Trinidad and Tobago’s Mixed Economic Outlook

Insights

The Trinidad and Tobago (T&T) economy is highly dependent on the cyclicality of the global energy market, since the energy sector contributes significantly to economic activity, government revenue as well as export earnings. T&T has benefitted from the uptick in energy prices resulting from several factors including a resurgence in energy demand in the post-pandemic period as well as ongoing geopolitical tensions in Eastern Europe and the Middle East, in addition to the production cuts implemented by the OPEC+ bloc of countries. These factors have kept oil prices elevated but there are headwinds which cloud the outlook for energy prices and can have adverse implications for the T&T economy. Furthermore, the global natural gas market has remained weak, with steep declines in prices. Moreover, T&T’s domestic energy sector has been affected by internal challenges which have resulted in supply curtailment which has stymied the growth in the sector. Promisingly, the T&T economy has been supported by the non-energy sector, which has helped to offset the weakness in energy but there remain many challenges which will impede the performance of the domestic economy in the short-to-medium term.

Recent Economic Performance

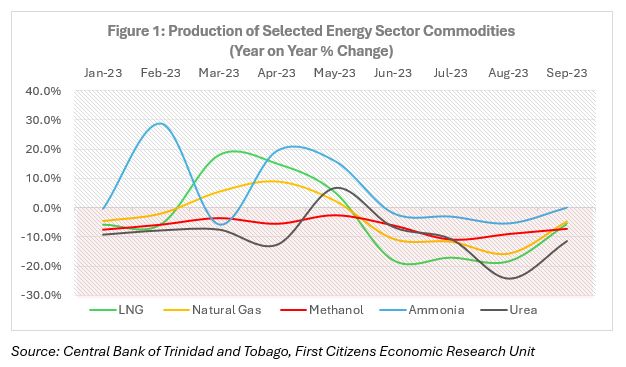

T&T’s economy is estimated to record positive GDP growth in 2023, with the International Monetary Fund (IMF) forecasting 2.1% and Business Monitor International (BMI) projecting real GDP growth of 0.7%. In the National Budget Statement, which was presented in September 2023, the projection for 2023 economic growth was 2.7%, supported by an estimated 3% expansion in the non-energy sector and a 0.3% decline in energy. Available data for 2023 shows that the economy expanded by 3.6% in the second quarter, relative to a revised 1.4% in the first three months of the year. The first quarter data was notably revised downwards from an earlier estimation of 3% due to significant adjustments to both the agriculture and manufacturing sectors. During Q22023, the mining and quarrying sector contracted by 2% on a year-on-year basis, while the manufacture of petroleum and chemical products grew marginally by 0.2%, after contracting by an average of almost 3% since the start of 2022. The non-energy sector was the major driver of GDP growth for the first half of 2023, supported by strong growth in sectors such as trade and repairs, transport and storage as well as accommodation and food services. Separately, the Central Bank of Trinidad and Tobago (CBTT)’s Quarterly Index of Economic Activity (QIEA) showed robust activity in the non-energy sector for the nine months of the year, with average growth of 3% alongside an average contraction of 3.8% in the energy sector. The overall index recorded a contraction of 0.4% (YoY) in the third quarter of 2023, driven largely by a steep decline of 9.1% in energy sector activity, enough to offset the 4.2% increase in non-energy activity for the same period. Domestic energy production fell in the third quarter reflective of a decline in upstream activity, which affected the mid and downstream sectors. Indeed, crude oil and natural gas production fell 9.1% and 11% respectively, partly due to the shutdown of Woodside Energy’s offshore production in July 2023, with knock on implications for methanol, ammonia and other output levels.

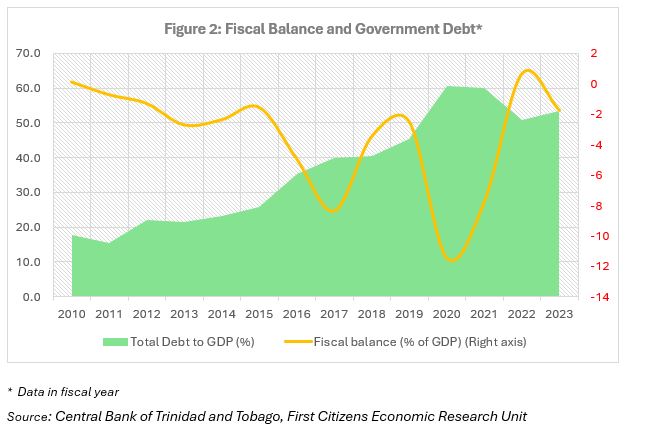

The weakness in the domestic energy sector has filtered through to the fiscal accounts, which recorded an overall fiscal deficit of 1.7% of GDP in FY2022/ 2023, reversing the surplus of 0.7% of GDP recorded in the previous fiscal year. Energy sector revenue has been waning and in November 2023, central government energy revenue totalled TTD46.7 million and for the first two months of the fiscal year (Oct-Nov 2023), energy revenue has fallen by close to 50% relative to the same period of 2022, with non-energy revenue up by 10.4%. Both the fiscal current account and the overall fiscal accounts saw a significantly higher deficit, widening by over 60% (year-on-year). The overall fiscal deficit stood at TTD2.4 billion at the end of November. The general government debt roses slightly during the first quarter of FY 2023 /2024 (Oct – Dec 2023) by around 0.03% and stood at TTD142.3 billion at the end of December 2023. In November 2023, the Government of Trinidad and Tobago (GOTT) issued a bond for TTD2.5 billion for the purpose of budgetary support, which matures in 2033. As at the end of September 2023, the country’s general government debt stood at 72% of GDP.

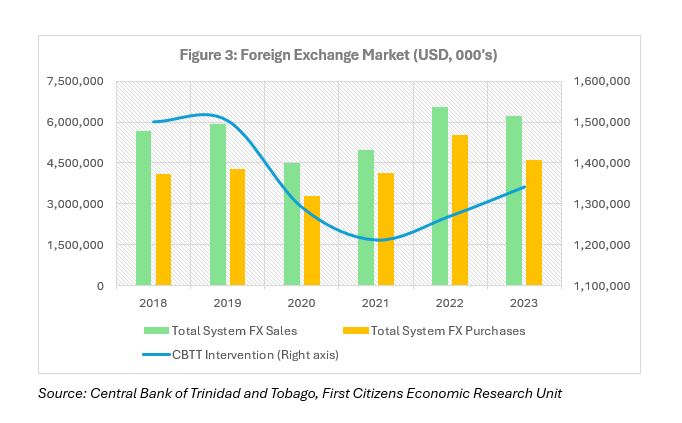

The tight foreign exchange market persisted in 2023, with purchases of foreign exchange by authorized dealers from the public dropping by 16.5% relative to the previous year, driven by a 29% decline in conversations by energy companies. Sales of foreign exchange by authorized dealers to the public also declined by 4.9% during 2023. As a result, the sales gap reached USD1.61 billion, with the CBTT intervening in the market, selling USD1.34 billion to authorized dealers.

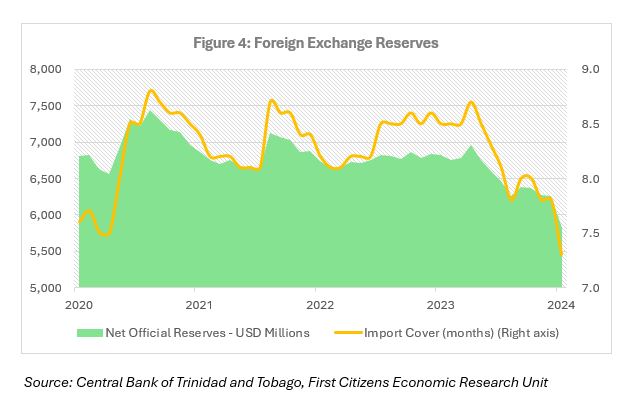

On the external accounts, the country’s foreign exchange reserves declined primarily due to the maturity of a Government of T&T Eurobond on 16 January 2024. As a result, the country’s FX reserves fell to USD5.8 billion at the end of January 2024, the equivalent of 7.3 month of imports. This represents a 15% decline on a year-on-year basis, and 7% relative to December 2023. For the full year 2023, reserves have fallen by 8.4% compared to a less than 1% decline in 2022.

Despite the decline in FX reserves, T&T’s financial buffers remain fairly strong, with the balance in the sovereign wealth fund, the Heritage and Stabilization Fund (HSF) at USD5.4 billion at the end of October 2023. S&P estimates that the country’s liquid assets stood at 39.2% of GDP at end of 2023 and remains a key strength for the country’s sovereign credit rating as it limits fiscal and external financing risks, according to S&P.

Challenges in the Year Ahead

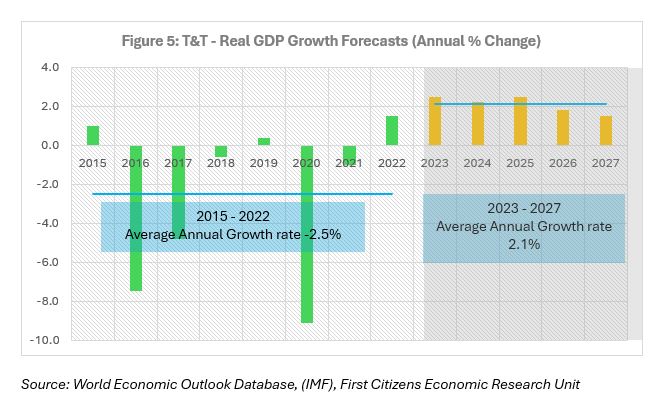

While the projections for GDP growth for the T&T economy for 2024 are lower than that of 2023, it is well above the five-year performance preceding the pandemic when the economy contracted by an average of 2.3%. The IMF is projecting that the economy will expand by 2.4% in 2024, while BMI’s projection is slightly lower at 2%, supported by the increase in the minimum wage which BMI expects will bolster final consumption. The Ministry of Finance also indicated that 2024 would experience growth at around the same rate as was expected for 2023 (around 2.7%). Standard and Poor’s forecasts that the T&T economy will expand at a more modest 1.7% in 2024. The impetus for continued economic expansion is expected in the non-energy sector, which is likely to benefit from stronger consumer demand, as well as the budgeted increases in the government’s capital expenditure. Indeed, the budget for FY2024 projects a fiscal deficit of 2.7% of GDP, relative to the 1.7% of GDP shortfall that was recoded in FY 2023. Based on the budgeted numbers, government revenue is expected to be 2.7% below that of FY 2023 and expenditure 3.5% above the previous year, driven by increases in wages and salaries, goods and services, as well as a 64% rise in capital expenditure. The IMF forecasts that the fiscal accounts will remain in a deficit position in the short-to-medium term, averaging 1.5% of GDP from 2024 and 2028.

The energy sector remains unpredictable, as it contends with significant volatility. Prices on the global market face numerous headwinds, including a slowdown in demand from some of the world’s largest consumers as well as the increased production from non-OPEC countries, which can both result in lower prices. Alternatively, ongoing geopolitical disruptions can cause prices to remain elevated. Given that T&T is a price taker with domestic production shortfalls, the extent to which T&T can fully capitalize when the global energy market turns bullish is limited. The license agreement with the Venezuelan Government regarding the Dragon Gas Field which allows T&T to access and process Venezuela’s natural gas reserves will brighten the supply picture for the T&T energy sector, however, there remains notable risks, including the reimposition of sanctions.

The performance of the energy sector will continue to have implications for the country’s external position, as energy exports constitute upwards of 80% of export earnings. Lower energy sector conversations will likely contribute to persistent tightness in the foreign exchange market as demand outstrips supply. Without meaningful increases in non-energy exports, the country’s FX reserves may continue to be eroded as the CBTT manages the exchange rate. The uptick in regional demand should augur well for T&T’s manufacturing sector, whose main export market is the Caribbean. However, activity in the local manufacturing sector has been lacklustre, contracting by an average of 1.3% over the first two quarters of 2023. The Trinidad and Tobago dollar (TTD) has depreciated gradually over the years, moving from around TTD6.35/ USD1 in 2010 to around TTD6.71 in August 2016 and has averaged around TTD6.75 since. This represents a depreciation of around 0.6% since 2016 and 6.3% since 2010. The very modest depreciation of the TTD over the years despite the decline in energy prices as well as lower production levels have likely undermined the country’s export competitiveness and terms of trade.

T&T seems to be on an upward economic growth trend, relative to the pre-pandemic period, but there are several lingering concerns, including the persistent fiscal deficits, growing indebtedness, foreign exchange imbalances, and the erosion of FX reserves, which must be addressed. The issue of crime also remains a serious threat and may have consequences for business activity as well as foreign investments. While there are some bright spots for the economy, such as upside potential for the non-energy sector, especially considering General Elections is carded for 2025, the risks are tilted to the downside in the absence of a strategy to diversify the economy, as well as the government revenue base and export earnings. Also imperative for long-term sustainability is the implementation of a viable medium term fiscal strategy to reduce fiscal risks.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.