Global Oil Market Dynamics

Insights

Economic uncertainties, geopolitical turmoil, cross border conflicts and erratic trade policies are all factors that continue to contribute to the volatility in the global energy market. The general tone, however, is trending towards a more bearish market despite the ongoing concerns about geopolitical tensions which have in the past caused wide swings in oil prices. In fact, oil prices fell by around 3% following Iran’s strike on the US airbase on Qatar in June 2025, which were intercepted and caused no casualties. But why have oil prices remained relatively subdued, particularly in the current heightened state of cross-border conflicts in regions that are home to some of the world’s key energy market players? This article will explore some of the factors that are currently driving oil prices in the global market.

Subdued Oil Prices Despite Disruptions

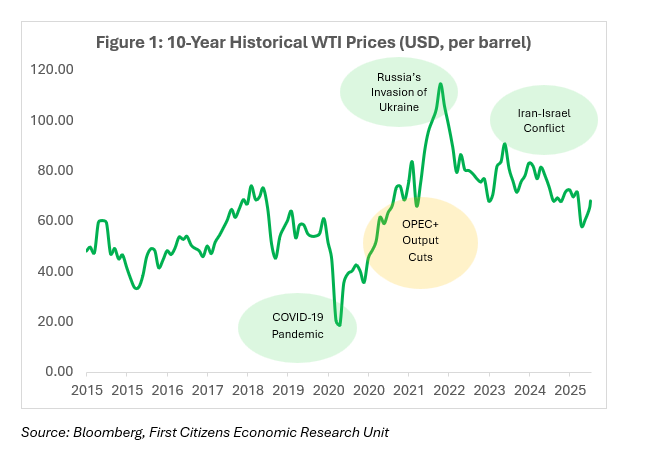

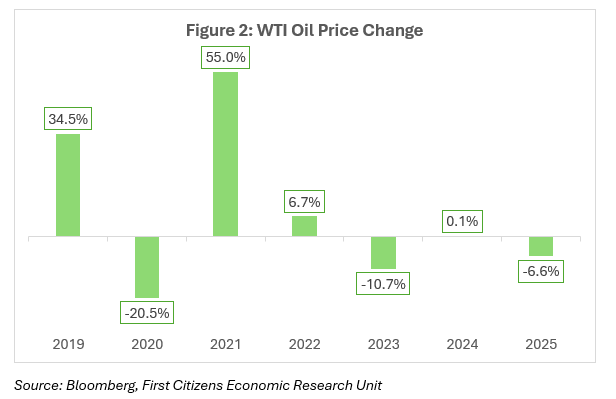

Year to date (up to 14 July 2025), WTI oil price has declined by around 6.6% and has traded within a range of USD80.04 – USD57.13 per barrel at an average price of USD67.54. Prices hit a 2025 high of USD80.04 on 15 January, on news of a decline in US inventory. Since then, however, prices have steadily declined, with an uptick seen in June to around USD75 per barrel, due to the US strike on Iran nuclear sites and the subsequent Iranian strike on the US airbase in Qatar. Prices have since retreated to around its current level of USD66 – USD67 per barrel.

From a historical perspective, in February 2022, Russia’s invasion of Ukraine resulted in a sharp rise, as WTI cross the USD100 per barrel threshold for the first time since 2014. Despite all the volatility associated with the geopolitical environment since February 2022, including the subsequent cross-border conflicts particularly in the Middle East region, oil prices have remained generally in check and range-bound. In 2023, prices fell by 10.7%, after increasing 6.7% in 2022 and the significant 55% gain experienced in 2021, which was due to the plunge in prices recorded in 2020 during the pandemic.

Geopolitical risk premiums, while still embedded in energy prices, seem to be relatively subdued. The structural changes in the energy market may be the major driving force behind the suppressed prices in the face of significant flare-ups of tensions, at least in the recent past.

Demand Factors

Several notable institutions have downgraded forecasts for GDP growth in the global economy for this year. In April 2025, the International Monetary Fund (IMF) slashed its projections for global growth for 2025, to 2.8% from 3.3% they had forecasted in January 2025. Similarly in 2026, the global economy is expected to grow by 3%, down from 3.3% projected in January. Both the advanced economies as well as the emerging and development economies saw their outlook revised downwards both by 0.5% for 2025. The biggest hit amongst the advanced economies was the US economy, whose economic growth projection was cut by 0.9% to 1.8%. Similarly, the Organization for Economic Co-operation and Development (OECD) trimmed its forecast for global growth to 3.1% in 2025 from 3.3% earlier projected. The World Bank also slashed its forecast for growth to 2.5% for 2025, down 0.4 percentage points also due to rising trade barriers and policy uncertainty. They also project that global trade growth will fall from 3.4% in 2024 to 1.8% in 2025.

The world’s top two consumers of oil are the US and China, and both growth prospects have been trimmed. The US economy is expected to slow this year due to the impact of tariffs on inflation and growth, while China’s economy continues to face challenges, both internal and external – the IMF forecasts that the Chinese economy will grow by 4% in 2025, down from an estimated 5% in 2024. The Chinese authorities have been providing stimulus measures to help support the economy amid the ongoing property market challenges as well as the expected economic fallout from the increased tariffs and trade negotiations with the US.

The prospects for slower economic growth will likely weigh on global demand for oil, putting downward pressure on prices.

Supply Side

The conflicts in the Middle East, which is strategically important in the global energy markets, have caused some degree of volatility in oil prices, as the rising tensions have raised concerns about supply disruptions. Iran is the third-largest producer in the Organization of Petroleum Exporting Countries (OPEC) bloc. With the flare up in tensions between Israel and Iran and the US in the middle of June, there were renewed concerns about speculation that Iran may retaliate by restricting access to the Strait of Hormuz, which is the world’s busiest oil shipping channel where about 20% of the world’s oil traverses. Despite the conflicts, there were no significant impact on oil flows from the Persian Gulf and exports from Iran continues to rise. The US strikes on Iran’s nuclear sites on 22 June and subsequent Iranian strike on a US airbase in Qatar resulted in a temporary and restrained rise in prices, but as a ceasefire arrangement was agreed between Iran and Israel, prices retreated to within a range of USD65 – USD67 per barrel.

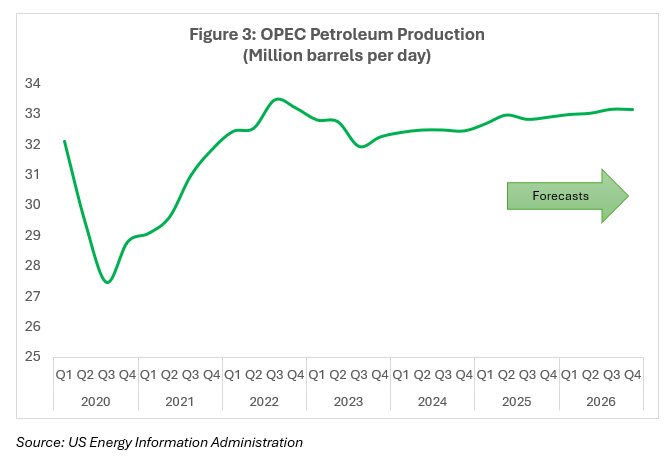

OPEC has also played a pivotal role in the market lately. OPEC and its allies (OPEC+) control approximately 40% of global oil production. During the COVID-19 pandemic, the bloc had implemented collective output cuts in response to the rapid accumulation of inventories in the first quarter of 2020 since the onset of the pandemic caused a steep decline in energy demand and a sharp fall in prices. The production cut arrangement began in May 2020, gradually tapering off through April 2022. However, in late 2022, OPEC+ agreed to more production cuts to restrict supply considering the uncertainty that surrounded the global economic and oil market outlooks at the time. This year, however, the bloc has decided to reverse the course and has implemented large output boosts to gain a greater share of the market. In April 2025, OPEC+ officially began to unwind cuts, with subsequent production hikes implemented in May, June, July and August. The market generally expects another increase in September, which will be decided at the bloc’s meeting on 3 August 2025.

Conclusion

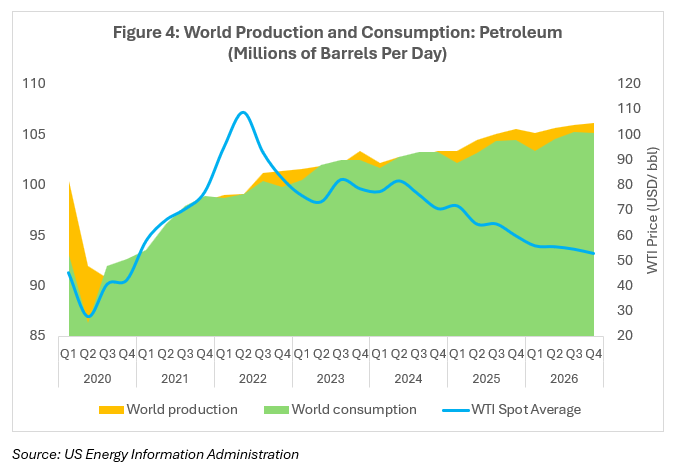

Since 2021 when total world consumption marginally exceeded production and prices rose, the global petroleum market has witnessed a glut, whereby supply has consistently exceeded demand, which has resulted in price weakness. The US Energy Information Administration projects that in 2025 and 2026, the situation will continue as world petroleum production will continue to outstrip consumption. As a result, prices are expected to drop to USD65.20 and USD54.80 per barrel, in 2025 and 2026, respectively. (See figure 4).

Demand is expected to be constrained by prospects for weaker economic growth amongst some of the largest consumers of petroleum, while at the same time, global supply is rising, due to OPEC’s decision to unwind production cuts, coupled with strong output growth in non-OPEC producers, such as the US, Brazil, Canada and Guyana. Despite the fundamentals of the oil market currently, which point towards lower prices, the threat of escalation in geopolitical tensions and intensified cross-border conflicts can cause substantial supply disruptions and volatility, creating much uncertainty regarding the outlook for global oil prices.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.