A Look Back at 2022

Insights

A Year Mired by Uncertainty

At the start of 2022, the raging spread of the Omicron variant of COVID-19 began to dampen economic sentiment as many countries were forced to reimpose restrictions. At that point, there were already several developments which had started to creep into the 2022 economic outlook that appeared to be less optimistic than previously anticipated. The supply disruptions caused by the pandemic, coupled with the general rise in consumer demand as well as the uptick in commodity prices all began to feed into headline inflation in many countries – both advanced and developing economies. Consequently, after almost two years of unparalleled accommodative policies to combat the economic fallout of the pandemic, many central bankers and policymakers began to pivot to a relatively tighter stance. Then, in February 2022 Russia invaded Ukraine which only exacerbated the economic challenges that had already permeated the outlook. Now, almost 11 months later, the Eastern European crisis persists and continues to generate significant volatility and economic uncertainty. Many economies are now battling stubbornly high inflation alongside the increasing likelihood of a recession. These global developments have undeniably affected the outlook for the Caribbean region as well, which is largely dependent on tourism and external demand, with a few commodity-exporters who stand to benefit from the rally in energy prices.

Weakening Global Economic Prospects

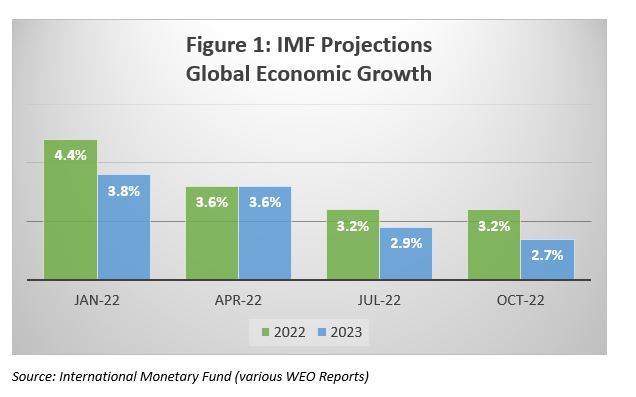

A culmination of various factors has severely weakened the economic outlook for the global economy. Aside from the prevailing economic headwinds, the Ukraine war introduced a tremendous amount of geopolitical risks that caused immense volatility and uncertainty. The aftermath of the pandemic left the global economy with supply disruptions which ushered in a steady and persistent rise in prices globally, which then triggered tighter monetary policies. The International Monetary Fund (IMF) steadily trimmed its forecast for global economic growth throughout 2022 citing factors such as the rising cost of living, tightening financial conditions, Russia’s invasion of Ukraine as well as the lingering impact of the COVID-19 pandemic.

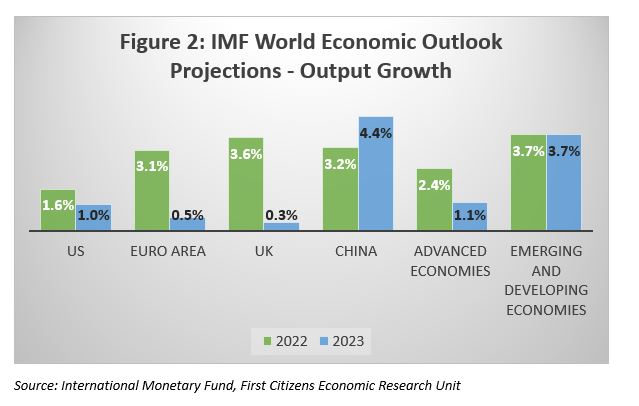

The most recent World Economic Update from the IMF, published in October 2022 projected that global growth will decelerate to 3.2% in 2022 and 2.7% in 2023 from estimated growth of 6% in 2021. The growth projections represent the slowest rate since the 2001 global downturn. There were substantial downward revisions to forecasts for major economies, including the US, China and the Euro area as surging prices erode consumers’ purchasing power, adversely impacting consumer demand, which is a large contributor to many of these economies.

Notably, China’s growth prospects have been undermined by the strict zero-COVID policy stance which was in place for the better part of 2022 as well as the ongoing real estate crisis. Stringent measures implemented to restrict movement to reduce the spread of the virus significantly affected business activity, leading to a sharp cut in growth from an estimated 8.1% in 2021 to 3.2% in 2022 and 4.4% in 2023, a multi-decade low. Given China’s size and role in the global economy, this downturn will have significant implications for global trade and will add to the supply chain constraints. The restrictions were only eased in early December and already, there has been a surge in the number of cases. However, despite the rise in the number of cases and increasing fears of a high mortality rate, especially among the vulnerable, official figures show only seven deaths from COVID between 19-20 December 2022, with none reported on the 21 December. There has been some skepticism about the real impact of COVID in the country, as the World Health Organization (WHO) has called on China to share more thorough and reliable data. Anecdotally, with no official data, various news reports indicate hospitals and ICU’s are filling up in major Chinese cities as this fresh COVID-19 wave hits one of the most populous countries in the world.

Broad-Based Inflation, Tightening Financial Conditions

Record high inflation levels have prompted central bankers globally to tighten monetary policy, after years of an unprecedented accommodative stance to combat the effects of the pandemic. Indeed, there has been a synchronized increase in policy interest rates across both advanced and emerging economies as inflation soared to record highs. The IMF projected that global inflation would rise from an estimated 4.7% in 2021 to 8.8% in 2022 but will moderate to 6.5% in 2023. Inflation in advanced economies is expected to average 7.2% and 6.5% in 2022 and 2023 respectively, while in the emerging markets, price levels are forecasted to rise by 9.9% and 8.1%. Inflation has generally been stoked by global supply chain disruptions, rising demand as economic activity normalizes as well as volatility in the commodity markets – particularly food and energy, which has largely been driven by the Ukraine war. Both Russia and Ukraine are major players in the global food and energy market.

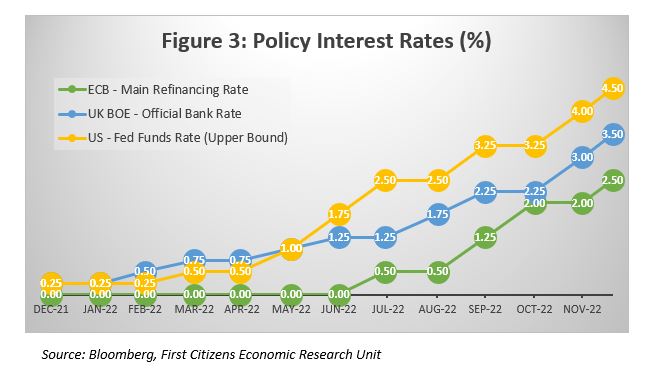

Consequently, central bankers have been relatively aggressive in raising interest rates to cool the rise in demand, despite a weakening economic growth outlook as policymakers try to prevent inflation from spiraling out of control, which has serious longer-term implications, particularly so for the consumer. Persistently rising inflation severely erodes consumers’ spending power and squeezes household budgets, putting additional pressure on consumers especially given that pandemic-related fiscal support has been steadily declining.

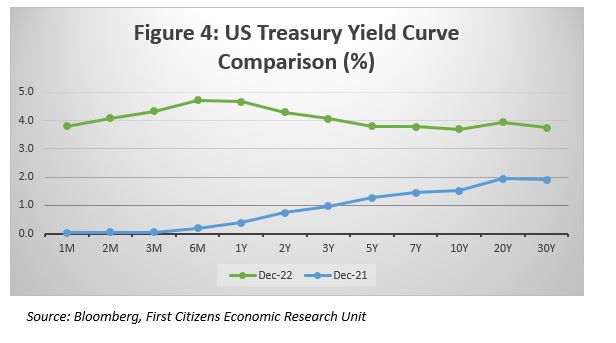

In the US, the Federal Reserve (Fed) has raised its benchmark interest rate – the fed funds rate by a total of 425 basis points (bps) for 2022, while the Bank of England has hiked by 325 bps over the same period. The European Central Bank has been slightly more conservative, increasing its main refinancing rate by 250 bps during 2022. Policymakers in Europe have generally been more cautious in its monetary policy stance given the high degree of uncertainty and much higher probability of a recession given the direct impact of the Eastern European crisis.

The combination of a relatively more aggressive stance by the US Fed and the greater degree of volatility and uncertainty in the global economy has resulted in risk aversion and ‘flight to quality’, with the US dollar appreciating sharply for the year against major currencies. The US Dollar Index (DXY), which indicates the general international value of the USD by averaging the exchange rates between the USD and major world currencies, increased by almost 9% year to date, but rising as much as 20% in September 2022. Furthermore, the US treasury yield curve inverted back in July 2022 as measured by the spread between the 10- and two-year treasury yields. The spread remains in deep negative territory, averaging -42.561 bps. Simply put, the yield on the two-year treasury, which is highly sensitive to changes in the fed funds rate, is on average 42 bps higher than the yield on a much longer tenor 10-year treasury. Historically, this anomaly always pointed towards a looming recession in the US economy. According to Bloomberg, the probability of recession in the US stands at 65% as at 20 December 2022.

Caribbean Feels the Pinch

The countries of the Caribbean are generally characterized as small and very open economies, making them highly dependent on the vagaries of the external economy. As such, while some economies witnessed a nascent recovery in 2022 as pandemic-induced restrictions were almost completely lifted which ushered in a return to tourists to the region, a sustained recovery may be some way off. There are many factors which will hinder the recovery in the region, particularly for those economies that are highly reliant on tourism. The weakening economic outlook for main tourism source markets, including the US, UK, Europe, and Canada will affect travel demand, coupled with the compression of disposable income due to persistently high inflation will significantly affect the outlook for the Caribbean. Furthermore, the appreciation of the US dollar can have implications for those countries in the region which maintain a fixed exchange rate with the USD – making them less competitive. A stronger US dollar simply means that Caribbean vacations in countries that have fixed exchange rates become more expensive relative to countries which has a floating exchange rate. The general rise in prices, including energy has also affected the cost of travel.

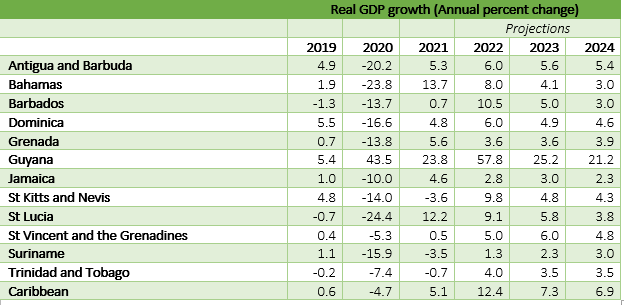

The few commodity exporters of the region have benefitted from the rally in energy prices globally. Guyana is set to be the world’s top performer in 2022 in terms of real GDP growth, driven by the country’s rapid oil industry expansion. After contracting by an average of 2.8% during the 2019 – 2021 period, the Trinidad and Tobago economy is forecasted to post economic growth of 4% in 2022 according to the IMF.

Table 1: Caribbean Real GDP Growth Rates (%)

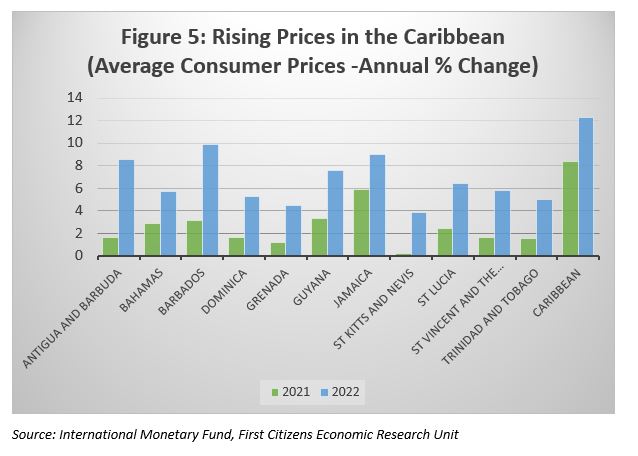

Given the reliance of the region on imported food and energy, rising costs have exacerbated the issue of food and energy security. The surge in prices also has the potential to elevate poverty levels. The IMF has proposed that government provide “temporary and well-targeted transfers to the vulnerable, by expanding social assistance programs while allowing a gradual pass-through if international prices and phasing out generalized subsidies.”

The average inflation rate for the Caribbean is estimated to reach 12.3% in 2022, with Suriname, Barbados, Jamaica and Antigua & Barbuda expected to register the highest rates. Prices are forecasted to moderate to around an average of 9.6% in 2023 – heavily skewed by high double-digit inflation in Suriname, where the inflation rate has averaged 47% over 2019 – 2022. The stronger US dollar will also add to the imported inflation in the region.

Many countries already face large and mounting debt and with the current high interest rate environment, further borrowing will likely come at a higher cost. In 2022, Suriname, Barbados and Dominica are all expected to record gross government debt of over 100% of GDP, while Antigua & Barbuda, Bahamas and St Lucia are in the 90% range. On the positive, several countries operate under a fiscal responsibility framework, including Grenada, Barbados, St Vincent & the Grenadines and Jamaica. This will ensure debt reduction and fiscal sustainable well into the medium term. There are various headwinds which the region faces but as economic activity gradually returns, fiscal consolidation will be necessary to restore fiscal space to help build economic resilience.

Headwinds Cloud the Economic Outlook

As we move into 2023, there are numerous challenges which face the global economy. The probability of recession in various advanced economies has increased markedly for countries such as the US, UK, and the EU bloc. While tighter policies will curb inflation, it will also have a dampening effect on economic growth. A major risk is the potential divergence in policy between key economies, which can push the USD higher. This can have implications for US trading partners, which will have to contend with higher imported inflation. Global financial tightening can also trigger widespread emerging market debt distress according to the IMF. Labour markets in key economies remain tight, with low unemployment rate and growing number of vacancies while wage pressures continue to build, which will only add to the inflationary pressures. The geopolitical environment also remains volatile and would continue to add uncertainty and of course, any resurgence in COVID-19 has the potential to weigh on the global economy. Overall, the risks to the economic outlook are considerably tilted to the downside, at least for 2023.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.