United States Consumption Outlook

Insights

Current Economic Developments

The outlook for United States (US) consumption is positive as growth in household savings throughout 2020, strong job and wage progress during 2021, as well as the economic recovery helped to boost private demand for goods and services. The government’s substantial fiscal stimulus package aimed at securing jobs, wages and providing improved social assistance to households affected by the pandemic improved national income. The near-term consumption outlook will depend heavily on the removal of restrictions on movement throughout the country which rests on the success of the government’s vaccination programs. The nation’s near-term economic outlook is highly dependent on the pass through effects of expansionary fiscal and monetary policies on businesses and consumers.

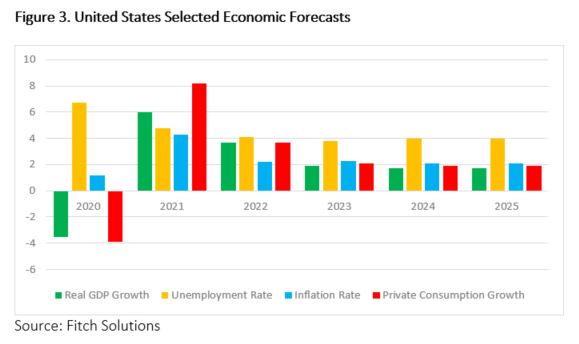

In Q321, real GDP growth of 2.0% was driven by increased private inventory investment, personal consumption expenditure (PCE) along with state and local government spending. However, this marks a deceleration from 6.7% in the previous quarter as residential fixed investment, federal government spending and exports showed significant declines. Despite the deceleration in growth, inflation as measured by PCE rose to 4.4% in September from 4.2% in August as food prices and energy commodities prices rose substantially. Although personal income decreased by 1.0% in September according to the Bureau of Economic Analysis, PCE continues to rise on a monthly basis. The decline in personal income reflected the expiration of government social benefits as various job and wage retention schemes launched to combat the economic fallout from the pandemic were unwound. Employment conditions continue to improve as various sectors reopened, including leisure and hospitality, which showed notable job gains in October. The unemployment rate declined to 4.6% in October from 4.8% in September as employment rose markedly in sectors such as manufacturing, transport, construction as well as leisure and hospitality. Notwithstanding the month on month improvement, there is some degree of slack in the labour market as the pre-pandemic unemployment rate was much lower at 3.5% measured in February 2020.

Vaccination Status

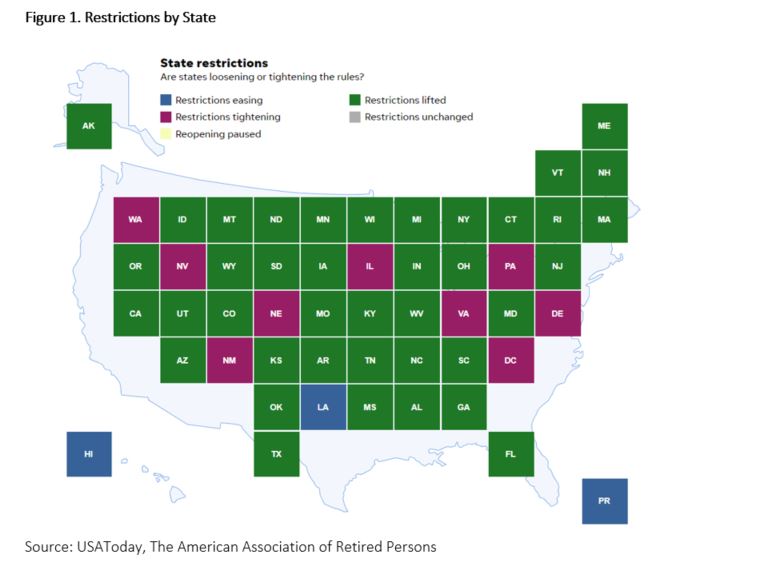

According to the Centers for Disease Control and Prevention (CDC), as of 10 November 2021 roughly 225Mn or 67.7% of the US population received at least one dose of a Covid-19 vaccine. The number of persons fully vaccinated is not far behind at 1945Mn or 58.5% of the population. In November, the weekly caseload slowed to 510,287 from a peak of 1.71Mn in January. The weekly death count declined significantly to 7,466 from 23,809 over the same period, with forecasts of declining death counts in the coming weeks according to the CDC. 40 states across the US reopened fully as restrictions have been lifted, however in nine states restrictions are being reinstated to curb the recent rapid uptick in new cases and three states’ restrictions are still in place but are being eased.

Ongoing Stimulus Support

Through the course of the pandemic, government spending increased substantially as several large fiscal stimulus packages were launched to mitigate the associated economic and social fallout. The majority of fiscal support was introduced in 2020 and is providing substantial assistance to households. Some ongoing support measures include direct relief payments, reduced taxation on unemployment benefits, emergency rental assistance to households that are unable to pay rent or utilities and the expansion of the child tax credit program. Businesses were granted various critical tax benefits such as employee retention credit and paid leave credit to small businesses that kept persons employed throughout the pandemic. The paycheck protection program provided small businesses with further resources to maintain payroll, re-hire employees that may have been retrenched and cover some expenses based on outlined criteria.

In the Federal Reserve Bank’s (Fed) quest to obtain maximum employment and stable inflation, the federal funds rate was lowered by 150bps to 0-0.25% in March 2020 due to depressed economic conditions. Although inflation surged to 4.4% in September 2021, the unemployment rate of 4.6% is well above their assessment of maximum employment the Fed decided to keep the federal funds rate at 0-0.25%. However, monthly purchases of net assets and Treasury securities lessened to USD 10Bn and USD 5Bn respectively. Several facilities aimed at boosting liquidity conditions and improving lending conditions to businesses were implemented by the Fed to ease monetary conditions and provide further support to the economy.

Rising Inflation Risk

Table 1. Metals Commodity Prices

| Commodity | Unit | Jul-Sep 2020 | Oct-Dec 2020 | Jan-Mar 2021 | Apr-Jun 2021 | Jul-Sep 2021 | 2022f | 2023f | 2024f |

| Aluminum | USD/mt | 1,708 | 1,919 | 2,091 | 2,400 | 2,645 | 2,640 | 2,403 | 2,267 |

| Copper | USD/mt | 6,525 | 7,185 | 8,477 | 9,706 | 9,382 | 8,606 | 7,882 | 7,083 |

| Iron ore | USD/dmt | 117.8 | 133.2 | 167.2 | 200.7 | 166.9 | 127.1 | 115.4 | 94.4 |

| Lead | USD/mt | 1,876 | 1,904 | 2,014 | 2,128 | 2,333 | 2,054 | 1,923 | 1,897 |

| Gold | USD/toz | 1,912 | 1,875 | 1,798 | 1,815 | 1,789 | 1,711 | 1,663 | 1,623 |

| Platinum | USD/toz | 904 | 939 | 1,160 | 1,182 | 1,023 | 978 | 976 | 975 |

dmt – dry metric ton, mt – metric ton, toz – troy ounce, f – forecasted

Source: World Bank

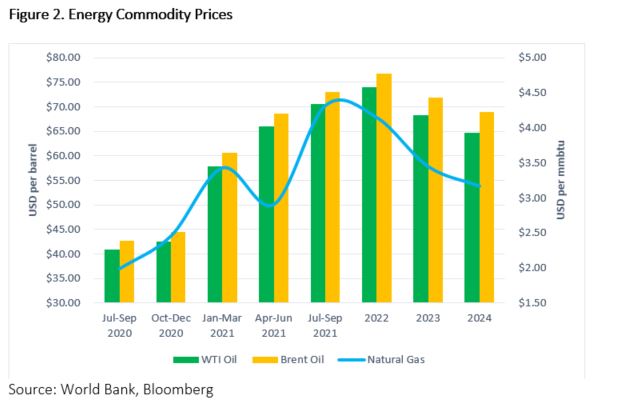

The price of energy commodities rose continuously during 2021 as global demand for transport services recovered along with increased manufacturing and industrial activity as economies across the world reopened. The prices of metals such as aluminum and lead used in the production of automobiles, machinery and aircrafts rose substantially in 2021 when compared to 2020. Over the medium-term, commodity prices are projected to decline as global demand lessens. As adherence to reduce the global carbon footprint becomes stricter, the demand for energy commodities are expected to fall further in the medium to long term.

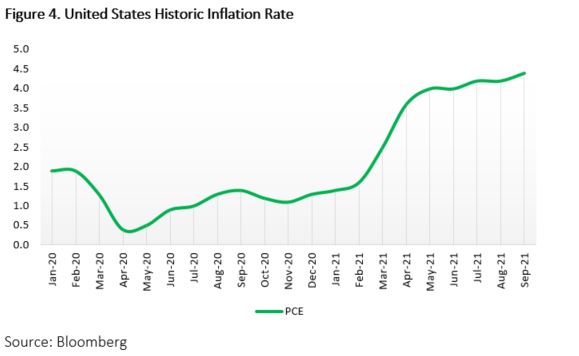

Since the onset of the pandemic, inflation measured by PCE has moved very much in line consumer sentiment. In April 2020, inflation dipped to its lowest at 0.4% as energy commodity prices tumbled as storage throughout the world reached their maximum capacities as demand for energy dipped and as global transportation and tourism nearly halted. Eventually as restriction eased in various states, inflation rose as private consumption picked up. In early 2021, the rollout of vaccinations to reduce the spread and risk of death from the pandemic boosted consumer sentiment substantially and led to the surge in inflation. The removal of restrictions in various states coupled with significant wage growth and increased employment led to the notable rise in inflation. One year later, inflation measured 3.6% in April 2021 and reached as high as 4.4% in September 2021 as energy and food prices surged in line with the uptick in consumer demand.

Currently, the inflation rate is well above the Fed’s target of 2.0% but the recent shift in its policy stance lowers the chance of a sudden interest rate hike. The Fed decided to target an average inflation rate of 2.0% over an unspecified period of time and ensure employment is at its maximum level before it chooses to adjust rates upwards or downwards. Given the relatively high unemployment rate of 4.6%, along with view that the surge in inflation is temporary, interest rates are likely to remain at current levels through the short-term. Inflation expectations in the medium-term are low with inflation averaging 2.2% and 2.3% in 2022 and 2023 respectively.

Outlook

In July, retail sales grew by 17.2% year-on-year and will remain robust through the end of the year with the usually busy holiday season. Fiscal policy measures to maintain disposable incomes, increased demand for labour and the sturdy buildup of household savings will contribute substantively to the growth in consumption. Private consumption will remain robust in 2022 as all pandemic-related restrictions are lifted and employment conditions continue to improve as well as wage growth. Risks to the outlook stem from reduction in fiscal stimulus as well as the pace of vaccination rollout across the US. A sudden and abrupt reduction in spending on social support measures will weaken consumer sentiment and shrink demand. Sustained increases in commodity prices will place upward pressure in prices of final goods such as automobiles, houses, as well as other consumer durables and may lead to weaker demand and private consumption in the short-term.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.