Citizenship by Investment: Importance to the Caribbean

Insights

Citizenship by Investment (CBI) program is defined by the World Citizenship Report as, “the process that legally grants individuals and in some cases, their families, a second citizenship through investments in specific industries approved by the government. This includes real estate and economic contributions through donation.” The program’s origins go back to 18th century in Scotland. Under the Scotland program, an individual was able to attain citizenship not only to Scotland but also to the United Kingdom, through a direct investment of £83 (at the time) into the Royal Bank of Scotland. Scotland’s CBI program inspired an adapted version a century later by St. Kitts and Nevis in 1984. Initially, many countries were very hesitant to adopt a CBI program, largely because of due-diligence concerns. However, its attraction increased as the economic potential of a well-designed CBI became evident through the experience of countries which would have implemented such programs. As such, its prominence and popularity rose significantly as many other countries began the implementation of their own modified versions. As of 2022, there are over 100 countries around the globe with a version of a CBI program; within the Caribbean alone, there are five (5) programs, primarily located in Organization of Eastern Caribbean States (OECS) islands such as St. Kitts, St. Lucia, Grenada, Dominica, and Antigua & Barbuda.

The COVID-19 pandemic brought the global economy to a virtual standstill, with most countries implementing strict measures in an attempt to curb the rapid spread of the virus. A particular aspect of these lockdowns which exacerbated prior imbalances that existed in the Caribbean region, was the temporary halting of all international flights. The Caribbean region is one of the most heavily reliant on tourism. This disruption resulted in a sharp fall in economic activity and foreign exchange earnings, which forced many governments to turn to external financing solutions to fill the growing financing gap amid the pandemic. According to the United Nations World Trade Organization, the loss of tourism revenue in 2020 is estimated to be USD1.3 trillion globally. In 2019, global revenue generated by the tourism industry was a significant USD1.5 trillion.

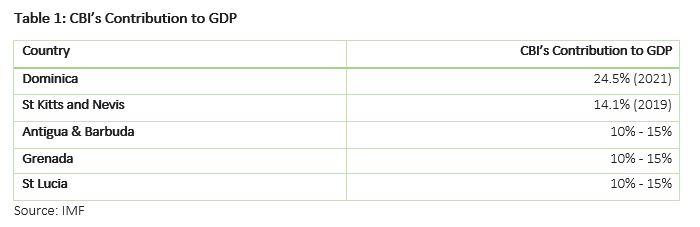

The importance of CBI programs in the region became very evident with the grounding of commercial aircrafts during the pandemic, as countries were able to generate much needed revenues that were necessary to meet financial obligations. CBI programs contribute significantly to the region and varies by country.

Table 1: CBI’s Contribution to GDP

CBI programs allow governments to fund and execute critical projects within the economy. The added fiscal space allows for the implementation of much needed social programs such as social security and pensions, improve infrastructure, reduce unemployment and providing a tax break for citizens.

St. Kitts and Nevis

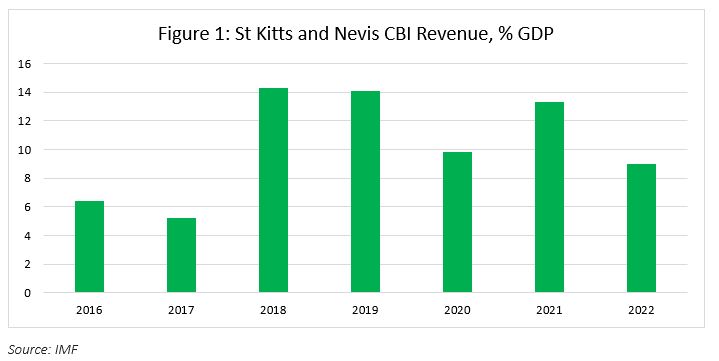

The CBI program in the St. Kitts economy was implemented not as a mere “quick fix” but as a means of diversifying the economy. The CBI program aids in reducing the level of economic volatility due to the dependence on the tourism sector, mitigating natural disaster risk, as well as maneuvering adverse economic shocks such as the COVID-19 pandemic.

In its most recent Article IV publication, the International Monetary Fund (IMF) stated that “St. Kitts and Nevis entered the COVID-19 pandemic from a position of fiscal strength following nearly a decade of budget surpluses. A significant part of the large CBI revenues was prudently saved, reducing public debt below the regional debt target of 60% of GDP and supporting accumulation of large government deposits.”

The revenue generated by the CBI positively impacts other sectors including real estate, tourism, and construction which in turn has a direct and positive impact on the labour market through employment generation. There have also been substantial infrastructural enhancements in St. Kitts and Nevis as a result of the windfall revenue, including more resilient houses, hospitals and clinics. For example, after Hurricane Irma devastated the country causing an estimated XCD53.2 million in damages, the Hurricane Relief Investment Fund was established by the CBI program to create a sound and reliable source of income to aid with the reconstruction of the economy.

With continued enhancements, the government seeks to expand the program by making it more accessible to foreign investors. In the fiscal year 2022/23 budget statement, it was announced that a new investment type would be created – the Alternative Investment Option. As stated by the Prime Minister, “this option provides investors with another means by which to gain economic citizenship while contributing to the overall development of the country. It would involve projects that would spur economic activity…, create jobs, and facilitate the transformation of the country in line with the Government’s Development Agenda. The success of this initiative would redound to the benefit of the people of this country and would certainly go a long way in putting St. Kitts and Nevis back on track.”

Dominica

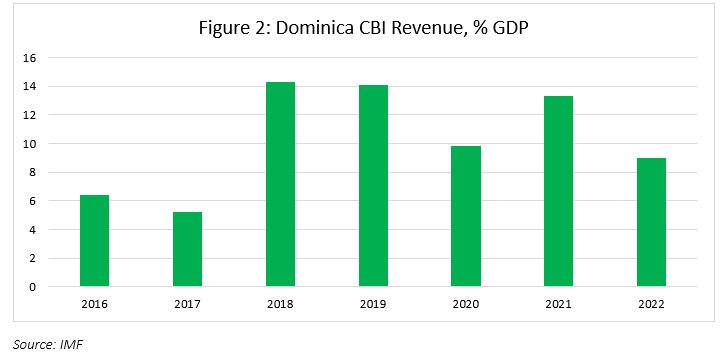

The Citizenship by Investment program in Dominica was established in 1993. It was utilized as a transformative tool to propel the economy into a tourism and service-based economy from being a former agricultural-based society. The CBI program allows for one to invest into the Dominican economy via two avenues with the Economic Diversification Fund (EDF), a government-authorized fund used for the development of houses, schools, hospitals, roads along with the advancement of both the tourism sector and the agriculture sector. The other investment option is real estate. This allows foreign nationals to invest in government-approved properties. These include internationally renowned hotel chains such as the Hilton and Marriot hotels.

The program is of grave importance to economy, allowing Dominica to rebuild from the double disaster of Hurricane Maria in 2017 and the ongoing COVID – 19 pandemic. In its Article IV consultation, the IMF estimated that the pandemic’s effect on Dominica’s economy led to the contraction of GDP by approximately 11%. Despite its impact, there was “strong growth in the construction sector stemming from the large public investment program through 2020-21, financed by exceptionally high revenue from the Citizenship by Investment (CBI) program.”

In light of the country’s susceptibility to natural disasters following hurricane Maria in 2017, the focus was placed on developing more resilient infrastructure, restructuring and repairing bridges and roadways all of which were funded by revenue attained from the CBI. The tourism sector is predicted to peak after the construction of a USD370 million international airport which is expected to be completed in 2025 – a project which is completely funded by the CBI program. The airport will facilitate an enhanced tourism industry as it will create greater accessibility to the island. It will also provide employment opportunities by the expansion of commerce prospects and increased training which will allow the labour force to meet the required skillset needed to facilitate the technological development within the country. Further, the program would have funded the completion of a school at a cost of XCD7 million.

In the long term, IMF policy recommends that Dominica reprioritize the use of the CBI revenue to financial insurance and debt service to reduce public debt and enhance near-term projections against natural disasters.

Conclusion

CBI programs are becoming increasingly popular globally, and at the same time, have come under more scrutiny. Therefore, countries are continuously seeking enhancements to their CBI programs to increase the effectiveness and efficiency by properly managing the inflow of the investments and ensuring its sustainability in light of growing global competition. Caribbean countries have been comparatively successful by offering visa free access to approximately one hundred and thirty (130) countries and a low introductory cost. Although there may be due-diligence issues whereby the fund may be misused or may be subject to bribery or corruption, countries are working tirelessly to develop a management framework in which saving, debt repayment and the building of financial buffers will be a point of priority.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.