Declining United States Money Supply

Insights

As the United States government evaluates economic conditions, price stability goals, and public unemployment, it enacts specific monetary and fiscal policies to promote the long-term well-being of its citizens. The supply of money is managed by central banks to achieve specific well-established objectives, such as low inflation, maximum growth, or high employment.

Money Supply Defined

Though there are a few variations of money supply, most economists tend to focus on M1 and M2. The former takes into account cash and coins in circulation, as well as demand deposits in checking accounts and traveller’s cheques. Simply put, money that’s either in your hand or can be accessed easily.

M2 accounts for everything in M1 and also includes savings accounts, money market funds, and certificates of deposit (CDs) below USD100,000. It’s money you have access to, but it takes a little extra effort to put this capital to work. M2 money supply will be discussed for the purpose of this article.

The Quantity Theory of Money suggests that all else being equal, there is a connection between the supply of money in an economy and the overall price level. So, an increase in the money supply results in more funds available for spending and borrowing, which stimulates economic activity. If the increase outpaces the growth of the real economy, it can lead to excessive demand relative to supply, resulting in upward pressure on prices. Conversely, a decrease in the money supply means there is less money available for banks to lend and for companies to borrow and spend, which can lead to downward pressure on prices. However, it’s important to note that this relationship is influenced by various factors and changes in the money supply might not immediately translate into changes in spending and the price level.

Money Supply During the Pandemic

During Covid-19, the Federal Reserve (Fed) enacted policies to combat the financial implications of the pandemic. In March 2020, the Fed issued stimulus cheques to the American public and announced it would keep its federal funds rate between 0% and 0.25%, and purchase at least USD500 billion of Treasury securities over the coming months, all in an effort to promote economic growth, thereby, materially increasing the nation’s money supply. As a result, the nation experienced historically high inflation, reaching a peak of 9.1% in June 2022. The United States had successfully navigated the economic downturn, however, the growth in the country’s money supply had resulted in inflation.

Money Supply Post-Pandemic

To combat this inflation, the Fed raised interest rates quickly with the intended effect of slowing spending and by extension, lowering inflation. According to an article from the Federal Reserve Bank of St. Louis, since late 2022, M2 money supply has been declining. This generally means that there is a reduction in the total amount of money circulating in the economy. The decline in money supply is largely a consequence of the reversal of the liquidity generated by massive pandemic fiscal and monetary stimulus, the Federal Reserve shrinking its balance sheet via quantitative tightening (QT), falling bank deposits, and weak demand for and provision of credit.

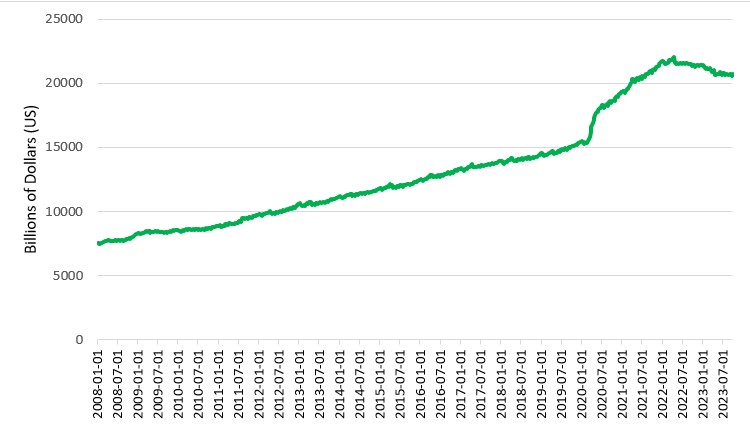

US M2 Money Supply

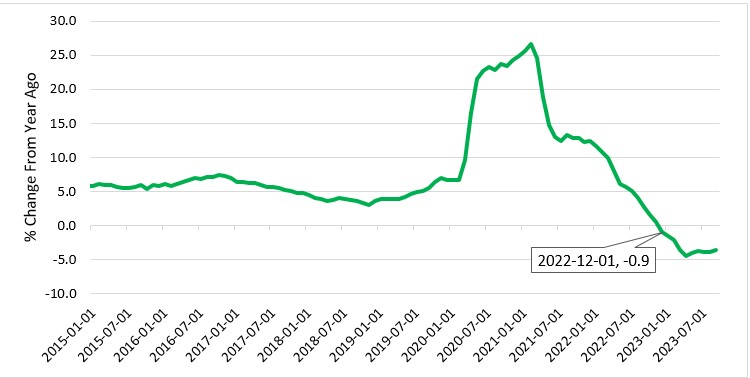

M2 Money Supply (% Change) Pre-Pandemic to Post-Pandemic

U.S. money supply shrank on an annual basis in December 2022 for the first time on record, giving some economists hope that inflation pressures will continue to abate. Fed data showed that M2 money supply, fell a seasonally adjusted 3.53% to USD20.61 trillion in September 2023 from USD21.4 trillion in the same period a year earlier.

As money supply rose rapidly into early 2022, so did inflation, however, since M2 money supply started a persistent decline later in the year, inflation pressures (CPI) have also receded.

Factors Affecting Money Supply

The Fed uses three primary tools in managing the money supply. They are:

1. Changing bank reserve requirements

A change in the reserve ratio is seldom used but is potentially very powerful. The reserve ratio is the percentage of reserves a bank is required to hold against deposits. A decrease in the ratio allows the bank to lend more, thus increasing the money supply. An increase in the ratio has the opposite effect.

2. Raising or lowering the discount rate

The Fed can change the money supply by lowering or raising the discount rate banks pay on short-term loans. If the discount rate is low, the Fed wants to increase banks’ reserves and lending activity and create an incentive to borrow more. Alternatively, if the discount rate is increased, the money supply decreases, lessening reserves and reducing borrowing.

3. Open market operations

The Fed can change the money supply by buying or selling Treasury bonds and other securities. To increase the money supply, the Fed will purchase bonds from banks, which injects money into the banking system. To decrease the money supply, the Fed will sell bonds to banks, removing capital from the banking system.

Falling M2

M2 has risen pretty steadily over many decades but since its peak in July 2022, this often overlooked data-point has declined. According to a paper by S&P Global Market Intelligence, much of the fall in M2 is due to the end of the federal government’s efforts to prop up the economy during the pandemic by pumping in trillions of dollars through stimulus checks and loans. From March 2020 to the peak in July 2022, the M2 supply increased over USD5 trillion.

The paper also stated that M2’s fall is additionally being driven by not only a decline in savings rates but also the ways Americans are saving their money. The highest interest rates since 2007 have motivated savers to move billions of dollars from demand deposits, or money in bank accounts that can be withdrawn at any time, to time deposits, which are interest-bearing accounts with maturity dates, such as certificates of deposit.

Additionally, businesses have been reducing demand for loans, partly in response to higher rates and tighter credit standards. Low or negative bank loan growth will likely add to the deterioration of M2.

The Impact of the Use of Digital Currency

Forms of money are continually evolving and digital currency is the latest form. Some examples include cryptocurrencies, stablecoins and central bank digital currencies (CBDCs). Increased use of this alternate form can indirectly impact the money supply by providing an alternative form of money, potentially leading some individuals to hold less traditional M2 assets. The extent of the impact would depend on consumer preferences, the rate of adoption of digital currency and regulatory policies.

On the other hand, CBDCs are under the direct control of the central bank or government, which means that the central bank can influence the money supply by creating or destroying digital currency units, just as they can with physical cash. The Fed and other central banks are considering how to account for digital currencies in their money supply calculations and are actively monitoring these developments.

Conclusion

With high interest rates, reduced money supply and slowing consumer spending, this points to a possible slowing in overall growth in the economy. If a recession were to take shape, demand for stocks could head considerably lower, at least in the short term. Demand for safe haven assets like gold and Treasuries may increase with investors trying to maintain or increase the value of their portfolios. It should be noted however, that GDP is growing at a healthy pace (4.9% in Q3 2023), and the unemployment rate is well below historical average at 3.9% as at October 2023.

It should be noted that even with money supply contracting, there is still an ample amount cash sitting around in America’s financial system. M2 is still higher than pre-pandemic levels, offering a more than adequate level of liquidity.

Just how much M2 will continue falling and when will its decline be more accurately reflected in inflation is a matter of debate. Hopefully, continued modest contractions can help to bring down inflation without pushing the economy into deflation territory.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.