased slightly in the Q1 2021. It was not until the Q2 2021 that restrictions began to gradually ease as vaccines were more readily available around the world and the number of cases began to fall. The easing of restrictions saw the return of tourists as air travel resumed, even though with strict testing and vaccination requirements. While the cruise industry was essentially closed off for most of the pandemic, nearing the end of 2021 and throughout 2022, the industry reopened, though, its performance remains below pre-pandemic levels.

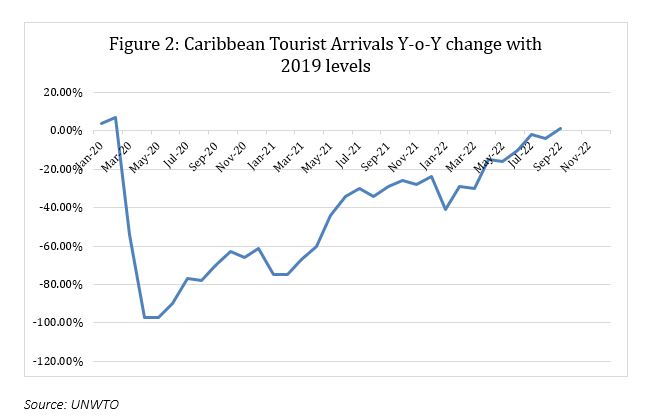

Data from the United Nations World Tourism Organization (UNWTO) shows that as of September 2022, global tourism has recovered significantly, only 27% below 2019 levels. Recovery in the Caribbean has been much more robust, with the region outpacing most of the world. UNWTO data indicates that monthly tourist arrivals for September 2022 were the same as 2019, though total arrivals for the year is 18% less. The recovery path for tourism in the Caribbean region is shown in Figure 2.

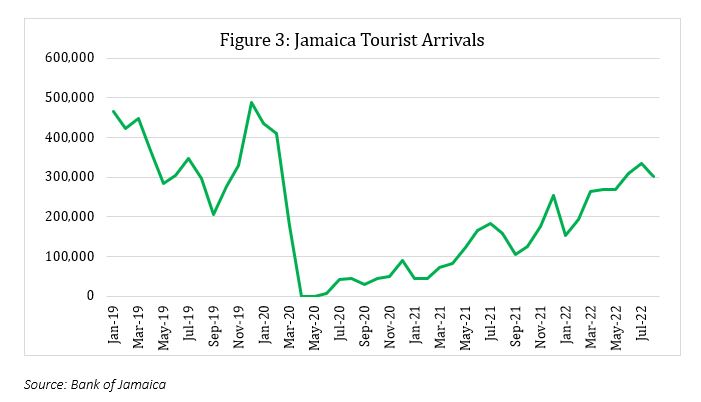

In the Caribbean, the recovery of the tourism industry varied greatly depending on the restrictions and travel policies in place in different countries. Countries such as Jamaica were able to recover more quickly than others in the region largely due to restrictions being eased at a much quicker pace than the rest of the region. Jamaica was amongst the first in the Caribbean to ease and subsequently remove travel restrictions for international travelers; in March 2022 travel authorization requirements were removed for entry into Jamaica, making the country open to all visitors. Given the significant contribution of tourism towards Jamaica’s GDP (29.1% of GDP in 2019), growth in the Jamaican economy began to recover, primarily driven by the tourism industry. Further, in April 2022, all testing requirements were removed for travelers entering Jamaica, which allowed for an improvement in processing speeds for travelers. As a result, the recovery of the tourism sector in Jamaica accelerated, with the months following, almost reaching 2019 levels. Figure 3 shows the total amount of tourist arrivals in Jamaica from 2019.

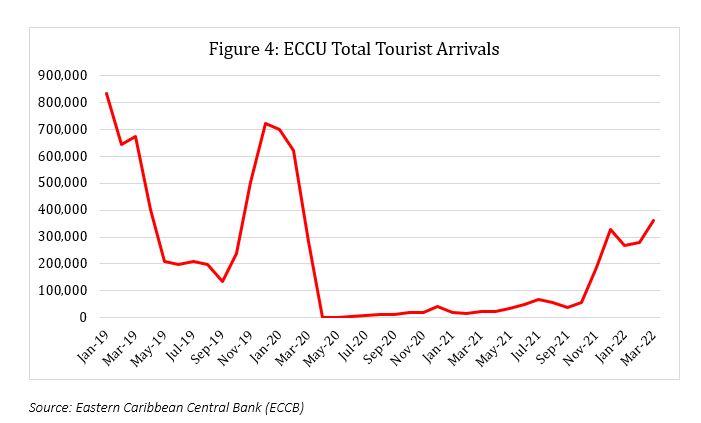

In the height of the pandemic, travel into the Eastern Caribbean ground to a stop. Data from the Eastern Caribbean Central Bank (ECCB) shows that for the period April 2020 – December 2020 total travelers entering the Eastern Caribbean was a mere 1,887, this is compared to 2.8 million for the same period in 2019. Latest data from the ECCB (March 2022) shows that while tourist arrivals have recovered, levels were still well below where it was pre-pandemic. Figure 4 shows total arrivals for the entire Eastern Caribbean.

On a country level, the rate of recovery has varied due to restrictions being eased at different periods from country to country. Some of the earliest countries to ease restrictions were St Lucia and Grenada, with the former easing restrictions in March 2022, and the latter removing all restrictions in April 2022. Countries such as St Vincent and the Grenadines have only recently removed pre-testing requirements for fully vaccinated travelers as of August 2022, whereas Antigua and Barbuda, and St Kitts and Nevis have fully removed all entry requirements that were in place.

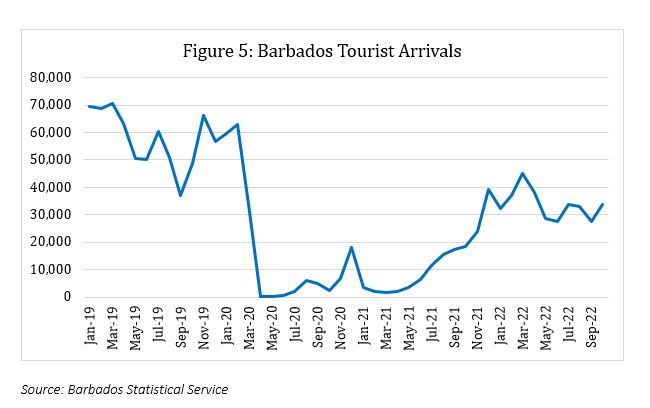

Barbados’s economy depends on the tourism industry for a significant chunk of activity (29.5% of GDP in 2019). It is of no surprise that with the stagnation of the industry, the Barbadian economy suffered a severe contraction. With regards to COVID-19 restrictions, Barbados has been relatively conservative, keeping some travel restrictions in place until September 2022, with a gradual easing at key periods to aid in recovery efforts. The easing of restrictions and the subsequent recovery in tourism has been the main driver of growth for the past six quarters in the Barbados economy. Tourism arrivals do however remain well below pre-pandemic, reaching 71% of 2019 levels in September 2022. Figure 5 shows total tourist arrivals into Barbados.

Outlook

The tourism industry in the Caribbean is expected to sustain its recovery, however, at a slower pace. Growth in the tourism sector for 2023 is projected by WTTC to slow further to 11.1% in the Caribbean region, much lower than 2021 and 2022 which saw growth of 36.6% and 27.2% respectively. Pent up demand, easing of COVID protocols by countries, and a forecasted improvement in the cruise industry will drive tourism growth in 2023 for the Caribbean. Downside risks to the industry include persistently rising prices, the threat of prolonged recessions in key tourist markets, as well as fluctuations in the currency market.

Two of the most significant source markets, the US and UK, are projected to slow further in 2023, with GDP forecasted by the IMF to grow at 1% and 0.32% respectively. This projected low growth comes after a less than stellar performance throughout 2022. The US economy contracted by 1.6% and 0.6% for Q1 and Q2 2022 before recording growth of 3.2% in Q3 2022, while in the UK, growth has been moderating sharply, with current forecasts showing persistent economic contractions until Q4 2023.

For the Eastern Caribbean, travelers are primarily from the US (43.4% of all travelers in 2019) with a notable contribution from the UK (16.6% in 2019). The slowdown of the US and UK economies will likely impact tourism activity as a result. Given the significance of US in the Eastern Caribbean, fluctuations in the US dollar (USD) will greatly affect the tourism demand. The Eastern Caribbean Dollar (XCD) is fixed to the USD at a rate of XCD2.7 to USD1; given the fixed exchange rate, tourist demand would fall if there is a strengthening of the USD as the relative cost to tourists would be higher. The USD is currently forecasted to strengthen in 2023 as the rate hikes by the US Federal Reserve continue to make the dollar an attractive asset, serving as a downside risk to tourism in the Eastern Caribbean. Tourism growth will vary slightly among countries within the region; St Vincent and the Grenadines, St Kitts and Nevis, as well as Antigua and Barbuda are expected to post the highest growth, largely in part to their recent removal of restrictions for travelers entering the country.

Jamaican tourist arrivals are forecasted to remain along its current trajectory, with the total number of arrivals improving with the return of the cruise industry. Jamaica operates a managed floating exchange rate regime, with the Bank of Jamaica gradually depreciating the value of the Jamaican dollar (JMD) in recent years to boost competitiveness of exports. This gradual depreciation of the JMD may be beneficial and can potentially improve tourism demand. Tourism is forecasted to return to pre-pandemic levels in Jamaica by mid-2023.

Barbados’s key tourist markets are the US and the UK, making up roughly 32% and 33% of all tourist arrivals in 2019. The projected slowdown of these economies in 2023 will negatively affect Barbados’ tourism sector. Similar to the Eastern Caribbean, Barbados operates a fixed exchange rate regime, at a rate of BBD2 to USD1. The forecasted strengthening of the USD will reduce the relative competitiveness of tourism in Barbados for tourists.

Notwithstanding the headwinds, the tourism industry is expected to continue along the path of recovery, supported by the complete removal of all pandemic restrictions as well as projected improvements in the cruise industry.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.