Climate Change and the Economy

Insights

The gradual heating of the earth’s surface and oceans since the dawn of industrialisation has led to a significant reduction in the volume of ice in the earth’s coldest regions which in turn aided in increasing the oceans’ overall mass. Rising sea levels have gradually reduced the land area of low lying plains and over time, and barring any significant efforts to reduce global warming, shorelines will recede and some islands may be submerged and disappear. Throughout the years, global warming saw the shift in climate across several nations globally with increases in the occurrences of acts of God such as tsunamis and cyclones.

To mitigate global warming and thus lower the rate of climate change, several nations across the globe entered into international agreements on climate change. The most noteworthy objective of these agreements is to limit the average global temperature increase to below 2°C but no more than 1.5°C above preindustrial levels. According to several notable international agencies, to reach this goal the entire world must attain net zero emissions (the difference between emissions produced and emissions reduced from the atmosphere) by 2050.

Investment

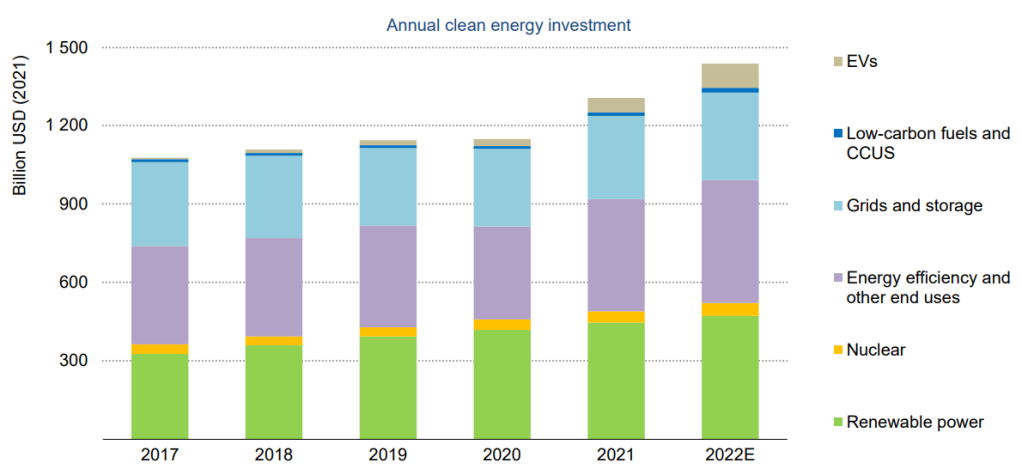

Figure 1. Global Annual Clean Energy Investment

To bring down emissions of greenhouse gases (GHG), considerable investment in capital infrastructure to promote the use of and access to green energy is paramount. Green energy refers to energy that is generated from natural resources such as sunlight, wind or water and produce little to no GHG in its generation. Over the medium to longer term horizon through to 2050, there will be a global rise in investment in promoting green energy, not only to tackle climate change but, also to improve energy security. The ongoing invasion in Ukraine raised a number of concerns for the world but more so for the European Union (EU) given their reliance on Russia for oil and gas. In 2021, more than 40% of the EU’s oil and gas imports originated from Russia and their current stance against the invasion led to calls to rapidly reduce its dependence on Russian fossil fuels. In 2022, the International Energy Agency (IEA) noted world energy investment will rise by 8%, reaching a total of USD 2.4Tn. The increase in energy investment stemmed from a boost in spending on renewables and grids to improve end-use efficiency. Fortunately, investment in oil, gas, coal and low-carbon fuels remained lower than pre-Covid levels however, the uptick in overall energy investments stemmed from higher costs. Supply-chain issues, higher energy and raw material prices continue to drive up the cost of clean energy technologies such as solar panels and wind turbines.

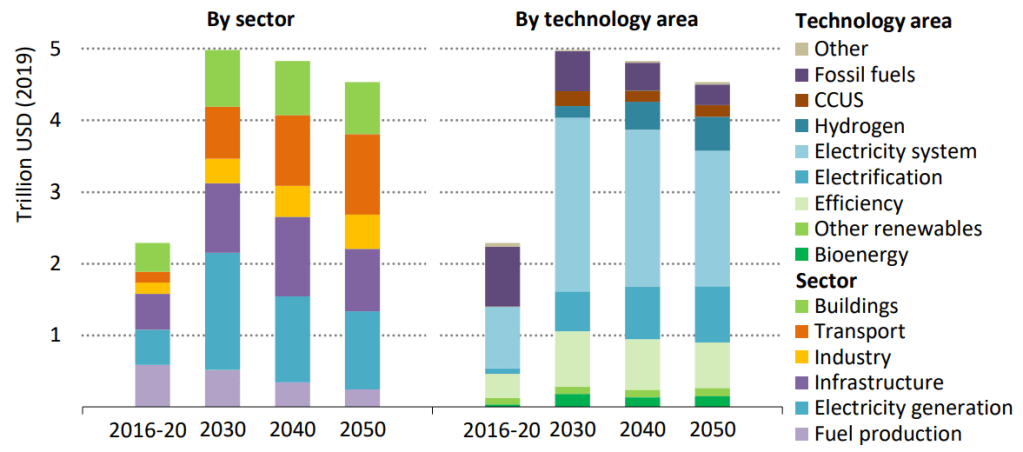

Figure 2. Annual Average Capital Investment to Achieve Net Zero Emissions

According to the IEA, annual investment in energy must double in nominal terms from around USD 2.4Tn in 2022 to around USD 5Tn by 2030 but slow to around USD 4.5Tn by 2050 to attain net zero emissions by 2050. The annual investment in electricity generation is expected to rise to around USD 1.6Tn by 2030 from USD 500Bn in 2021 but, decline thereafter as the cost of renewable technology falls. Much of the rise in capital expenditure in electricity generation stems from the expansion of grids as well as on batteries and industrial equipment necessary to aid in the shift away from fossil fuels to green energy.

Economy

The energy transition necessary to mitigate climate change will have considerable effects on all economic activities either directly or directly. Pronounced changes will be observed in the transportation sector as gas and diesel consuming vehicles are replaced with hybrid and Electric Vehicles (EV). A large number of jobs will be created in the engineering, manufacturing and construction industries which according to the IEA will boost annual global growth by around 0.5% in real GDP terms. By 2030, it is estimated that 14Mn new green energy jobs will be added to global labour and a further 16Mn due to increased demand for labour in construction and manufacturing of green energy infrastructure. Educational sectors will benefit from the energy transition as increased demand for workers in green energy require a higher number of programmes offered at all levels of education. Employment in research and development will increase tremendously as the eventual introduction of regulations and fines on emissions necessitate organisations to have a greater understanding and level of accountability for their emissions. The increase in green energy infrastructure investment will require blended financing on part of financial institutions resulting in greater cohesion amongst banks and non-banking institutions to support the energy transition.

Hydrocarbon exporting nations will see a gradual decline in investment as companies and governments shift spend more on green energy projects resulting in major adjustments to external balances. Nations rich in resources used in battery production and other resources necessary for green technology may see improvements in their current account balances due to higher demand however, hydrocarbon dependent nations may witness deteriorations in their current account balances due to curtailed demand for hydrocarbons. Over the long-term global economic growth will be sustained due to heightened investment in green technology, growth in the number of jobs and thus an uptick in household consumption as disposable incomes are poised to grow on the back of increased employment and lower household energy costs.

Conclusion

Industrialisation has led to a significant increase in GHG emissions spurring the rapid heating of the earth’s surface resulting in the gradual decline of ice found in the earth’s coldest regions. The need to mitigate climate change through a reduction in global warming motivated many nations to sign international agreements which necessitate rapid and sustained cutbacks in emissions. The requirements of a rising population along with falling costs of electronics will demand greater levels of electrification throughout the world calling for nations to boost their respective energy security but at the same time keeping their emissions in check. If adopted quickly, renewable sources of energy for electricity generation, as well as nuclear, will for the most part accomplish the goals of greater energy access and lowering emissions.

Attaining net zero carbon emissions by 2050 will require noteworthy investments in green energy which will be financed through the provision of blended financing options by financial institutions and funding from governments that collect emissions taxes and/or fines. Numerous benefits will be realised during the energy transition through to 2050 from increases in jobs in green energy sectors, advancements in education and improvements in trade balances.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.