The Fed’s Policy Stance and its impact on the Financial Markets

Insights

The US Federal Reserve (Fed) has the ability to influence the performance of the US economy and this indirectly impacts the performance of the stock market. The stock market can be seen as a reflection of how confident consumers are about the strength and performance of the economy currently and in the future. The Fed’s dual mandate for monetary policy is to achieve price stability and maximum employment in the U.S. economy. The Fed policymakers have set a target rate of inflation of 2% in order to accomplish price stability. Investors are generally forward looking and pay attention to Fed announcements to gauge expectations of future monetary policy actions and its impact on financial markets.

Policy measures implemented by the Fed since the start of the Pandemic

During the early part of the pandemic in the US, financial market stress rose significantly. For the week ending 20 March, 2020, the St. Louis Fed Financial Stress Index, which measures the degree of financial stress in the markets, reached its highest level observed since the December 2008 financial crisis. As a result, the Fed stepped in with a broad array of actions to cushion the economic damage from the pandemic and provide support to the US economy and financial markets. The US Federal Reserve slashed its short-term benchmark rate by a total of 1.5 percentage points since 3 March, 2020, bringing it down to a range of 0% to 0.25%.

The Fed also resumed purchasing massive amounts of securities (Quantitative Easing), a key tool employed during the 2008 financial crisis, when the Fed bought trillions of dollars in long-term securities. After the outbreak of COVID-19, the Treasury and mortgage-backed securities markets became dysfunctional and the Fed indicated that it would buy at least USD500 billion in Treasury securities and USD200 billion in government-guaranteed mortgage-backed securities over the coming months which were aimed at restoring smooth market functioning and flow of credit. Market function subsequently improved and the Fed tapered its purchases through the months of April to May 2020. On 10 June 2020, the Fed said that it would stop tapering and buy at least USD80 billion a month in Treasuries and USD40 billion in residential and commercial mortgage-backed securities. These measures currently remain in place.

The Fed also revived the Primary Dealer Credit Facility (PDCF), which was used in the global financial crisis and offered low interest rate loans up to 90 days to 24 large financial institutions known as primary dealers. The Money Market Mutual Fund Liquidity Facility (MMLF) was also relaunched to provide loans to depository institutions to purchase assets from prime money market funds. The Fed also implemented a number of other tools aimed at encouraging banks to lend, supporting corporations and businesses as well as households and consumers.

Most of the measures implemented by the Fed to support the US economy and the Financial Markets expired in March and June 2021 with the exception of a few, such as, the Quantative Easing Programme, its Repo operations and the cuts made to its short-term benchmark rate.

Market Reaction to Fed Policy Guidance

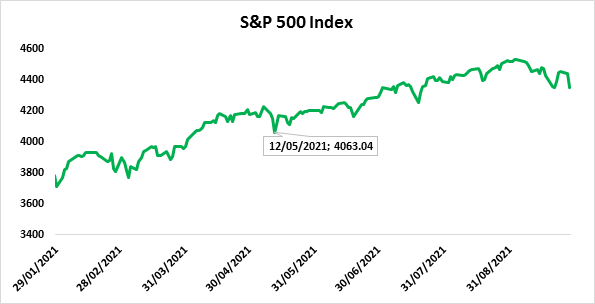

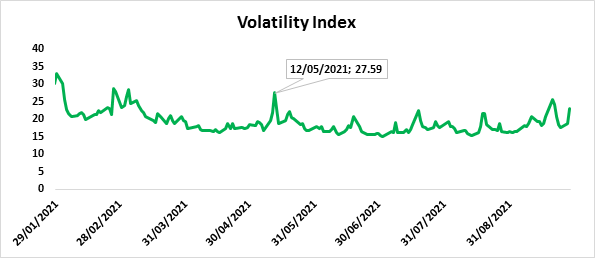

With the reopening of the economy in Q1 2021 and the fiscal spending from the stimulus put forward by the Biden Administration and passed by Congress, US GDP increased at an annual rate of 6.3% in Q1 2021 and 6.6% in Q2 2021, reflecting the continued economic recovery. US inflation as measured by the Consumer Price Index (CPI) significantly increased from 2.6% in March 2021 to 4.2% in April 2021. This was the fastest annual increase in inflation since September 2008. The rising inflation pressures resulted in heightened stock market volatility with the Volatility Index moving from 16.69 on 7 May to 27.59 on 12 May. The S&P index also experienced a 4% decline as investors feared that the Fed could move earlier than expected to begin pulling back on its monetary policy accommodation. The stock market rebounded and recuperated most of its losses by the first week of June 2021. At its June 2021 meeting, the Fed attributed the higher inflation to transitory factors related to the reopening of the economy.

The Fed also signaled in its July 2021 meeting that it would start reducing the volume of its bond purchases later in the year. This signal made some investors worried about the risk of another ‘taper tantrum’ as occurred in 2013; however, despite the fear of history repeating, investors remained calm when the Fed hinted at tapering in July 2021. One explanation for this difference in market responses is that the announcement in 2021 was in line with market expectations whereas the announcement in 2013 came earlier than expected.

Fed guidance in its latest meeting

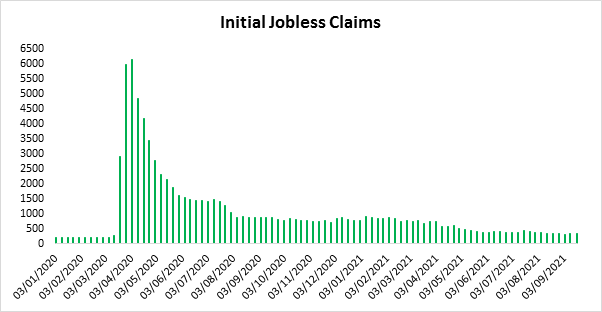

Inflation for August 2021 remained relatively high at 5.3% and the labour market statistics, as measured by initial jobless claims (the number of Americans filing new claims for unemployment benefits), has been trending down signifying a recovery in the labour market. As the economy continues to grow, the Fed will need to strike a balance in changing its accommodative monetary stance and not disrupting the growth in the markets and economy.

In the most recent Federal Open Market Committee (FOMC) meeting held on the 21st and the 22nd of September 2021, the Fed kept the target range for the federal funds rate at 0% to 0.25% and continued with its purchase of Treasury securities by at least USD80 billion per month and of agency mortgage‑backed securities by at least USD40 billion per month. The Fed Chairman Jerome Powell did not give a definite time as to when it will start to trim back its bond purchases but stated that the economy has made progress toward the Fed’s employment and price stability goals and if progress continues broadly as expected, a moderation in the pace of asset purchases may soon be warranted.

The Fed in its dot plot projections for September showed nine of eighteen members of the FOMC expect to raise interest rates by the end of 2022, increasing from seven members in June. Interest rates are also projected to increase further in 2023 to as high as 1%to 1.25%.

What to expect going forward

The Fed has announced the tapering of its bond purchases since its July meeting in an attempt to prepare the market for a tightening in its monetary policy. In its meeting in September, the Fed indicated that the tapering may begin soon as highlighted in its minutes. This may lead to higher interest rates as the volume of bond purchases by the Fed falls, the supply of bonds in market will increase. Assuming demand for bonds remains the same, this will lead to a fall in bond prices and subsequent rise in interest rates, given its inverse relationship.

The Fed also projected an increase in the Fed Fund Rate as early as 2022 which will strongly impact on short-term interest rates. The Fed’s near zero rates have helped to prop up the stock market over the past year by keeping bond yields low and pushing investors towards riskier assets such as stocks. While markets did not react negatively to the announcement by the Fed of a potential increase in interest rates in its September meeting, this could pose a risk for stock markets going forward.

The Fed, in its latest projections, expects growth of 5.9% for the US economy over 2021 and will moderate to around 3.8% in 2022. While these projections are positive, there are still underlying risks such as the impact of the Delta variant which could pose a risk to economic recovery.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.