Trinidad and Tobago’s Energy Sector Economic Activity

Insights

The domestic economy continues to rebound…

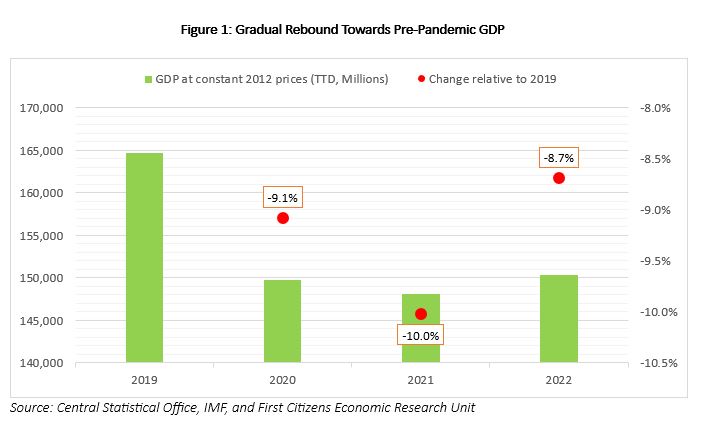

Global economic activity continues to be resilient resulting in a 0.2 percentage point increase in the global growth forecast for 2023. The global economy is now expected to expand at a 3.0% pace in 2023 and remain stable through 2024. The rebound of the domestic economy is expected to continue with estimated growth of 2.5% in 2022 and projected growth of 3.2% in 2023. This follows pandemic associated contractions of -7.7% and -1.0% in 2020 and 2021 respectively. Prior to the pandemic, real GDP growth in Trinidad and Tobago has been subdued with an annual average of -0.9% between 2013 and 2019.

The estimated growth in 2022 and 2023 represents a continued, albeit partial recovery of the base effect lost during the pandemic (2020-21). However, sustainable growth remains elusive due to the rent dependence on the energy sector and its associated volatility. The IMF forecasts an annual average economic growth of 2.0% between 2024 and 2028, and this improvement in economic activity will be dependent, and driven by the performance of the energy sector. For example, key projects such as Shell’s Colibri, DeNovo’s Zandolie and bpTT’s Cassia should bolster natural gas supplies while energy prices are expected to remain stable.

The energy sector remains a key contributor to economic activity…

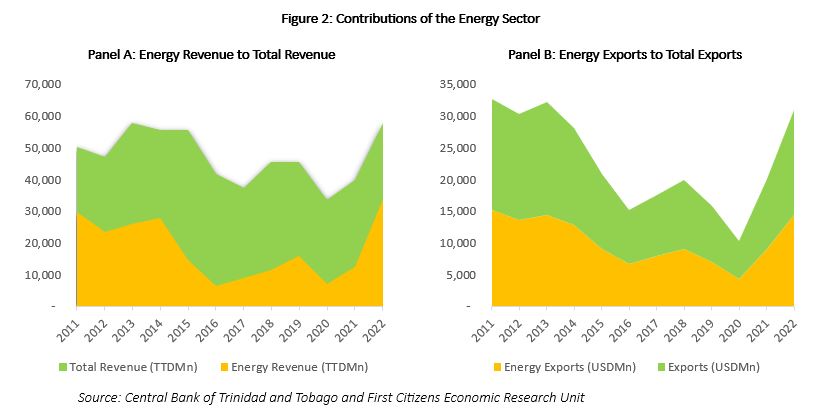

Between 2011 and 2022, energy sector revenue contributed an annual average of 36.6% of the government’s total revenue. In 2022, its contribution accounted for 58.2% of government’s total revenue. Similarly, export earnings were dominated by the energy sector with energy export earnings accounting for an annual average of 81.0% of total export earnings over the same period. In 2022, energy exports contributed 85.7% of total exports.

On the upstream side…

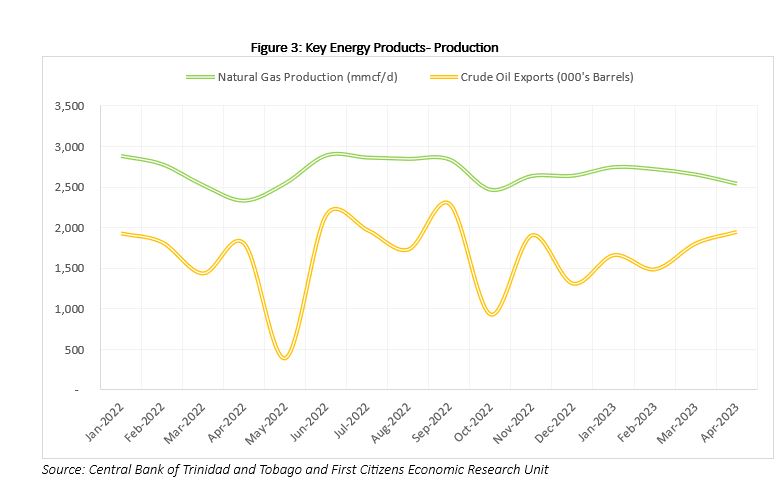

From January 2022 to April 2023, natural gas production remained stable with an average of 2,677 million cubic feet per day (mmcf/d) and the production was maintained by Shell’s Colibri and Barracuda projects, bpTT’s Matapal project, and DeNovo’s Zandolie project. Train 1 of the four-train Atlantic LNG facility has been closed since late 2020 due to a shortage of feedstock gas. However, the majority stakeholders bpTT and Shell have been working feverishly to ensure timely completion of the four-year restructuring process. The restructuring will give state-owned National Gas Company (NGC), which was previously a partner in Trains 1 and 4 only, a 10% stake in all four trains, with bpTT and Shell each holding a 45% share across all trains. The new arrangement also allows Atlantic LNG to receive gas from third-party sources, which could include Woodside Energy’s deep-water Calypso field and Shell’s Manatee field. Trinidad and Tobago also expects to resume negotiations to bring gas from the Loran field for processing.

Crude oil exports averaged 1,660,000 barrels per month between January 2022 and April 2023. Apart from significant declines in May 2022 and October 2022 in part due to scheduled maintenance, crude oil exports have been fairly consistent over the period.

There are key energy products that are large export earners…

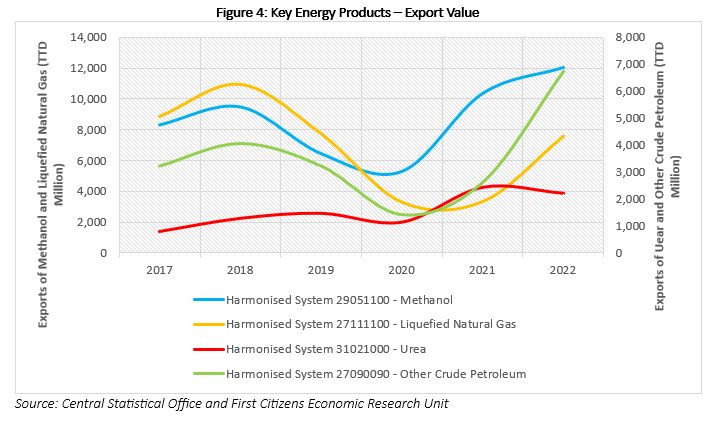

Export revenue from crude petroleum has increased significantly from the pandemic low of TTD1.4 billion in 2020. Exports of crude petroleum were approximately TTD6.7 billion in 2022 and this represents a 109% increase in export value from 2019. This was due to increases in both price and production over the period. Similarly, export earnings from key downstream products such as Methanol, Liquefied Natural Gas and Urea rebounded after the pandemic. Methanol exports recovered to TTD12.0 billion in 2022 following export earnings of TTD5.3 billion in 2020, and surpassed 2019 earnings of TTD6.5 billion. With Methanol export volume fairly stable and averaging 5,129,000 tonnes per annum, the increase in export value was largely driven by prices which increased from USD363 per tonne in 2019 to USD556.40 per tonne in 2022. The price of Methanol remains elevated and stood at USD523.00 per tonne in June 2023.

Liquefied Natural Gas production has been declining steadily over the last decade. In 2019, 28,882,260 cubic metres of LNG was produced in comparison to 18,120,540 cubic metres in 2022.

The daily natural gas production average for EOG, bpTT and Woodside all fell in 2022 relative to 2021. However, a 29% increase in production from Shell resulted in a marginal increase in total natural gas production relative to 2021. Due to recently higher prices, LNG export revenue increased to TTD7.6 billion in 2022 after remaining fairly stagnant at approximately TTD3.3 billion in 2020 and 2021. While natural gas production has not returned to its pre-pandemic levels, upcoming projects between 2024-26 should expand production capacity.

The export earnings from Urea remain above pre-pandemic levels. In 2022, Urea export earnings were TTD2.2 billion, representing a 273% increase relative to 2017. Exports of Urea increased from 576,000 tonnes in 2017 to 724,000 tonnes in 2021. Over the same period, the price increased from USD214.90 per metric tonne to USD483.10 per metric tonne. Exports fell to 420,000 tonnes in 2022 but the earnings were supported by a sharp rise in price to USD644.50 per metric tonne due to surging input costs, supply disruptions caused by sanctions to Belarus and Russia, and export restrictions on fertilizers from China. The price of Urea has since declined to USD305.60 per tonne in June 2023.

Energy prices remain volatile…

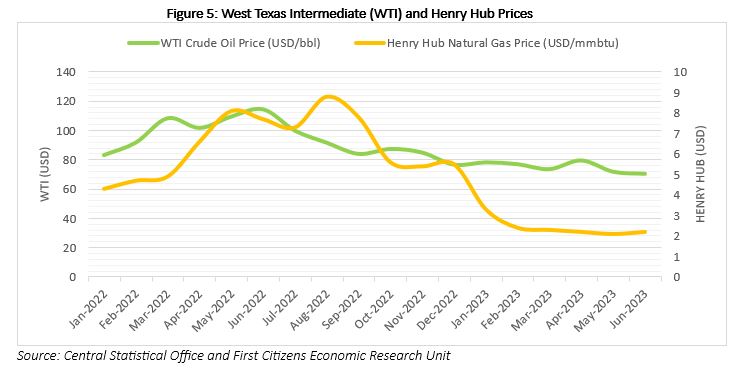

The volatility of energy prices is no stranger to economic research, and it continues to fluctuate. Between January 2022 to June 2023, both crude oil price (as captured by the West Texas Intermediate) and natural gas price (as captured by the Henry Hub) have fluctuated significantly with large increases and decreases over such a short period. In January 2022, crude oil prices stood at USD83.10 per barrel. It then peaked at USD114.60 per barrel in June 2022 and gradually declined over the last year and closed at USD70.20 per barrel in June 2023. Over the last 12 months, oil markets have been struggling for direction. Bearish macroeconomic indicators and concerns over demand growth have been clashing with resurgent oil use in key consuming countries. Oil prices appear to be taking their cue from the former, resulting in significantly lower levels from its peak in 2022 despite a looming supply deficit.

The Henry Hub gas price increased by more than 100% within the first eight months of 2022 from USD4.30 per MMBtu in January 2022 to USD8.80 per MMBtu in August 2022. It then plunged through February 2023 to USD2.40 per MMBtu and stabilized through June 2023 where it closed at USD2.20 per MMBtu. This was largely due to relatively mild temperatures, record production, and higher-than-average inventories.

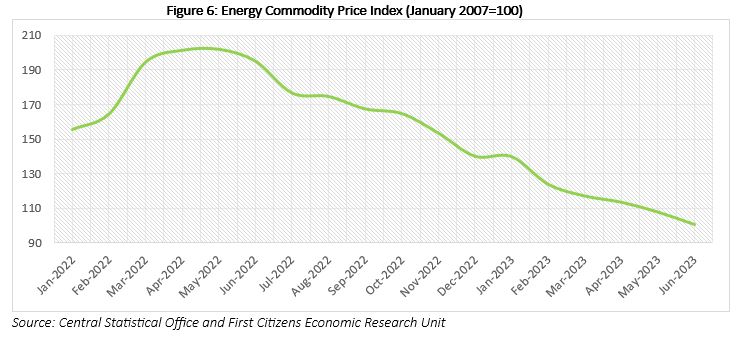

The Energy Commodity Price Index (ECPI) is a useful summary measure that captures the average price movements of the top ten energy-based commodity exports for Trinidad and Tobago. An increase in the ECPI value signifies a rise in the weighted average prices of the energy commodities exported. The converse holds true. Similar to the movements in key prices such as the WTI and Henry Hub, the ECPI had an upward trend between January and May 2022 where it peaked at 202.0. Since then, the ECPI had a precipitous fall and stood at 100.6 in June 2023.

The energy sector continues to have major implications for the macroeconomic performance of Trinidad and Tobago…

The performance of Trinidad and Tobago’s energy sector has far-reaching implications for the country’s macroeconomic indicators and fundamentals such as fiscal stability, export earnings, foreign exchange reserves and overall economic growth. In the absence of progressive diversification, Trinidad and Tobago remains highly dependent on the performance of the energy sector. While efforts are being made to expand exploration and production as well as downstream activities, the performance of the energy sector continues to be influenced by the international landscape and must be continuously monitored.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.