Stock Market Volatility Under Trump’s Second Term

Stock market volatility refers to the degree of variation in stock prices over time, indicating the level of uncertainty or risk associated with the market. High volatility signifies large price swings, while low volatility suggests more stable prices. Volatility is often measured by indices, with the most popular index being the VIX, which reflects market expectations of future volatility. It is often called the “Fear Index” because it reflects investor uncertainty and stress in the market.

President Donald Trump’s current administration has introduced a series of policies that have significantly influenced the U.S. stock market. These policies encompass trade tariffs, tax reforms, deregulation efforts, and immigration restrictions, each contributing to market volatility and investor sentiment. This article delves into the multifaceted effects of these policies on the stock market.

Trade Tariffs and Market Volatility

A central element of President Trump’s economic strategy has been the use of tariffs to shield domestic industries. On February 4, the administration launched the first wave of tariffs targeting a broad range of imports and countries. These measures culminated in reciprocal tariffs, some reaching rates as high as 125%. Much of Trump’s tariff rhetoric has been aimed at China, leading to a tit-for-tat trade conflict between the two nations.

Trump’s unpredictable trade policies have heightened investor uncertainty for several reasons. When tariffs are announced or threatened, investors become concerned about their potential impact on businesses and the broader economy. Tariffs raise the cost of imported goods, which can lead to higher consumer prices and reduced corporate profits. This economic strain often prompts investors to sell stocks and seek safer investment options.

Moreover, Trump’s tariffs has thus far provoke retaliatory actions from other countries, intensifying trade disputes. These conflicts has the potential to disrupt global supply chains and trade flows, amplifying market instability and volatility. As a result, investors face an environment marked by heightened risks and fluctuating market conditions.

Tax Reforms and Economic Stimulus

The Trump administration’s focus on extending and expanding the Tax Cuts and Jobs Act (TCJA) of 2018 has the potential to significantly impact market volatility. While proponents argue that such tax cuts can stimulate investment, enhance productivity, and drive economic growth, the uncertainty surrounding their implementation and long-term effects introduces risks that can destabilize financial markets.

Critics warn that if these tax cuts are not paired with spending reductions, they could lead to increased federal borrowing and ballooning deficits. This can raise concerns among investors about the government’s fiscal health, which can lead to potential downgrades of the U.S credit ratings. This uncertainty about fiscal sustainability can make investors uneasy, prompting shifts in portfolios and contributing to market fluctuations.

If the tax cuts are significant, it can boost consumer spending or business investment. Against the backdrop of a tight labour market and higher operational cost due to the tariffs, it could fuel inflation. Markets may then fear more interest rate hikes from the Federal Reserve, which tends to hurt stocks and bonds, increasing volatility.

Deregulation Efforts and Market Confidence

The Trump administration has made deregulation a key part of its economic strategy. The goal is to reduce the number of rules businesses must follow, creating a more favorable environment for companies. This approach aims to boost corporate profits, which could lead to higher stock prices.

On January 31, 2025, an executive order titled “Unleashing Prosperity Through Deregulation” was issued. It requires government agencies to ensure that any new regulations in fiscal year 2025 do not add costs. Instead, any new costs must be balanced by eliminating costs from at least ten older regulations.

Some industries, like financial services and energy, have welcomed these deregulation efforts as it will lower compliance costs for many businesses. However, such an aggressive push for deregulation creates uncertainty about the future regulatory landscape. Investors may struggle to predict which industries will benefit from reduced oversight and which may face unforeseen risks due to weakened protections. This unpredictability can lead to rapid shifts in market sentiment and increased volatility.

The implementation of such sweeping deregulation policies often sparks political and public debate, which can influence investor sentiment. Positive sentiment may drive short-term rallies, while negative sentiment—fuelled by fears of regulatory rollbacks—could trigger sell-offs.

Immigration Policies and Labour Market Implications

Immigration policies have long played a significant role in shaping the U.S. labour market and, consequently, the stock market. Changes in immigration regulations influence workforce availability, wage trends, and corporate profitability, all of which have direct and indirect effects on market performance.

In President Trump’s second term, a renewed focus on stricter immigration policies has raised concerns about labour shortages and economic growth, leading to increased market volatility. Stricter immigration controls can lead to reduced labour supply, particularly in industries that rely heavily on immigrant workers, such as agriculture, construction, and technology. A decline in available labour can drive up wages, increasing operating costs for businesses and potentially reducing corporate profits. In contrast, relaxed immigration policies tend to support labour market flexibility, keeping wage inflation in check and allowing businesses to maintain steady productivity levels.

The stock market reacts to shifts in immigration policies based on their perceived impact on economic growth and corporate earnings. For example, the tech industry, which depends on high-skilled foreign workers through H-1B visa programs, could see stock price declines if visa restrictions tighten, limiting the talent pool. Looking at Agriculture & Construction, companies in these sectors face rising labour costs if immigration policies restrict low-skilled worker inflows, which could reduce profit margins and trigger stock declines. Also, with respect to Consumer Goods & Services, if wage pressures lead to higher prices, inflation concerns may prompt the Federal Reserve to adopt a more restrictive monetary policy, negatively impacting stock market performance.

Investor Sentiment and Market Performance

Investor sentiment refers to the overall feeling or attitude that investors have toward a specific market, asset, or economy. It is shaped by a mix of logical factors—like economic reports, company results, and global events—and emotional responses such as hope, fear, or uncertainty.

This sentiment is often measured through indicators like stock price changes, trading activity, and surveys of investor opinions. Investor sentiment can be positive (bullish), negative (bearish), or neutral. It plays a crucial role in how markets perform because it influences whether investors choose to buy or sell. When sentiment is positive, more people tend to buy, driving prices up. Conversely, when sentiment is negative, selling increases, causing prices to fall.

The uncertainty surrounding trade policies and their potential to ignite inflation by raising manufacturing costs and consumer prices has heightened market volatility. As at March 6 2025, the S&P 500 had lost almost all its gains since November 2024. On March 10, the S&P 500 fell by 1.4%, pushing it into correction territory, defined as a decline of over 10% from its peak.

U.S. stocks sold off primarily due to concerns about President’s Donald Trump’s economic policies, particularly tariffs, and fears of a potential recession. As shown on the graph above, the S&P 500 peaked on February 19 2025 at 6,144.15, representing a market value of USD52.06 trillion but fell thereafter by approximately 10% or USD2.28 trillion.

Markets experienced a brief rebound in March after White House officials indicated that President Trump’s tariffs would be more narrowly focused and could exempt countries that do not impose tariffs on U.S. goods. This reassurance, along with hints that the new tariffs planned for April 2 2025, would be implemented with added flexibility, further boosted investor confidence. However, once the broad and severe reciprocal tariffs were officially announced, stocks suffered sharp declines. Retaliatory tariffs from major trading partners, especially China, further escalated fears of a global trade war, compounding market uncertainty and driving the index lower.

U.S. Stock Market Volatility Update

Often referred to as the “fear index” because it captures investor anxiety and market stress, the Cboe Volatility Index (VIX) is a tool that gauges the expected volatility of the U.S. stock market over the next 30 days. When the VIX rises, it signals that investors are bracing for bigger price swings, which usually reflects growing fear or uncertainty in the market. A VIX reading above 25 suggests heightened volatility and possible market turbulence, while a lower VIX points to calmer, more stable conditions. The VIX index has recently soared to 52.33, well above the critical 25-point mark. This sharp spike signals a period of acute short-term fear gripping the market. Several factors have contributed to this heightened volatility: mounting concerns over the health of the U.S. economy as businesses brace for the disruptive impact of tariffs on global trade, escalating geopolitical tensions, and renewed anxiety over interest rates as persistent inflation dampens hopes for further rate cuts by the Federal Reserve. Together, these forces have unsettled investors, fuelling a climate of uncertainty and caution across financial markets

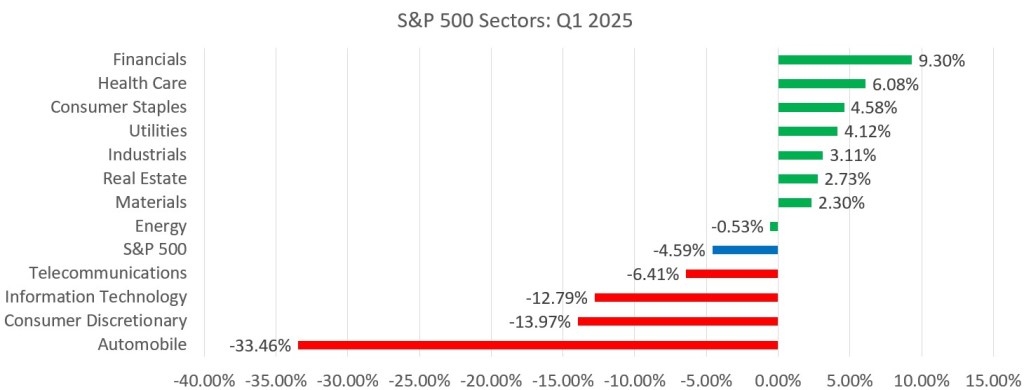

Over the past 90 days, U.S. stock markets have experienced significant volatility, driven by the geopolitical tensions, trade policy uncertainties, and sector-specific developments. Different sectors have exhibited varied volatility patterns in response to recent events, for example the automobile sector which declined 33.46% in the last quarter. This decline was a major contributor to the S&P 500’s overall drop of 4.6% during the quarter. Tesla, which accounts for over 90% of the S&P Auto Index, plays a major role in driving the index’s performance. Tesla’s stock has dropped sharply, down 41% year to date, primarily due to concerns about Elon Musk’s involvement in politics and increased competition, especially in China. Another sector that experienced significant volatility was the Information Technology (IT) sector, which constitutes nearly 30% of the S&P 500 and declined by 12.8%, marking one of its worst quarters in recent years. Key mega-cap tech stocks, including NVidia (-19%), Alphabet (-18%), Apple Inc. (-11.30%), Microsoft Corp (-10.94%) and Tesla (-35%), saw significant losses due to economic uncertainty, interest rate volatility, and trade tensions.

The U.S. stock market’s turbulent performance in early 2025 highlights how sensitive investor confidence is to uncertainties in trade policy. Although markets briefly rebounded on signals of easing tariffs, underlying risks persist, including declining earnings, sector-specific challenges, and geopolitical tensions. The Trump administration’s apparent disregard for market downturns has left investors without a clear strategy, increasing market volatility. As tariffs and retaliatory actions unfold, Wall Street faces the considerable challenge of navigating an environment where policy uncertainties overshadow traditional drivers of growth. The market’s future now depends on whether the administration’s trade strategy leads to economic benefits or worsens the downturn—a risk investors are increasingly unwilling to take.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment, or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.