Returning Capital to Shareholders

Insights

Returning Capital to Shareholders: Dividends and Share Buybacks

Returning capital to shareholders is a fundamental aspect of corporate financial strategy, reflecting a company’s commitment to delivering value to its owners. Once a firm has met its reinvestment needs and maintained adequate reserves for future growth and contingencies, surplus capital is often distributed to shareholders through mechanisms such as dividends and share buybacks. These actions not only signal financial strength and confidence in the company’s outlook but also serve to optimize capital structure and enhance shareholder returns. The decision to return capital, the timing, magnitude and method of capital return carries significant implications for investor sentiment, share price performance, and long-term value creation.

Rationale behind returning capital

Companies return capital to shareholders when they generate more cash than is needed to fund operations, invest in profitable growth opportunities, or maintain a strong balance sheet. Once these priorities are met, distributing surplus capital becomes a way to reward shareholders directly, reinforcing the principle that investors should benefit from the company’s success. This is especially true for mature businesses in stable industries where reinvestment opportunities may be limited or yield diminishing returns. Rather than hoarding excess cash or allocating it to low-yielding or speculative projects, companies can enhance shareholder value by returning funds that would otherwise sit idle or be inefficiently deployed.

Returning capital also serves as a signal of corporate discipline and management’s confidence in the firm’s financial health and future earnings. It reflects a balanced capital allocation strategy—one that recognizes the limits of internal reinvestment and prioritizes shareholder returns without compromising operational integrity. Moreover, it helps align management interests with those of shareholders, particularly when capital is returned in a thoughtful and transparent manner. In doing so, companies can build credibility with investors, attract a more stable shareholder base, and support long-term valuation by demonstrating consistent, value-oriented financial stewardship.

Dividends

Dividends are the most straightforward way for companies to reward shareholders. A dividend is simply a payment made directly to shareholders, usually in cash, but sometimes as shares or other assets. They are typically paid regularly on a schedule – quarterly, semi-annually or annually, and represent a direct way for investors to receive income from their investment.

Benefits of Dividends for Shareholders

Dividends provide shareholders with a consistent and tangible return on their investment. For income-focused investors such as retirees or those seeking regular cash flow, dividends serve as a reliable source of earnings, especially during periods of market volatility when capital gains are uncertain. This recurring income can be reinvested, used to meet living expenses, or allocated toward other financial goals.

Furthermore, companies that consistently pay dividends are often perceived as financially healthy and stable, which can make them less risky investments. Many shareholders opt to reinvest their dividends by purchasing additional shares of the company. This strategy, often referred to as dividend reinvestment, can lead to substantial growth in the overall return on investment over time, as the compounding effect allows investors to accumulate more shares and benefit from both share price appreciation and future dividend payments.

While dividends are usually subject to taxation in many countries, for residents of Trinidad and Tobago (T&T), the tax treatment of dividend income varies depending on the type of dividend received. Ordinary dividends paid to individual shareholders by domestic companies are exempt from income tax, meaning that shareholders receive the full amount without any deductions. This tax exemption can make ordinary dividends especially attractive as a source of tax-efficient income. In contrast, preference dividends are treated differently under Trinidad and Tobago tax law. These dividends are subject to a withholding tax of 15%, which is deducted at the source before the dividend is paid out to the shareholder.

However, it is important to remember that not all companies pay dividends. Fast-growth companies and companies on a strategic acquisition drive may frequently choose to reinvest all of their profits back into expanding their business, rather than distributing cash to shareholders. Similarly, during periods of economic distress or liquidity constraints, even mature firms may suspend or reduce dividends to preserve cash and safeguard operational flexibility. In these instances, the temporary absence of dividends is not necessarily a sign of weakness but a reflection of prudent financial management responsive to evolving business conditions.

Domestically, ANSA McAL recently suspended its dividend payments for three years, after distributing $1.80 per share annually from 2021 to 2024, in order to redirect capital toward acquisitions and investment in technology and automation. According to Group CEO Anthony N. Sabga III, this strategic pause is intended to drive operational efficiencies and expand the company’s market reach, with the goal of creating a much larger, more competitive enterprise and delivering substantial future growth and long-term benefits to shareholders.

Share Buybacks

A share buyback (also called a stock repurchase) occurs when a company buys its own shares from the stock market. This lowers the total number of shares available (called shares outstanding), increasing the ownership percentage for remaining shareholders. For instance, if a company has 1 million shares and buys back 100,000 of those shares, the outstanding amount is now 900,000. Shareholders who held on to their shares now own a larger fraction of the company.

Benefits of Buybacks to Companies

Share buybacks offer several strategic advantages to issuing companies. They provide management with a flexible capital allocation tool that can be adjusted based on market conditions and available cash flow, unlike dividends, which create ongoing payment expectations. This means companies can deploy cash opportunistically, repurchasing shares heavily when stock prices are low or when there is surplus liquidity, and scaling back when market conditions or internal needs change. This flexibility helps maintain financial agility without locking the company into regular commitments.

When a company’s operations generate more cash than it can reinvest profitably, for example, when there are few compelling projects, acquisitions, or expansion opportunities, share buybacks offer a way to return this excess to shareholders. Unlike initiating or raising a dividend, which creates a recurring financial obligation and can draw investor scrutiny if later reduced, buybacks are one-time or episodic events. This allows companies to distribute cash on their own schedule, aligning payout with business cycles or the presence of windfall gains, and avoids signalling a permanent shift in dividend policy.

Share repurchases can signal to the market that management believes the company’s shares are undervalued. When insiders choose to buy back shares, it can be interpreted as a vote of confidence in the firm’s future earnings, competitive position, or intrinsic value. This signalling effect may attract investors who are reassured by management’s actions, and it can lead to upward price adjustments if the market agrees with management’s assessment.

Benefits of Buybacks for Shareholders

Share buybacks reduce the number of outstanding shares in the market, which has the effect of increasing a company’s earnings per share (EPS), even if total earnings remain unchanged. This artificial boost in EPS can make the stock appear more attractive to investors by improving key valuation metrics. A higher EPS often signals stronger profitability on a per-share basis, which may positively influence the company’s stock price and shareholder value.

In many countries, capital gains earned from selling shares are taxed at lower rates than dividend income, making buybacks a more tax-efficient method of returning capital to shareholders. Specifically, in Trinidad and Tobago, in addition to ordinary dividends, individual capital gains are generally not subject to tax, which enhances the appeal of buybacks compared to dividend pay-outs that might be taxed at source. This tax advantage can be particularly meaningful for investors, as it allows the value returned through share repurchases to accumulate.

Buybacks can genuinely create shareholder value when a company repurchases its shares at prices below their intrinsic value. By doing so, the number of outstanding shares is reduced, which increases the ownership stake of each remaining shareholder. As a result, the value of each individual share rises, reflecting a greater claim on the company’s earnings and assets. When executed thoughtfully at undervalued prices, buybacks are an effective way for management to allocate capital, enhance per-share metrics, and ultimately benefit long-term investors.

While investors stand to benefit from share buybacks, consideration must be given to the reasons for the buyback and whether the shares are repurchased at a favourable price to ensure long-term value creation.

Comparing Dividends and Buybacks

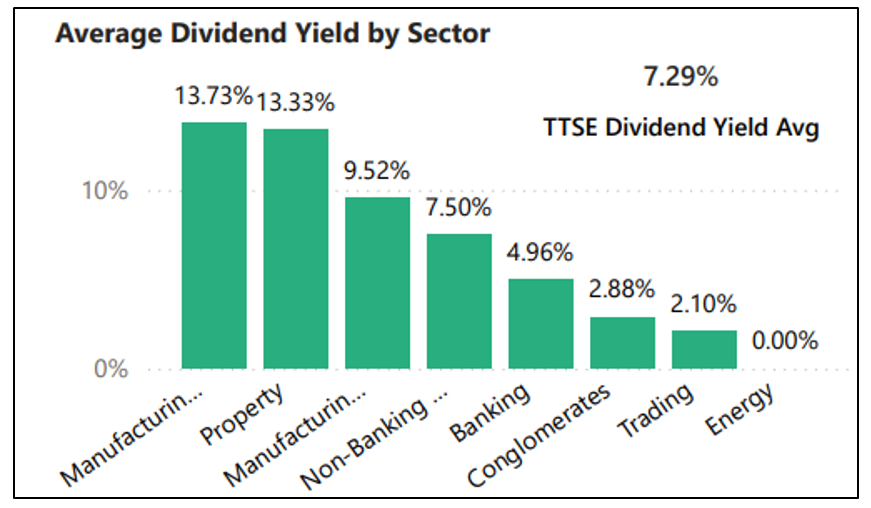

In Trinidad and Tobago, most locally listed companies pay dividends, with the average dividend yield being 7.29% as at the week ended July 31, 2025. Given the full exemption of ordinary dividends from income tax, the distinction between dividends and share buybacks in terms of tax treatment becomes inconsequential for shareholders, effectively enhancing the appeal of dividend income in the local market.

Figure 1: Average Dividend Yield

Source: TTSE, FCIS Research & Analytics

It may appear that share buybacks are not popular among the locally listed companies. In 2024 and 2025, at least two companies listed on the Trinidad and Tobago Stock Exchange (TTSE) actively implemented share buyback programs – JMMB Group Limited (JMMBGL) and GraceKennedy Limited (GKC). JMMBGL commenced a share buyback (repurchase) program, making several open market purchases of its ordinary shares in both 2024 and 2025. While GraceKennedy Limited (GKC) also conducted a share repurchase program in 2024, having bought back a portion of its shares as part of its announced maximum intended repurchase of up to 1% of shares in issue (approximately 9,950,000 shares).

While both methods of returning capital offers benefits to shareholders, investors must also consider the potential downsides. Dividends, while consistent, may limit a company’s flexibility during times of financial stress and could be reduced or suspended, which may negatively impact the stock’s perception. Buybacks, though tax-efficient and flexible, can be executed at inopportune times, such as when the stock is overvalued, leading to inefficient capital use. Additionally, unlike dividends, buybacks provide no guaranteed benefit to shareholders unless they result in meaningful price appreciation. Ultimately, shareholders must weigh their own financial goals, risk tolerance, and time horizon when assessing the value of dividends versus buybacks in a company’s capital return strategy.

The consistent track record of companies on the Trinidad and Tobago Stock Exchange (TTSE) in returning capital to shareholders via robust dividend yields and targeted share buyback programs underscores the strength and maturity of the local market. With ordinary dividends fully exempt from income tax and capital gains generally untaxed, investors can maximize after tax returns while benefiting from the stability and transparency of a well-regulated exchange. Whether as an Investor, you are seeking steady income or long-term capital growth, participating in the TTSE provides a unique opportunity to align with companies demonstrating disciplined financial stewardship and a clear commitment to shareholder value creation.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment, or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.