Third Quarter of 2023 Review

Insights

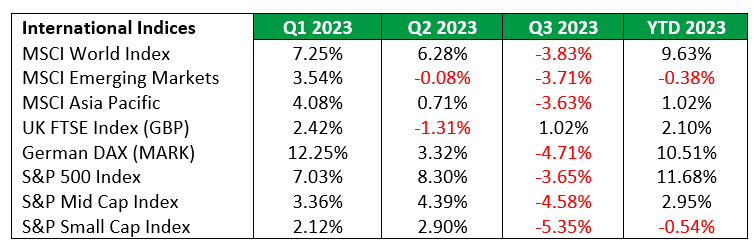

Following a strong performance in the second quarter of 2023, the positive momentum did not persist in the third quarter, resulting in negative returns for global equities. The MSCI World Index, a measure of global stocks, experienced a decline of 3.83%. This decrease reduced the year-to-date gain from 13.99% at the end of June 2023 to 9.63% by the end of September 2023. Sluggish and decelerating economic growth in some of the world’s major economies, coupled with persistent high inflation and elevated interest rates, introduced instability to the markets. This, in turn, had a negative impact on investors’ risk appetite and sentiment.

US

After experiencing three consecutive quarters of positive growth, US equities faced a decline in the third quarter of 2023, with a quarterly loss of 3.65%. Investors initially held optimism that the Federal Reserve (Fed) would adopt a more lenient monetary policy and conclude their rate-hiking stance. However, these hopes were dashed in September 2023 when the Fed signalled one more rate hike in 2023 before an extended pause. Additionally, they revised their “dot plot”, which is a chart showing each Fed policymaker’s forecast for interest rates, that illustrated a higher median interest rate for 2024. The median rate increased by 50 basis points from 4.6% to 5.1% in 2024 and 3.4% to 3.9% in 2025, suggesting a belief that the Fed needs to maintain a more restrictive policy for a longer duration to curb inflationary pressures. Consequently, the enthusiasm observed in July diminished in August and September as the likelihood of an imminent rate cut dwindled, impacting US stocks.

The S&P 500 index was down 3.65% in Q3 2023, after posting gains of 7.03% in Q1 2023 and 8.30% in Q2 2023. On a year-to-date basis, the S&P 500 index generated a return of 11.68% at the end of September 2023, down from 15.91% as at June 2023.

In terms of market capitalisation, large-cap and mid-cap stocks outperformed small caps for a third consecutive quarter. Smaller companies heavily rely on debt financing due to limited resources, thus the heightened interest rate environment imposes a more substantial financial burden on smaller companies compared to their larger counterparts. The Small Cap Index recorded the most significant quarterly loss of 5.35%, while the Mid Cap Index was down 4.58%.

Europe

European stocks also declined over the quarter as investors were challenged by a rising interest rate environment and sluggish growth in the Eurozone economy. In the September 2023 meeting, the European Central Bank (ECB) hiked its key policy rate to 4%, reaching the highest level since the creation of the single-currency bloc.

Additionally, the ECB revised down its economic growth forecasts for the Eurozone in 2023 and 2024. The reduction in the economic growth projections was largely due to Germany as it grapples with recessionary pressures and a disappointing export performance, with the manufacturing sector bearing the brunt of the energy price shocks triggered by the Ukraine war. The Eurozone is expected to grow by 0.80% in 2023 and 1.3% in 2024, down from the May estimates of 1.1% and 1.6%, respectively. Notably, Germany’s economy is projected to contract by 0.40% in 2023, a stark deviation from the previous estimate of marginal growth.

Emerging Markets

The downward trajectory of emerging market equities continued into the third quarter, with the MSCI emerging markets index down by 3.71% compared with 0.08% in Q2 2023. Most markets declined in the quarter on concerns of China’s anaemic economic growth which is expected to negatively impact the smaller emerging economies given China’s importance as a trading partner.

Investor sentiment further soured due to China’s real estate crisis, driven by the debt issues of several major Chinese property companies, raising fears of a financial crisis. Poland and Chile led the downturn among emerging markets, with Poland facing political uncertainty in the lead-up to its October parliamentary elections, while Chile felt the impact of declining lithium prices.

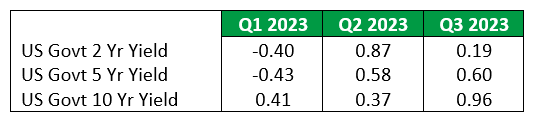

US Treasury Yields

During the third quarter of 2023, US Treasury Yields continued their upward trend. The Treasury market faced pressure from increasing US debt issuance, and concerns were heightened by Fitch Ratings’ decision to downgrade the US’s AAA credit rating to AA- plus. This downgrade was a response to the growing debt burden and a decline in governance. The Federal Reserve’s indication of an additional rate hike and the adjusted dot plot contributed to a further increase in market yields throughout the quarter.

The inversion of the US Treasury yield curve eased somewhat during the quarter, as yields on the long end experienced a more significant rise compared to yields on the short end. As a result, the US 10-year yield increased by 96 basis points in Q3, reaching a peak of 4.68%, which marked a 16-year high. In contrast, the 2-year and 5-year yields saw more modest increases, rising by 19 basis points and 60 basis points, respectively, over the quarter.

International Stock Indices

Quarterly change: US Treasury Yields (basis points)

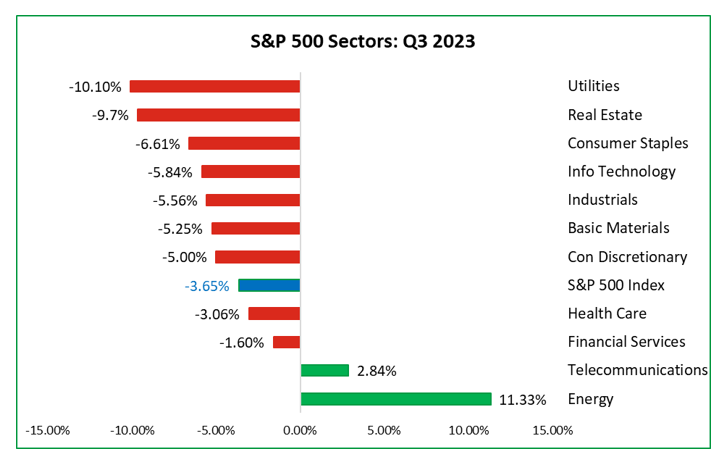

US Sector Performance

From a sector perspective, Energy emerged as the top performer, delivering a quarterly return of 11.33%, as anticipated. Telecommunications followed with a 2.84% return. However, nine out of the twelve sectors experienced declines in Q3 2023. Utilities led the downturn with a 10.10% decrease, trailed by Real Estate (9.70%) and Consumer Staples (6.61%).

The surge in Energy stocks was propelled by a roughly 30% increase in crude oil prices, attributed to extended supply cuts by the Organization of the Petroleum Exporting Countries (OPEC) and Russia until the year’s end. The West Texas Index (WTI) crude witnessed a notable 29% rise in Q3 2023, reaching its highest levels in over a year, ascending from US$70.64 at the end of June to US$90.79 at the close of September 2023.

US Sector Performance

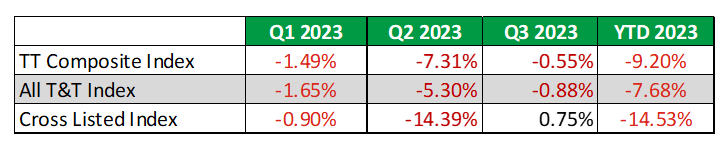

Local Market Review

The Cross Listed Index concluded the third quarter on a positive note, recording a quarterly return of 0.75%, a notable improvement from the preceding quarter’s loss of 14.39%. In contrast, both the T&T Composite Index and the T&T Index continued their downward trajectory, registering quarterly losses of 0.55% and 0.88%, respectively.

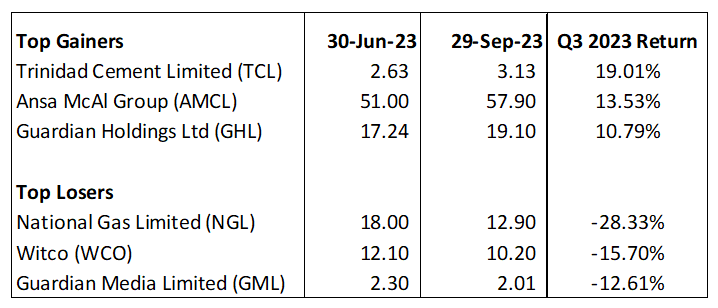

Highlighting the top performers for the three-month period ending September 2023 were Trinidad Cement Limited (TCL), Ansa McAl Limited (AMCL), and Guardian Holdings Limited (GHL), with returns of 19.01%, 13.53%, and 10.79%, respectively. On the flip side, the stocks experiencing the most significant share price declines during the same period were National Gas Limited (NGL), West Indies Tobacco Company (WCO), and Guardian Media Limited (GML), with losses of 28.33%, 15.70%, and 12.61%, respectively.

Local Stock Indices

Top Gainers and Losers: Quarterly Performance

Capital Markets Outlook

The commencement of the fourth quarter in 2023 was marked by the Israel and Hamas conflict, raising significant concerns, particularly regarding its potential impact on energy prices. Should the conflict expand to involve other Middle Eastern nations, the risks to oil production would escalate, given that this region contributes 32% of the world’s annual crude oil supply. The recent surprise attack in Israel has triggered calls for stricter U.S. sanctions on Iran’s oil exports from lawmakers. Considering the existing production cuts by the Organization of the Petroleum Exporting Countries (OPEC) and ongoing challenges in Libya and Venezuela, additional restrictions on Iranian oil production could lead to a further increase in oil prices, consequently influencing global inflation.

Moreover, the war has the potential to disrupt international trade, particularly the flow of goods through the Strait of Hormuz, a critical shipping lane for oil and gas exports between Europe and Asia. The Strait of Hormuz plays a pivotal role in the energy market, with around 90% of Persian Gulf oil exports passing through daily. If a direct link emerges with Iran, the United States might intervene and impose tighter sanctions on Iran’s oil exports. In response, Iran could threaten to close the Strait of Hormuz, a tactic previously employed during oil export sanctions.

Closing the Strait is not the sole risk to the global energy market. Attacks on ships, especially those associated with Israel, can significantly impact trade. Shipping companies may be reluctant to send vessels through the Strait, potentially leading to longer alternative routes, higher shipping costs, and significant delays. Furthermore, if insurers perceive a high risk of violence, they may raise premiums for shipping companies, likely resulting in increased energy prices for consumers.

The war also poses a credible threat to the global information technology industry. Israel has the world’s second-largest number of startup companies and attracts 19% of global investment in cybersecurity. Leading globally in Research and Development (R&D) expenditures per GDP and receiving the highest rate of venture capital funding per capita, Israel’s tech sector is deeply interconnected with the global tech industry. Disruptions to Israel’s tech sector could lead to shortages of crucial inputs worldwide.

Should energy and essential technology input prices surge due to the spread of the war to oil-producing nations in the Middle East, there will be an intensification of inflationary pressures, adding to the already heightened inflationary environment. To counteract such price pressures, central banks may resume raising interest rates, directly impacting borrowing costs. This, in turn, could lead to a decline in consumer spending, negatively affecting global economic growth.

Amidst ongoing uncertainty, it is imperative for investors to remain vigilant to economic and market risks and prudently manage their portfolio’s risk and return objectives. The focus should be on establishing and maintaining a well-balanced portfolio capable of withstanding any unforeseen market surprises and fluctuations. By doing so, investors can better position themselves to navigate the uncertainties and potential challenges that may arise in the future.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.