Barbados’ ReBERT

Insights

Barbados has expressed interest in another economic program supported by the International Monetary Fund’s (IMF) three-year Extended Fund Facility (EFF) aimed at maintaining and strengthening macroeconomic stability and to continue with the implementation of the country’s structural reform agenda. The Barbados Economic Recovery and Transformation (BERT) 2.0 plan would entail Barbados entering a 36-month programme which would allow access to approximately USD110 million. In addition, a further USD183 million will also be made available through a staff-level agreement to access the IMF’s Resilience and Sustainability Trust (RST), which aims to provide affordable, long-term financing to help build resilience against climate change.

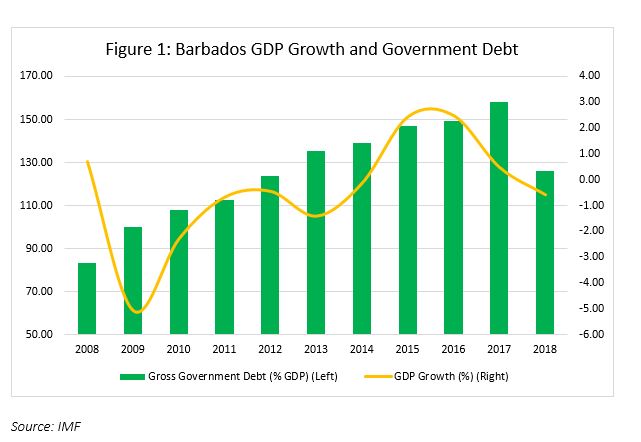

The first iteration of the BERT programme began in 2018 and resulted from significant imbalances in the Barbados economy coming out of the global financial crisis of 2008/09. Prior to the global financial crisis, the Barbados economy registered modest but consistent growth, averaging 2.1% for the 2000 – 2008 period. Structural imbalances while present, were not at the forefront, with the external current account balance averaging a deficit of 6.9% of GDP between 2000 – 2008, largely due to the country’s high import dependence alongside gradually increasing debt, which remained below 75% of GDP until 2008.

Following the global financial crisis, Barbados’ economy entered an extended recession, with GDP contracting by an average of 0.52% for the 10-year period until 2018 while simultaneously, structural imbalances continued to deepen. Government debt rose significantly to 126% of GDP in 2018, the majority of which was domestic (roughly 93% of GDP). Interest payments as a percentage of total government revenues steadily increased, costing over a quarter of all revenues (27%) by 2018, significantly reducing available and already scarce resources. Throughout this time, the credit rating of Barbados deteriorated, moving from a Standard and Poor’s (S&P) investment grade rating of ‘BBB+ in 2008 to Selective Default (SD) in 2018.

Given the severity of the looming Barbados debt crisis, the IMF[1] noted that meeting the debt obligations without jeopardizing financial stability of Barbados was the top priority. In the 2018/19 period the following actions were taken for domestic debt:

- Debt service on external debt held by commercial creditors was halted immediately.

- Government continued to pay interest on domestic debt, with holders of domestic debt expected to roll over maturing principal.

- Interest on domestic debt continued to be paid until the government launched an exchange offer for domestic debt (Barbados dollar-denominated) on September 7, 2018. This measure was put in place to fill the gap until the launch of the Extended Fund Facility (EFF) on October 1 2018.

Legislative amendments were also required by Barbados. In September 2018, the parliament of Barbados adopted legislation that retrofitted a collective action mechanism into domestic debt. Under this legislation, in the event of a debt restructuring, creditors holding 75% of the aggregate outstanding principal amount of “specified debt instruments” that submit a voting form can, if they accept a restructuring proposal, make the restructuring legally binding for all holders.

During this time also, the BERT plan was introduced and was aimed at restoring fiscal sustainability, increasing reserves, and unlocking growth potential through structural reforms. The programme was subject to review by the IMF at regular six-month intervals for a period of four years. The three broad goals of BERT were:

- Fiscal adjustment – such that a primary surplus of 6% of GDP over time can be achieved and maintaining the surplus in years to come to strengthen social safety nets and protect vulnerable groups. The surplus of 6% would be maintained until 2023/24 and gradually reduced afterwards. This goal was pushed back because of the COVID 19 pandemic.

- Ensure debt sustainability by achieving a debt to GDP ratio of 80% in FY 2027/28 and 60% in 2033/34 – through debt restructuring, a reduction in financing needs to 15% of GDP, and drastically reducing total interest expenditures.

- Reforming of State-Owned Enterprises (SOEs) – a reduction in transfers to SOEs by 2% of GDP to around 5% of GDP in total, to allow greater fiscal space as the level of 7.5% at the start of the programme was considered too high.

- Structural reforms to support economic growth – by addressing “weaknesses in the business climate, including slow processes for obtaining construction permits, getting electricity, and registering property, and will include financial and labour market liberalization policies.”

With the implementation of the BERT programme, Barbados’ credit rating with S&P recovered to a “highly speculative” rating of B-, which it has since maintained.

How did COVID-19 affect BERT?

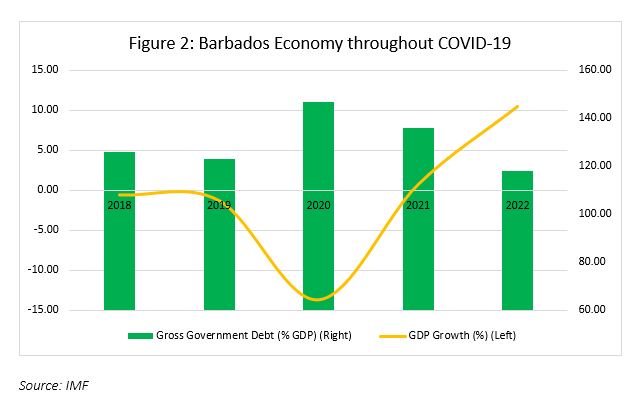

Barbados’ primary means of economic activity is the tourism industry, which accounted for roughly 32% of GDP before the pandemic. The COVID-19 pandemic brought the global economy to a near standstill in 2020, with most countries implementing strict lockdown measures and travel restrictions in an attempt to curb its spread. These measures had a significant impact on the Barbados economy as the government had to turn to debt financing from international financial institutions in order to maintain some economic activity. This resulted in a reversal of the progress made as the debt burden rose and GDP contracted by a significant margin.

Many of the targets under BERT were pushed back as a result of the pandemic; two key shifts were the primary surplus goal of 6% of GDP by FY2023/24, which was pushed to FY 2025/26, and the debt sustainability goal of 60% of GDP was pushed to FY 2035/36. With all these factors considered, seven reviews were conducted by the IMF during the BERT programme, five were done during the COVID-19 pandemic. In each review, the Government of Barbados met all required quantitative targets, however, some structural targets were delayed.

With each successful review, funds under the EFF were made available to Barbados. In its final review on 31 May 2022, the IMF praised Barbados for continuing to make good progress considering the challenges faced. All quantitative targets for end-December 2021 and end-March 2022 under the EFF were met. With this final review, authorities were allotted about USD23 million, making total disbursements under the EFF programme USD435 million.

Conclusion

The BERT programme has undoubtedly supported the recovery of the Barbados economy and allowed for some level of beneficial reform to occur. While the COVID-19 pandemic reversed and/ or stalled some of the progress made in prior years, the Barbados economy is on a favourable path, especially with the easing of restrictions globally and expectations of a strong recovery in the tourism industry. The BERT 2.0 programme is likely to allow Barbados to effectively continue along its trend and achieve much needed further economic and structural reforms.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.

[1] Working paper “Barbados’ 2018–19 Sovereign Debt Restructuring–A Sea Change?”