Barbados’ Economic Renaissance: Navigating Diversification for Sustainable Growth

Insights

Introduction

Barbados, like many of the Caribbean islands, grapples with the challenges of an economy heavily reliant on traditional sectors, notably tourism and agriculture. Recognizing the vulnerabilities exposed by global uncertainties, the government has embarked on a transformative journey towards economic diversification, seeking sustainable growth and resilience. Barbados has actively advanced its Economic Recovery and Transformation (BERT) Plan, supported by the International Monetary Fund (IMF). Barbados has continuously met the specified quantitative targets under these programs, indicating significant progress in implementing its economic recovery initiatives. This financial support underscores Barbados’ commitment to navigating the present economic challenges and building a foundation for sustainable growth.

A Brief History on the BERT Plan

In response to the formidable challenges in traditional economic sectors, the Government of Barbados, in collaboration with the IMF, devised the BERT plan. At its core, the BERT plan seeks to strategically reposition Barbados on the global stage by enhancing competitiveness through innovative approaches and strategic investments, propelling the nation beyond the limitations posed by traditional sectors.

In 2018, the Barbadian government was faced with a decade-long cycle of economic challenges marked by low growth and escalating debt. International reserves had dwindled to approximately USD240 million, representing approximately six weeks of import cover and dangerously below acceptable adequacy levels, which is around three months.

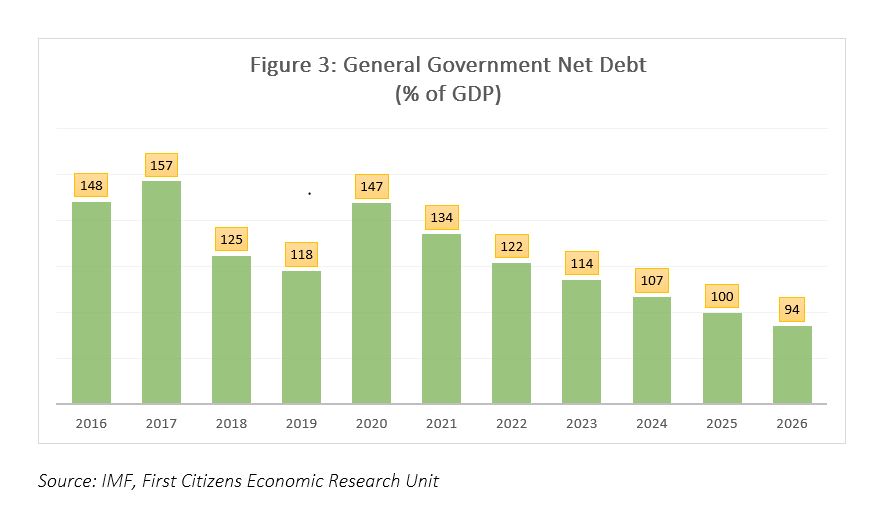

Additionally, at that time, the Central Government’s debt had reached unsustainable levels. Recognizing the urgent need to address these economic vulnerabilities, the BERT Plan was formulated, aiming to achieve macroeconomic stability and set the economy on a trajectory of sustainable and inclusive growth. The plan emphasized the imperative need for fiscal consolidation and announced debt restructuring to establish a clear downward trajectory for debt.

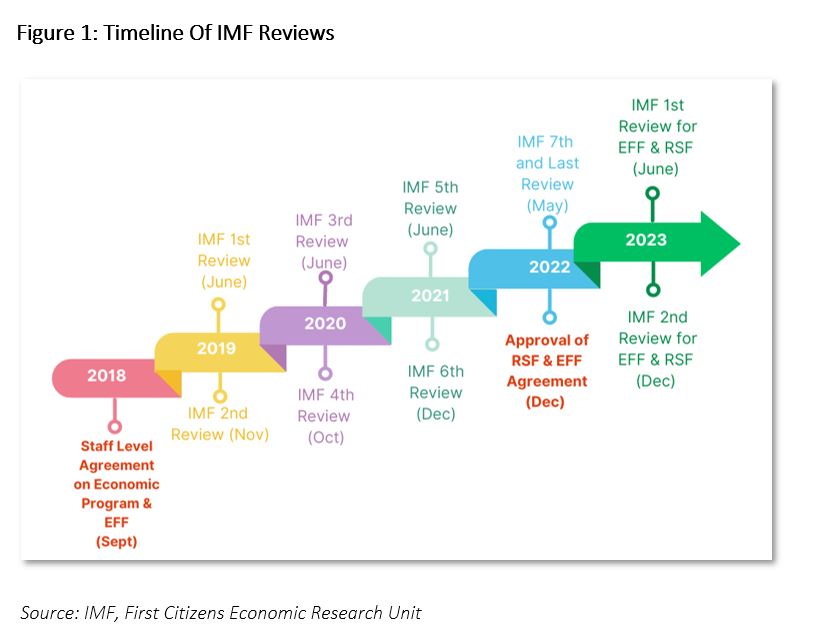

Moreover, the Government of Barbados formally requested a 48-month arrangement under the Extended Fund Facility (EFF), seeking an amount equivalent to SDR 208 million (approximately USD290 million). This figure represented 220% of Barbados’ IMF quota and was intended to support the program outlined in the Memorandum of Economic and Financial Policies (MEFP).

Subsequently, Barbados has demonstrated commendable progress in implementing its economic reform program, featuring notable achievements in the growth of international reserves and successful debt restructuring. The comprehensive debt restructuring initiated on June 1, 2018, and subsequent domestic debt exchange operations have significantly alleviated Barbados’s public debt burden, contributing to a clear downward trajectory. Efforts concentrated on achieving a targeted 6% of GDP primary surplus in the fiscal year 2019/20, supported by new taxes, ongoing reforms, and reduced transfers to State-Owned Enterprises (SOEs). Furthermore, the Barbadian government’s commitment to fiscal consolidation is evident, with the implementation of a fiscal rule in 2020 to sustain adjustment efforts over the medium and long term. Structural reforms targeting business environment improvements, such as streamlined processes for construction permits, are actively underway.

In December 2022, the Barbadian authorities entered another EFF program with the IMF alongside the Resilience and Sustainability Facility (RSF) arrangement, with renewed focus on the ‘BERT 2022’, which builds on the progress achieved since 2018. The EFF is a 36-month arrangement in the amount of USD113 million and the RSF in the amount of USD189 million. As at end December 2023, the second review of the programs was concluded, with all quantitative performance criteria and indicative targets met.

Current Economic Landscape

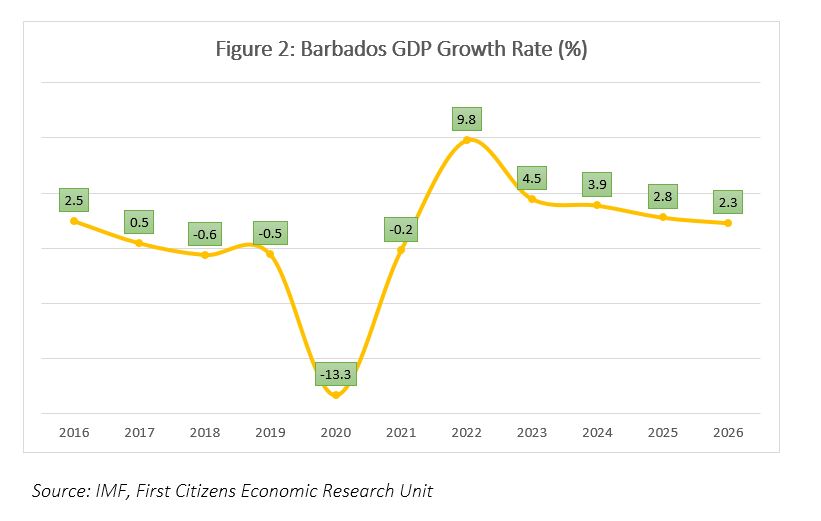

In 2023, the Barbados economy defied global and local challenges, maintaining its growth momentum primarily through the resilient performance of the tourism sector. Despite facing obstacles such as elevated foreign interest rates, geopolitical tensions, and adverse local climatic events affecting agriculture and prices, the Barbadian economy achieved a notable 4.4% growth rate. This expansion not only boosted transaction-based tax revenues but also played a pivotal role in reducing the debt-to-GDP ratio, narrowing the external current account deficit, and enhancing financial sector profitability. Tourism remained the driving force behind economic expansion, with increased airlift capacity, intensified promotional efforts, notable cricket events, and the vibrant resurgence of Crop-Over festivities contributing to its success. This sustained growth in tourism acted as a catalyst for non-tradable sector expansion, particularly in construction, wholesale and retail, and various other services, highlighting the interconnectedness of economic sectors.

Looking ahead, the Barbados economy, having showcased significant resilience over the past two years, holds a cautiously optimistic outlook for 2024 and the medium term. Successfully navigating challenges posed by the global pandemic, the economy rebounded to exceed its pre-COVID size in both nominal and real terms. Expectations point to a further GDP expansion of approximately 4% in 2024 and the medium term, contingent on ongoing investments from both the public and private sectors. Anticipating a return to pre-pandemic levels of tourist arrivals by year-end, early bookings reflect renewed traveller interest, and the continuous growth in seating capacity underscore airlines’ increasing confidence. The hosting of ICC World Cup matches in 2024 and intensified marketing strategies are poised to generate significant interest in Barbados during the summer months, with growing visitor demand for local goods and services expected to contribute to broader economic growth across various sectors.

Simultaneously, Barbados experienced a drop in inflation to 4.3% in July 2023 from the previous year’s 6.4%, attributed to reduced costs of gasoline and electricity. However, domestic factors, including shortages of local vegetables and international scarcities, along with increased demand for dining and recreation, played a role in driving inflation. The current account deficit for January to September 2023 decreased, positively impacting the external position, with international reserves reaching BBD2.9 billion (USD1.45 billion), covering 30.3 weeks of imports. Barbados faces challenges in managing increased gross financing needs, driven by a reduction in the primary surplus and higher debt servicing. Despite progress, the debt-to-GDP ratio remains at 115.4%, emphasizing the importance of sustained efforts in fiscal management.

Challenges for Barbados moving forward

Barbados, in its journey to economic recovery and transformation, confronts multifaceted challenges that warrant strategic consideration. Firstly, the nation’s heavy reliance on tourism as a cornerstone of its economy exposes it to vulnerabilities stemming from global uncertainties, such as the COVID-19 pandemic and geopolitical events like Russia’s invasion of Ukraine. These external shocks impact Barbados’ economic outlook, influencing inflation rates and posing uncertainties for the sustained growth trajectory. Moreover, despite significant strides in fiscal stability and successful debt restructuring, Barbados faces the intricate challenge of striking a delicate balance between fiscal consolidations and stimulating economic growth. The pursuit of climate resilience and sustainable development, exemplified by initiatives like the RSF demands substantial investments and careful planning. Addressing the impacts of climate change while concurrently fostering economic growth and reducing debt levels requires intricate policy measures and financial commitments.

In addition, the effective implementation of structural reforms poses another set of challenges. Initiatives targeting state-owned enterprises and public financial management demand sustained efforts to ensure their success in a dynamic global economic landscape. Maintaining momentum in reformative actions while adapting to changing circumstances requires a careful and agile approach. Despite the remarkable achievements, Barbados is navigating these challenges to secure long-term economic stability and resilience. The ongoing commitment to structural reforms, fiscal consolidation, and climate resilience reflects the determination to overcome obstacles and position Barbados for sustainable and inclusive growth. Collaborative efforts with international financial institutions, particularly the IMF, underscore the acknowledgment of shared challenges and the importance of global cooperation in addressing them.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.