The Effect of China’s Downturn On Trinidad And Tobago’s Economy

Insights

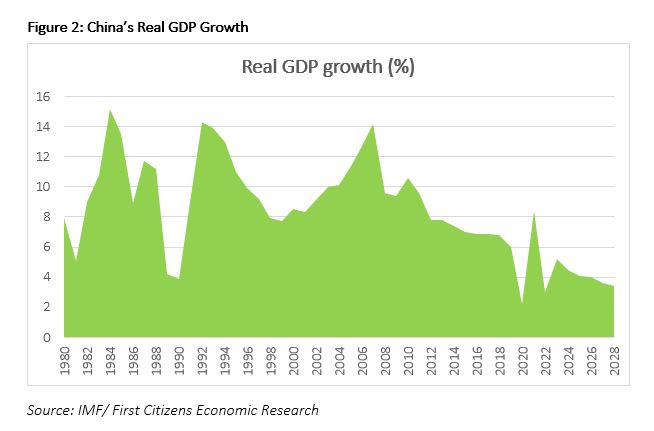

Trinidad and Tobago’s relationship with the People’s Republic of China has evolved significantly over the years, driven by mutual economic interests and collaboration in various sectors of energy, primary oil and natural gas. Despite strong trade relations over the past two years which exceeded USD1bn, China’s economic downturn would have adversely affected T&T. According to the IMF, China’s economy grew 3% in 2022 and is expected to expand further by 5.3% in 2023. The World Bank’s forecast indicates that economic growth will gradually decelerate from 5% in 2024 to 3.4% in 2028, well below the country’s historical average. The deceleration in China’s rate of growth will certainly have implications for Trinidad and Tobago in different sectors across the economy.

China’s Economic Downturn: An Overview

China, often referred to as the ‘world’s factory,’ plays a pivotal role in the global economy. As the second-largest economy by GDP, China’s economic performance exerts significant global influence. When China’s economy experiences a downturn, this has a ripple effect throughout international markets and has consequences for countries with which they have established economic ties. China’s economic slowdown is the result of a combination of factors. During the COVID-19 pandemic, China faced a significant challenge with lockdown measures, particularly after the 2022 outbreak in Shanghai, which had a profound impact on the economy due to its adherence to a strict “Zero-COVID” policy. This rigorous approach enforced stringent control measures and aimed for maximum virus suppression. The necessity for such measures arose from the fact that Shanghai, a major Chinese city, was not only a prominent tourist destination where nearly 40% of China’s tourists visited but also the city with the highest number of COVID cases since the initial outbreak in Hubei province in 2019, before it spread to other urban centres. The lockdown restrictions in Shanghai had substantial economic ramifications, given the city’s central role as a hub for semiconductor, electronics, and automobile manufacturing. Additionally, Shanghai is home to the world’s busiest shipping port and plays a pivotal role in China’s financial stability and manufacturing sector. Its strong connectivity to other regions in China, particularly the “manufacturing hub” of the Yangtze River Delta, underscores its significance. The stringent lockdown measures, imposed by the Chinese government, disproportionately affected local businesses, retailers, hotels, and restaurants, ultimately causing an approximate 3.7% contraction in the country’s GDP. Major corporations like Volkswagen scaled back their operations in Shanghai, and other manufacturing and service firms did the same in 2022, leading to a slowdown in production from 5% in March 2022 to 2.9% in April 2022.

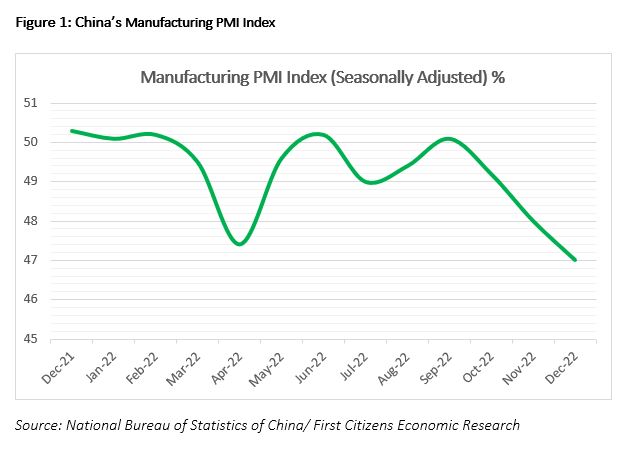

The lockdown in Shenzhen, China’s largest manufacturing hub, had significant repercussions for the country, impacting other cities as well. This was evident in the 28.5% increase in the number of vessels waiting outside the Port of Yantian for exports to Europe and North America. Large multinational companies anticipated shipping delays, with Amazon stockpiling China-based inventory prior to the Omicron outbreak to offset expected shortages. Similarly, Foxconn, a prominent iPhone manufacturer, relocated its production to other manufacturing facilities in Asia to circumvent shipment delays and production disruptions. The prolonged lockdown in Shanghai led to a considerable economic slowdown in China’s industrial and manufacturing sector, as reflected in the Purchasing Managers’ Index (PMI) data[1], which provides insights into the country’s market conditions.

Additionally, The COVID-19 pandemic significantly impacted China’s consumer demand in several ways and remains pertinent to the current downfall in the economy. The widespread fear of infection and the government-imposed lockdowns led to a decline in consumer confidence, prompting people to cut back on spending as they focused on essential items and safety precautions. Many businesses, particularly those in the hospitality, travel, and entertainment industries, faced reduced customer traffic or were forced to temporarily close, causing a sharp drop in consumer spending on these services. Furthermore, the economic uncertainties brought about by the pandemic, such as job losses and income reductions, led to more cautious spending habits among Chinese consumers. E-commerce and online retail, however, experienced a surge in demand as people turned to digital platforms for their shopping needs, reflecting a shift in consumer behaviour driven by the pandemic’s challenges.

Property developers in China have traditionally funded their projects by buying land, securing loans, and pre-selling unfinished homes, but excessive borrowing raised concerns by 2020. Government regulations categorized developers by debt levels, but in 2021, a severe drop in property demand led to a crisis, with Evergrande Group’s default triggering a chain reaction, causing defaults by numerous private property developers, accounting for 40% of Chinese home sales. As a result, the real estate sector is facing obstacles, which in turn impacts household wealth, as roughly 70% of China’s household wealth is tied to real estate and contributes to approximately 29% of the country’s GDP.

Moreover, it is crucial to note that the medium-term prospects for China’s GDP growth rate are nowhere close to historical averages, and this deceleration will have implications from a global perspective. The slowing economic growth in China, driven by a mix of domestic and external factors, adds another layer of complexity to the global economic landscape. As China’s economy moderates, it affects not only its own economic outlook but also the interconnected world of international trade and investment, making it an important trend to watch for global markets and economies.

Trinidad and Tobago’s Economic Ties with China

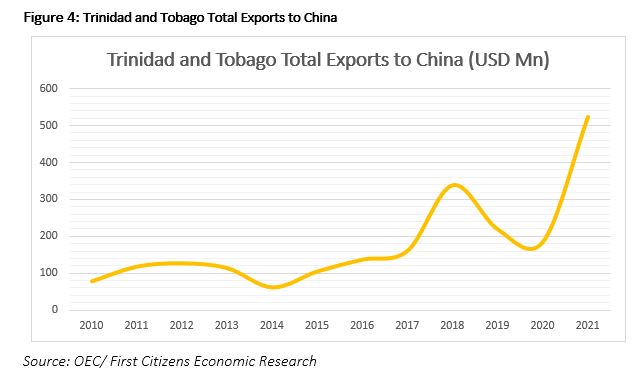

In 2022, bilateral trade between Trinidad and Tobago and China exceeded USD1.13bn, underscoring the robust economic relationship mainly through trade and investments.

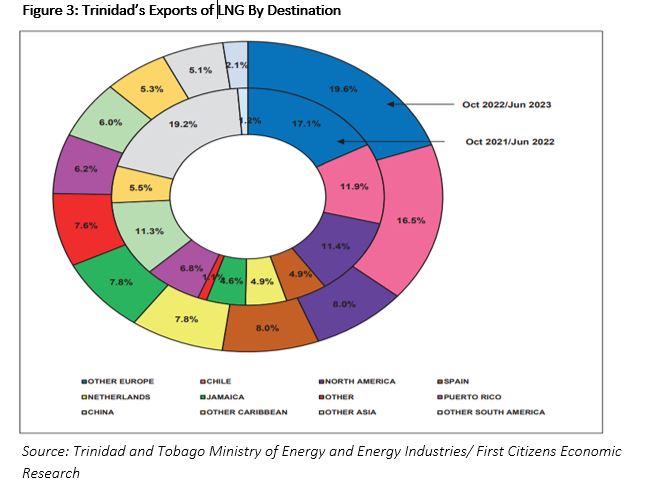

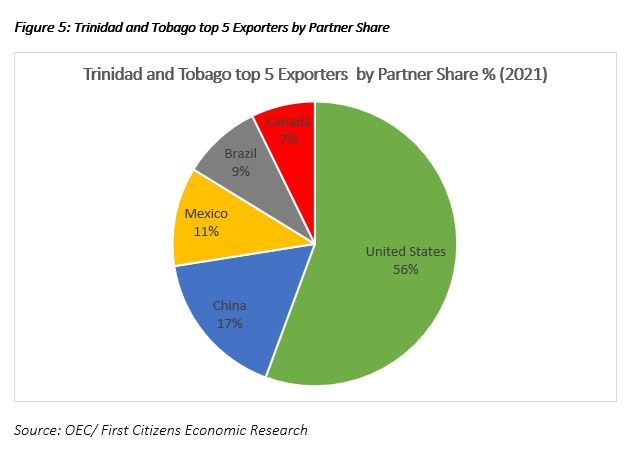

These connections were strengthened in January 2023 when T&T hosted the China Investment Cooperation Forum, which created a platform for both Trinidad and Tobago and China to discuss investment opportunities in areas they both find important and strategically valuable. This event aimed to strengthen their existing business connections. The sectors highlighted for potential collaboration included distribution and logistics, manufacturing, nearshoring, agriculture, agro-processing, agri-technology, and the emerging industrial zones overseen by the Ministry of Trade and Industry, such as the Phoenix Park Industrial Estate and the Moruga Agro-processing and Light Industrial Park. China has become a major buyer of Trinidad and Tobago’s energy exports, particularly liquefied natural gas (LNG) and petrochemicals and accounts for 10.51% of the country’s trade since 2021. China, a major consumer of these commodities, making up 23.81% total global energy consumption, plays a crucial role in determining the price of these energy commodities, as such if China’s economy experiences a slowdown, it could lead to decreased global energy demand, ultimately resulting in lower commodity prices. Consequently, Trinidad and Tobago would face challenges in terms of export revenues and government revenues, as the country’s economic performance is closely tied to energy exports.

Decreased Investment Opportunities

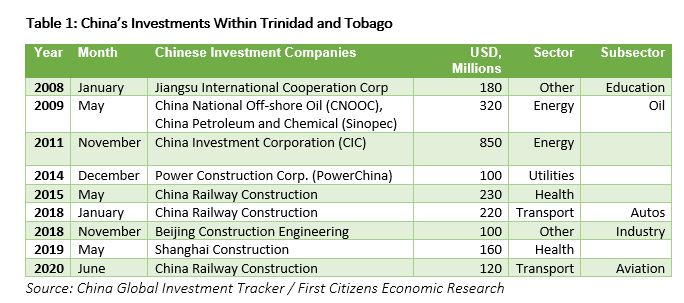

China is heavily dependent on investments, which makes up nearly 50% of the country’s GDP. China’s economic slowdown has also affected its outbound investments which amounted to USD39 bn in 2022, potentially influencing Trinidad and Tobago’s foreign direct investment (FDI) prospects within sectors of Energy and Natural Resources, Infrastructure and Construction, Manufacturing, Telecommunications and Technology, Finance and Tourism. Apart from the pivotal role played by medical and pharmaceutical investments in the distribution of 100,000 COVID-19 vaccines, which significantly curbed the pandemic’s fatalities, Trinidad and Tobago has embarked on several initiatives in collaboration with China to foster economic growth and trade. Notably, China’s far-reaching Belt and Road Initiative has witnessed a substantial infusion of funds into diverse global infrastructure ventures. This project, initiated by the People’s Republic of China, is a transcontinental network linking China to South East Asia, South Asia, Central Asia, Russia, and Europe through both land and sea routes. This comprehensive connectivity spans China’s coastal regions to Southeast Asia, South Asia, the South Pacific, the Middle East, Eastern Africa, and Europe.

Launched in 2013, the Belt and Road Initiative aims to catalyse extensive infrastructure development, encompassing ports, highways, railways, airports, power plants, and telecommunications networks. Its overarching goal is to establish a robust framework for trade between China and its Belt and Road Initiative partners. The Belt and Road Initiative has mobilized nearly USD1 trillion in investments across more than 3,000 projects within its member countries.

China has made notable investments in Trinidad and Tobago, exemplified by the 2018 memorandum of understanding signed by the University of Trinidad and Tobago. This agreement fostered collaborative programs and activities for both educators and students, facilitating the exchange of teachers from China to Trinidad and Tobago. Another significant investment is the TTD500mn dry dock, constructed by the China Harbour Engineering Company (CHEC) in 2018. This facility serves as a hub for ship inspections and repairs, contributing to maritime trade.

China has also made its presence felt in Trinidad and Tobago through the widespread adoption of Huawei products, providing widespread Wi-Fi connectivity across the nation. Furthermore, a distributorship agreement between Beijing Construction Engineering Group (BCEG) and Lake Asphalt is set to enhance the company’s marketing of products in the Chinese region.

One of the more notably investments by China in Trinidad and Tobago is the USD104.3mn Phoenix Park Industrial Estate in Point Lisas, constructed in collaboration with the BCEG and Evolving Tecknologies and Enterprise Development Company Limited (eTeck). This state-of-the-art facility employs advanced technology, artificial intelligence, and ‘Internet of Things’ (IoT) to facilitate trade and investments in Trinidad and Tobago.

There are also projects in the works, including the possible manufacturing of Samsonite luggage locally as well as a pilot project of chocolate production in Hainan, China, through the TT Fine Cocoa Company, with expectations of increased exports.

The Chinese economy is now facing its own economic challenges which may result in a reduction of large-scale investments, especially abroad, which can have the potential to negatively impact the level of job creation, infrastructural developments and economic growth within Trinidad and Tobago.

Financing and Consumer Goods

Trinidad and Tobago imports a range of consumer goods from China. In 2020, import of consumer goods from China stood at USD241mn, which increased to USD277mn in 2021. However, as China’s economy slows down, it could lead to disruptions in the supply chain, causing anticipated shortages and potential price increases for these imported goods in 2023 and ahead. This, in turn, affects consumers’ purchasing power and the cost of living in Trinidad and Tobago.

Furthermore, China’s economic slowdown could contribute to global market uncertainties and volatility, impacting investor confidence worldwide, including in Trinidad and Tobago. This, in turn, could affect capital flows and financial markets in Trinidad and Tobago. Furthermore, if China’s economy experiences a significant slowdown, it might impact its ability to provide loans and financial assistance to countries like Trinidad and Tobago. If Trinidad and Tobago has outstanding loans or financial agreements with China, changes in China’s economic status could affect the terms and availability of such financing.

Over the years, Trinidad and Tobago has forged a significant connection with the People’s Republic of China, fostering a relationship rooted in mutual economic interests and collaboration across various sectors, particularly energy. The economic downturn in China, a titanic force in the international arena, can cast a shadow across Trinidad and Tobago, revealing the interconnectedness of our world. This also underscores the importance of economic diversification and building resilience in the face of global economic uncertainties. Trinidad and Tobago must adapt to the changing economic landscape by exploring new opportunities and strengthening its ties with a diverse range of trading partners. By doing so, the nation can weather the challenges posed by China’s economic downturn and emerge as a more robust and resilient economy in the long run.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.

[1] According to the National Bureau of Statistics of China, the Purchasing Managers Index (PMI is an index summarized and compiled through the results of the monthly survey of enterprises purchasing managers. It covers every links of the enterprises, including purchasing, production, and logistics. A reading above 50 indicates that the economy is expanding, while below 50 reflects a recession.