Green or Gone: Climate Risk and Investment Flows in the Caribbean

Insights

Introduction

Climate change is no longer a distant concern for the Caribbean; it is already shaping the trajectory of investment and economic growth. As one of the most climate-vulnerable regions in the world, the Caribbean faces frequent hurricanes, rising sea levels, and coral reef degradation that directly threaten its key industries. Investors are increasingly attentive to these risks, relying on climate risk ratings, ESG screening, and adaptation-readiness assessments before committing capital. The discussion that follows considers how climate vulnerability is shaping investment patterns in tourism, infrastructure, and foreign direct investment, while also highlighting the ways Caribbean economies can strengthen their resilience and position themselves as attractive destinations for sustainable finance.

Climate Risk as a Determinant of Investment

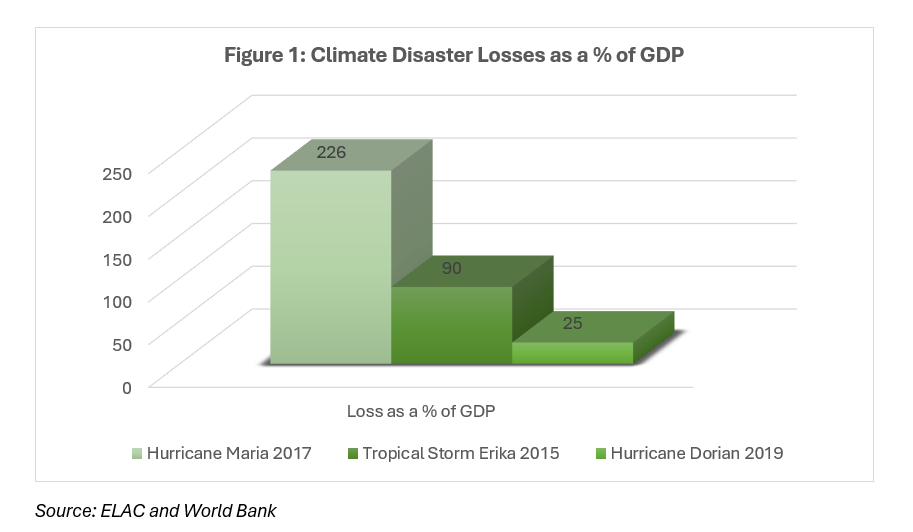

The scale of climate-related disasters in the Caribbean has made investors factor climate risk directly into their decisions. After Hurricane Maria struck Dominica in 2017, the Economic Commission for Latin America and the Caribbean (ECLAC) estimated that the damages amounted to 226% of the island’s GDP. Similarly, when Hurricane Dorian devastated The Bahamas in 2019, ECLAC calculated the losses at USD3.4 billion, nearly one quarter of the nation’s GDP. Such catastrophic figures highlight how climate shocks can overwhelm small economies, forcing investors to reconsider the risks of doing business in the region.

Insurance mechanisms have become crucial for sending positive signals to markets. Following Hurricane Beryl in 2024, the Caribbean Catastrophe Risk Insurance Facility (CCRIF) announced that it had disbursed USD84.5 million to seven member states, with Grenada alone receiving more than USD44 million. The speed and scale of these pay-outs demonstrated that the region has developed financial tools to manage disaster shocks, thereby reassuring investors that their capital is less likely to be stranded following a natural disaster.

The vulnerability of the tourism sector offers a stark example of how climate change translates into investment risk. The United States National Oceanic and Atmospheric Administration (NOAA) reported in 2025 that the world was experiencing its fourth global mass coral bleaching event, with more than 80% of reef areas exposed to bleaching-level heat stress between 2023 and 2025. For the Caribbean, where the World Travel and Tourism Council estimated in 2024 that tourism generates tens of billions of dollars annually, the loss of coral reefs undermines a central pillar of economic and financial stability.

How Investors Screen Climate Readiness

In recent years, investors have moved beyond traditional economic indicators and begun to place greater emphasis on climate readiness. The Notre Dame Global Adaptation Initiative, in its 2024 Country Index, ranked Barbados 26th globally for readiness, signalling strong institutional and financial capacity to adapt to climate risks, while Jamaica was placed much lower at 90th out of 187 ranked countries, suggesting weaker resilience and greater execution risk.

City-level diagnostics also play a role in shaping perceptions of investment risk. The Stimson Center’s Climate and Ocean Risk Vulnerability Index (CORVI), published in 2023, has been applied to cities such as Kingston in Jamaica and Roseau in Dominica. These reports provide detailed profiles of risks to ports, housing, and tourism infrastructure, helping investors determine where resilient investment pipelines may be most viable. At the sovereign level, rating agencies such as Moody’s have also begun integrating climate risks into their assessments, noting in 2024 that exposure to hurricanes and sea-level rise can directly affect debt sustainability and borrowing costs.

Disclosure practices further influence investor confidence. In 2023, the International Sustainability Standards Board (ISSB) issued its first global climate disclosure standards, creating a unified framework that helps reduce information risk. Jamaica quickly followed suit by introducing guidelines for green, blue, and sustainability bonds through its Stock Exchange in 2024, a move that provides local platforms for ESG-focused investors to finance projects that address climate risks directly.

Sectoral Impacts: Tourism and Infrastructure

Tourism is perhaps the most climate-sensitive industry in the Caribbean. A study conducted by the United Nations Conference on Trade and Development (UNCTAD) in 2023 showed how rising sea levels and storm surges threaten Jamaica’s coastal transport systems, including ports and airports that serve as gateways for millions of tourists. Such vulnerabilities not only jeopardize tourism revenues but also increase investor concerns over the longevity of tourism-linked projects.

Caribbean governments have recognized these risks and are investing in resilience. In Saint Lucia, the World Bank’s 2022 Disaster Vulnerability Reduction Project financed the construction of climate-resilient bridges and coastal protections designed to withstand stronger hurricanes. Similarly, the Green Climate Fund reported in 2021 that Grenada’s G-CREWS program had been launched to improve water security for households and hotels, ensuring that tourism and community needs could still be met even after natural disasters. These types of initiatives reassure investors by demonstrating that governments are actively working to climate-proof vital infrastructure.

Infrastructure finance is equally shaped by climate concerns. In March 2023, the International Monetary Fund (IMF) approved Jamaica’s Resilience and Sustainability Facility, which introduced reforms to embed climate risk screening into public investment and public-private partnership frameworks. By ensuring that future infrastructure projects account for disaster resilience from the start, Jamaica is signalling to investors that projects will remain bankable over their entire life cycle, despite growing environmental risks.

Financial Innovation: Climate-Smart Instruments

One of the most notable developments in the Caribbean is the way governments are innovating with financial instruments to address climate risks. In 2024, the World Bank reported that Jamaica had successfully issued a USD150 million catastrophe bond covering hurricane seasons through to 2027, transferring fiscal risk to international markets and ensuring the government has quick access to funds after disasters.

Debt-for-nature swaps have also become a key tool for balancing financial stability and conservation. In 2021, The Nature Conservancy announced that Belize had executed a “Blue Bond” restructuring, which provided debt relief while committing the government to protect 30% of its marine areas. The Inter-American Development Bank highlighted in 2022 that Barbados had completed a USD150 million marine debt conversion with similar conservation goals. In 2024, the Government of The Bahamas executed one of the largest such transactions globally a USD3.1 billion debt conversion linked to marine and climate resilience objectives.

The Caribbean has also pioneered the use of debt-pause clauses. Following Hurricane Beryl in 2024, both Grenada and St. Vincent and the Grenadines became the first countries in the world to activate such clauses, temporarily suspending debt repayments in order to free up resources for recovery. The IMF noted in its 2024 review that this instrument provided much-needed fiscal space during a crisis. Barbados had already set the stage by including natural disaster clauses in its sovereign bonds as early as 2019, and in June 2025 the Government of Barbados issued a global bond that formalized these disaster-protection features on a larger scale. Collectively, these measures signal to investors that the region is willing to innovate in order to manage climate-related fiscal risks.

Country Snapshots

Barbados stands out as a leader in climate finance reform. According to the IMF’s 2023 country review, the island has combined resilience-focused fiscal policies with marine debt conversions and disaster-resilient bond clauses, giving investors’ confidence in its long-term climate strategy. Belize, through its 2021 Blue Bond, has gained international recognition for successfully marrying debt restructuring with marine conservation goals.

Jamaica has demonstrated what a layered disaster financing strategy can look like, with catastrophe bonds, CCRIF policies, and IMF-supported fiscal reforms all working in tandem to reduce risk. Dominica, which was nearly destroyed by Hurricane Maria in 2017, declared its ambition to become the world’s first “climate-resilient nation” and has since invested in resilient infrastructure, though questions remain about implementation capacity. The Bahamas, still reeling from the devastation of Hurricane Dorian in 2019, has experimented with a large-scale debt conversion to finance conservation. Grenada and St. Vincent have provided proof of concept for debt-pause clauses, while Guyana has taken a different path, leveraging jurisdictional carbon credits under the ART-TREES mechanism, including a multi-year offtake agreement with Hess Corporation signed in 2022.

Policy Priorities for Attracting Climate-Smart Capital

To remain competitive for global investment, Caribbean economies must continue to strengthen climate-related disclosures by adopting ISSB-aligned standards and developing thematic bond markets that make climate-smart projects more accessible to ESG investors. Publishing adaptation-readiness assessments, such as those from ND-GAIN or CORVI, will provide clearer information on vulnerabilities and opportunities, allowing investors to make more confident decisions. Expanding disaster financing strategies to include layered instruments, insurance, catastrophe bonds, and debt clauses will reduce fiscal risks and send strong market signals. Embedding climate resilience into public investment systems and PPP frameworks will ensure that infrastructure remains viable over the long-term. Finally, scaling nature-linked finance such as debt-for-nature swaps and blue bonds will appeal directly to investors seeking to combine financial returns with measurable sustainability outcomes.

Conclusion

For the Caribbean, climate vulnerability is now a defining factor in investment flows. Countries that fail to address these risks run the danger of being bypassed by capital markets that increasingly prioritize resilience and sustainability. Those that embrace reform, strengthen disaster financing, and pioneer innovative financial tools are already showing that climate risk can be managed and even turned into an opportunity. The future of investment in the region depends on this shift: to remain viable players in the global economy, Caribbean countries must go green or risk being gone from the investment map.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment, or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.