Europe’s Economic Landscape – Risk of Global Recession

Insights

A recession in Europe seems inevitable, adding even more fuel to speculations of a global recession. In its World Economic Outlook in January, the International Monetary Fund (IMF) stated that “the global recovery was underway despite the resurgence of the pandemic with world growth expected at 4.4% in 2022.” In April, however, its projection for global GDP growth was lowered to 3.6% and was cut even further in July to 3.2%, largely attributed to the economic damage stemming from the war in Ukraine. Worries of inflation in Europe had been brewing even before Russia invaded Ukraine in February but with the start of the war and its prolongation, the threat of recession in Europe has been triggered.

Europe continues to face several other challenges contributing to its downturn. Firstly, the temporary suspension of its gas supply from Russia to Germany, has resulted in gas prices surging to an all-time high of €339 per Megawatt-Hour in August. According to Capital Economics, most European nations will be more adversely affected by the rising gas prices today than by the oil crises of 1974 and 1979, both of which were “followed by recessions.” Russia’s decision to suspend natural gas supplies via the Nord Stream 1 pipeline, which connects Russia to Germany via the Baltic Sea has caused a jump in gas prices, raising fears of energy rationing of throughout the coming winter season in Europe. Russia has claimed this decision was driven by the economic sanctions imposed on the country by the West and resumption of gas supplies are completely dependent on these sanctions being lifted.

Moreover, the euro has also hit a new 20-year low against the dollar, which makes it even more expensive to purchase energy on international markets which is paid in U.S. dollars. Overall business activity has also contracted in Germany, France and Italy due to the overall rise in prices and a fall in demand. Additionally, Europe has also been experiencing a drought with record-low water levels in rivers such as the Rhine, its major route for essential products like grains and chemicals. While some vessels can no longer pass all together, others are only being loaded to 30-40% capacity. Credit rating agency Moody’s said the low Rhine water levels will increase costs for chemicals companies. With less freight, delays, and overall higher costs, other economists have concluded that economic growth can be impacted by as much as half a percentage point. The drought has also led to a reduction in hydroelectric production, putting a further strain on power supply at a time when it seems to be needed most.

Not only are energy-intensive industries being affected, but the European fertiliser industry association also indicated last month that 70% of production had been disrupted by the hike in gas prices, demonstrating the threat that the energy crisis has on other sectors such as food production. According to Reuters, “this coincidence of higher prices and low growth, often referred to as stagflation, leaves the European Central Bank (ECB) with only painful choices that will increase the pain for the euro zone’s 340 million people.” This of course leaves implications for emerging and developing countries who may suffer a blow if a global recession occurs.

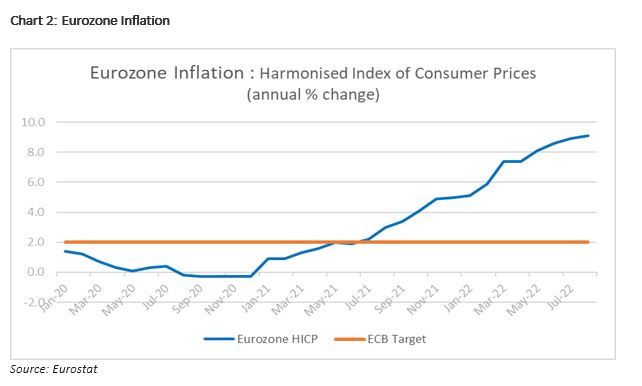

With inflation continues to erode purchasing power, there is increased pressure on the ECB to raise interest rates. On 8 September, the ECB raised interest rates 75 basis points, taking its benchmark rate to 1.25% to tackle record inflation and has warned that interest rates can raise further since inflation remains far too high and is likely to stay above target for an extended period. According to latest data from Eurostat, inflation in the Eurozone rose 9.1% in August. Runaway energy prices, which have increased dramatically since Russia’s invasion of Ukraine in February, are fuelling inflation. The ECB has revised up its inflation expectations, forecasting an average 8.1% in 2022, 5.5% in 2023 and 2.3% in 2024.

Despite growth of 0.8% in the second quarter, many economists believe that a recession in the Eurozone is almost certain to materialize in the months to come as consumers’ purchasing power remains constrained and businesses find it difficult to pass on rising input prices. According to Barclays Bank, the Eurozone will experience a recession in the fourth quarter that will last until the second quarter of 2023, causing real GDP to contract by 1.7%. More optimistic economists have argued that the downturn may be temporary as the current energy prices were sparked by the war, therefore the implications are circumstantial rather than reflective of a longer-term systematic problem. However, there are no indications of the war coming to an end which leaves Europe in a very vulnerable state.

The U.S. and China seem to also be entering a slowdown this year and a downturn in one region will significantly increase the possibility of recession in another. Chief economists of the IMF have indicated that “a recession in the US, especially if triggered by a cycle of interest-rate hikes by the Federal Reserve, would curtail global import demand and trigger chaos in financial markets.” Business confidence and financial markets globally will also be gravely affected if a slowdown continues because of the ongoing war, leaving uncertain consequences for global economic growth. This dilemma is very complex and will require governments and policymakers to adjust and manage economic policy wisely to remain resilient in the face of a possible global recession.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.