The Fall of the FTX Cryptocurrency Exchange and the Impact on the Industry

Insights

Cryptocurrency enjoyed a prosperous year in 2021 as the asset class enjoyed record returns. In 2021, the crypto industry total market capitalization grew by 187.5%, peaking at around US$3 trillion, with many of the top coins offering four-digit and even five-digit percentage returns. The value of Bitcoin peaked to almost US$65,000 in mid-April 2021 before falling to US$30,000 by June 2021. Today, there exist over 20,000 different cryptocurrencies with some having little to no following while others like Bitcoin and Ethereum, enjoy immense popularity.

The tide turned however as the year came to an end as many economies around the world grappled with numerous macroeconomic headwinds. Financial markets were negatively impacted by these headwinds with both stocks and fixed income assets struggling. Cryptocurrency would not be spared, with leading crypto assets like Bitcoin and Ethereum down as much as 50% in the first half of 2022. Market experts speculate that cryptocurrency may fall even lower by year end 2022 given the uncertainty that has recently plagued the industry following the collapse of one of the largest cryptocurrency exchanges.

The Fall of A Crypto Giant

Prior to November 2022, FTX was recognized as one of the largest cryptocurrency exchanges in the world, gaining immense popularity during its short existence. The exchange was founded in 2019 with Sam Bankman-Fried co-founding and being the largest stakeholder in the company from inception. Mr. Bankman-Fried also co-founded Alameda Research in 2017, a quantitative cryptocurrency trading firm.

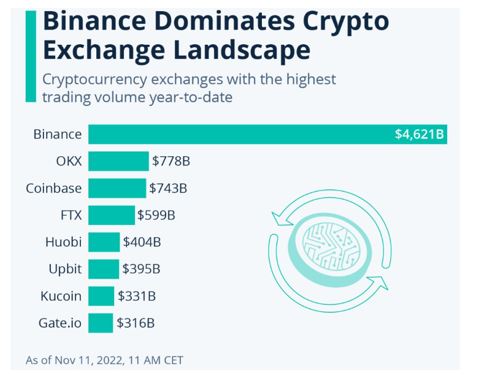

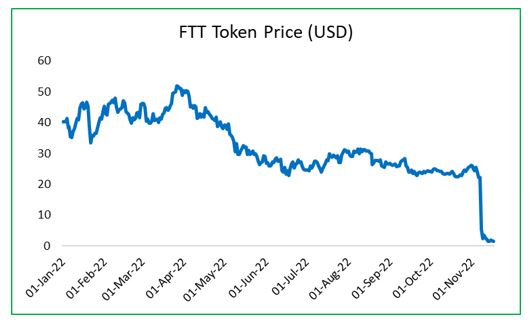

FTX enjoyed a meteoric rise, peaking in 2021 as the company’s valuation reached US$32 billion. The exchange also issued its own cryptocurrency token called FTT. At its peak in 2021, the exchange had over 1 million users and was the third largest crypto exchange by volume with its token FTT reaching a market cap of $9.39 billion. In 2022, as crypto assets struggled, the FTX exchange stood as one of the brighter lights in the sector. As other cryptocurrency exchanges were challenged on many fronts including bankruptcy earlier in the year, the majority owner of FTX came to the rescue offering financial support to several companies including Robinhood and Voyager. Sam Bankman-Fried would soon gain the nickname “Crypto’s White Knight”.

FTX downfall began when CoinDesk, a news site specializing in bitcoin and digital currencies, released a statement on November 2 2022 revealing that Alameda Research Trading firm was heavily invested in FTT, FTX’s own cryptocurrency, which represented around 40% of the trading firm’s asset holdings. This news put Sam in the spotlight and sparked widespread selloffs in the digital assets. The story exposed the depth and complexity of the relationship between FTX and Alameda Research, including that FTX was lending significant quantities of its own token FTT to the trading firm to build up their cash levels.

Although the company attempted damage control through public reassurances to their customers, it failed to prevent customers from withdrawing their funds. Four days later on November 6 2022, Binance, the world’s largest crypto exchange announced their decision to sell their entire holdings of the FTT tokens worth approximately US$529 million. Binance’s decision to liquidate their position in FTT was based on a risk management strategy following the collapse of the Terra (LUNA) crypto token earlier in 2022.

Subsequent to this announcement, withdrawal requests began to rise rapidly and two days later, FTX was faced with a liquidity crisis and stopped paying back customers. While a bail out was initially offered by Binance, it was rescinded after the necessary due diligence. As a result, eight days after the story broke, on November 11 2022 the company, FTX filed for bankruptcy.

Impact on the Cryptocurrency Market

The catastrophic collapse of the company reverberated throughout the crypto ecosystem, headlining sell-offs in other digital assets. Bitcoin fell by as much as 15% on November 9 2022 after a 13% drop the day before, trading below US$16,000 for the first time since November 2020. Etherium, meanwhile, plunged more than 30% over a two day period ending November 9 2022 and was close to falling below US$1,000.

Beyond the sell-offs in the cryptocurrency market is the damaged reputation of digital assets, raising major concerns about the industry as it is largely unregulated. Despite seeing the value of cryptocurrencies balloon in recent years and gaining widespread popularity, the asset class continues to be challenged by crises that have served to undermine investor confidence in the whole system.

While it is still too early to know and assess the full impact of FTX’s fall out on the crypto industry, the possibility of a contagion, which is a situation whereby a shock in a particular area spreads out and affect others, is very high. The fear of other exchanges and platforms experiencing a similar insolvency is elevated given the number of firms who have exposure to FTX. Crypto.com and Genesis, leading exchanges were faced with a run on withdrawals, with Genesis suspending redemptions at its lending business.

Cryptocurrency Outlook

Since the launch of the first cryptocurrency, Bitcoin, in 2009, the decentralized asset has come a far way in gaining credibility as a currency, though it still attracts some notoriety. The viability of the currency continues to gain credibility as major investment firms and professionals allocate a portion of their portfolio to crypto.

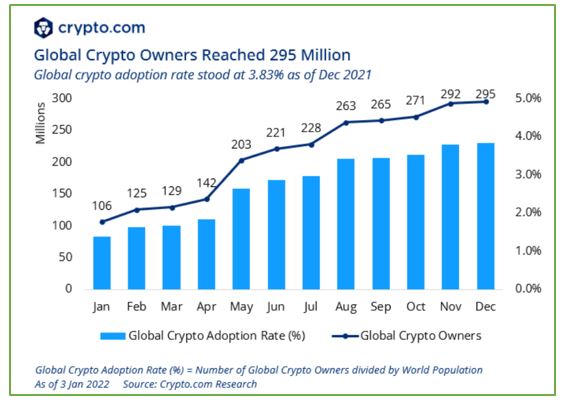

Research from Crypto.com show that adoption of cryptocurrency rose to 295 million in 2021 with the global adoption rate calculated at 3.83% at the time, led by emerging markets. Crypto.com explained that the reason for the uptake in emerging market countries is likely due to the unique, tangible benefits it provides to people living in unstable economic conditions.

One may conclude the collapse of FTX most likely set the crypto industry back a few steps in terms of its acceptability and investor confidence. Regulation continues to be seen as a material mechanism that could provide the digital market the stability and framework it needs to run more efficiently and transparently. Investors should be aware that caution must continue to be practiced in the extremely volatile cryptocurrency market as the risks are numerous and may be potent.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.