Hurricanes and the Caribbean Region

By: Shania Taylor – UWI Intern, First Citizens Economic Research Unit

Insights

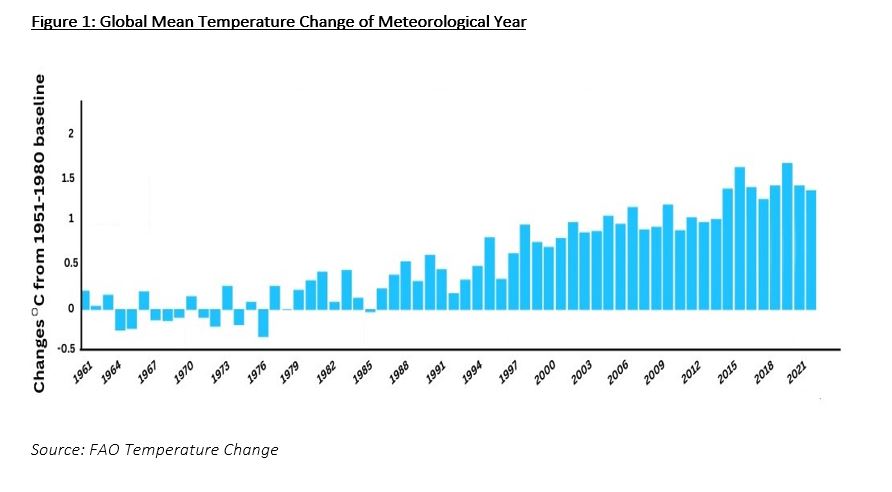

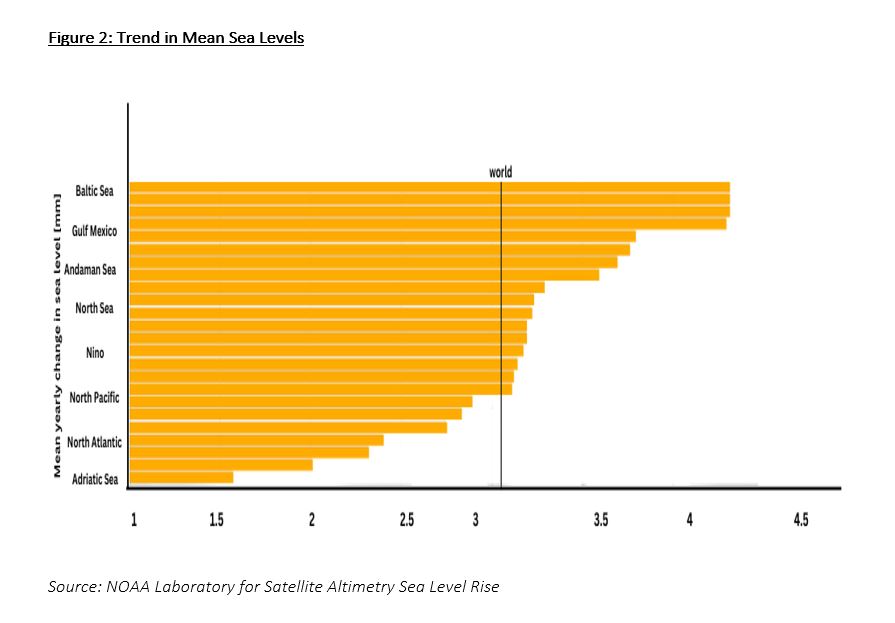

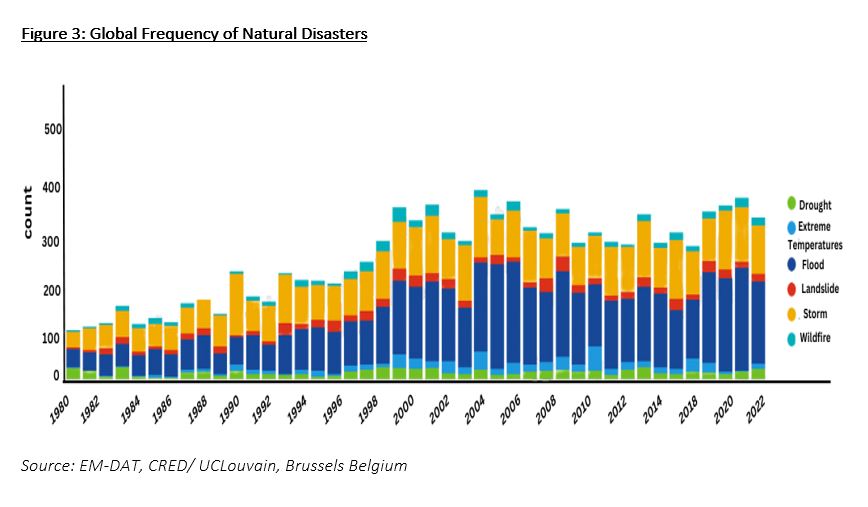

The Caribbean, renowned for its breath-taking beaches, vibrant culture, and thriving tourism-based industries, boasts unparalleled beauty and allure. Yet, within this splendour lies inherent challenges that pose significant hurdles to the region’s economy, particularly related to climate change and natural disasters. The hurricane season, marked by the heightened development of tropical cyclones, casts a shadow of uncertainty over the Caribbean’s economic landscape. Spanning from June 1 to November 30, with peak activity typically occurring between August and October, the hurricane season brings warm ocean waters, low wind shear, and unfavourable atmospheric conditions that create an ideal environment for the formation and intensification of tropical cyclones. These formidable storms can wreak havoc on infrastructure, homes, crops, and, most critically, human lives. Given the Caribbean’s geographical vulnerability, the impact of the hurricane season can be devastating, with some territories experiencing more frequent and intense storms than others. However, it is essential to note that whether a Caribbean Island is directly hit by a hurricane or not, its vulnerabilities make the build-up just as impactful as the main event.

The repercussions of hurricanes on the Caribbean are multifaceted, encompassing economic losses, population displacement, and disruptions to vital services. As economies heavily reliant on tourism, agriculture, and coastal industries, Caribbean nations face an elevated risk of severe setbacks, including infrastructural collapse, crop damage, and decreased tourist arrivals. Such challenges can significantly impact credit ratings and economic stability, further compounding the region’s economic struggles. In recent years, the Caribbean has witnessed several instances where hurricanes have significantly affected its economic standing, potentially leading to credit rating downgrades as nations grapple with the aftermath of these devastating storms.

Case Studies of Caribbean Economies Affected by Hurricane Season

Grenada: Navigating the Impact of Hurricane Ivan

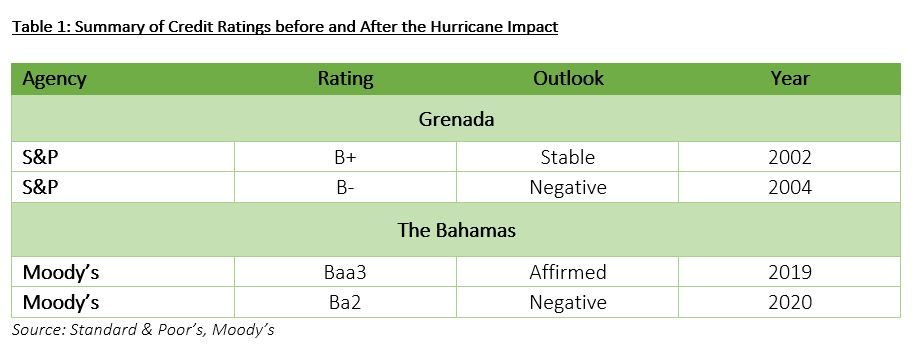

In September 2004, Grenada faced a severe challenge when Hurricane Ivan, wreaked havoc on the island. The hurricane’s devastating winds and heavy rainfall caused widespread destruction to homes, infrastructure, and agricultural sectors. Prior to this natural disaster, Grenada had been making notable progress in economic development and stability. However, the impact of Hurricane Ivan led to significant setbacks in the country’s economic growth. Credit rating agency S&P downgraded Grenada’s credit rating from ‘B+’ with a Stable Outlook in 2003 to ‘B-‘ with a Negative Outlook in 2004 after the hurricane hit. This downgrade reflected concerns about economic losses and potential strain on the government’s finances. The credit rating downgrade hindered Grenada’s ability to secure favourable financing terms, impeding recovery and reconstruction efforts. The hurricane caused a drastic decline in GDP from growth of 9.5% in 2003 to a contraction of 0.6% in 2004, along with an increase in debt to GDP from 80% to 95%, according to the World Economic Outlook Database.

Dominica: Weathering the Storm of Hurricane Maria

The small island nation of Dominica experienced the full force of Hurricane Maria’s fury in September 2017. Although Dominica has no evidential credit ratings, its vulnerability was seen in their economic indicators of GDP and their debt to GDP percentage. According to data from the World Economic Outlook Database, the hurricane had a significant impact on Dominica’s economy. In 2016, the country’s GDP growth was positive at 2.8%. However, in 2017, it experienced a severe downturn, with GDP contracting by -6.6%. Alongside this economic decline, the country’s debt to GDP also increased from 77% to 84%. There were some signs of improvement in the following years. Dominica’s GDP showed a partial recovery in 2018 and 2019, growing by 3.5% and 5.5%, respectively. Nevertheless, the country’s debt situation continued to worsen, reaching 85.6% of GDP in 2018 and a concerning 97.9% of GDP in 2019. The impact of the powerful storm was significant, causing widespread destruction, disrupting livelihoods, and putting immense pressure on the nation’s economy. In the aftermath of Hurricane Maria, Dominica’s economy reflected concerns about the country’s ability to manage its debt obligations and recover from the economic impact of the storm. The increased risk for investors made it more challenging for Dominica to access financing and implement robust recovery measures.

The Bahamas: Hurricane Dorian’s Wrath

In August 2019, the Bahamas faced a devastating blow when Hurricane Dorian struck, leaving a trail of destruction in its wake. Before this disaster, the Bahamas had a relatively stable credit rating. However, the unprecedented impact of Hurricane Dorian was catastrophic, severely affecting the nation’s infrastructure, homes, and livelihoods. The situation was further exacerbated when the COVID-19 pandemic hit. In response to the economic losses and strain on the government’s finances, credit rating agency Moody’s downgraded the Bahamas’ long-term issue and credit ratings from ‘Baa3/ Stable’ in 2019 to ‘Ba2’ with a Negative Outlook in 2020. This downgrade highlighted the lasting consequences of the hurricane and pandemic on the Bahamian economy, predicting a slow return to pre-pandemic levels by 2024. The lowered credit rating signalled increased risk for investors, making it more expensive for the Bahamas to borrow and access capital markets. This downgrade was directly linked to the country’s GDP and debt, with Hurricane Dorian and the pandemic causing a significant drop in GDP, from growth of 2% in 2018 to a massive contraction of 23.8% in 2019, and an increase in debt to GDP from 62% to 75%, respectively, according to the World Economic Outlook Database.

Mitigation and Preparedness Measures

Amidst the persistent threat of hurricanes, the Caribbean region has taken proactive measures to safeguard its credit ratings and overall economic stability. Emphasizing collective efforts, regional initiatives like the Caribbean Disaster Emergency Management Agency (CDEMA) facilitate seamless disaster response coordination among member states. Additionally, the Caribbean Catastrophe Risk Insurance Facility (CCRIF) serves as a lifeline, offering essential financial support through parametric insurance coverage based on predetermined triggers, ensuring swift pay-outs for rapid recovery. Nonetheless, addressing hurricane impact requires a closer focus on individual countries. Central to this endeavour is effective risk assessment, where nations analyse their vulnerability to hurricanes and accompanying natural disasters, empowering them to tailor targeted strategies that bolster resilience. Comprehensive insurance coverage plays a pivotal role in easing the financial burden post-hurricane, providing critical resources for prompt reconstruction and recovery.

A key responsibility rests with Caribbean governments, urging prioritisation of resilience-building policies. Investing in hurricane-resistant infrastructure and coastal protection measures is vital to safeguarding communities and essential assets. Implementing disaster risk reduction policies and fostering public awareness campaigns also actively engage communities in promoting preparedness. The pursuit of economic diversification further strengthens the region’s capacity to weather hurricane impacts. By reducing dependence on vulnerable sectors and fostering stability, the Caribbean can secure a more resilient and prosperous future. Embracing these initiatives, alongside risk assessment, insurance coverage, and prudent government policies, fortifies the region’s capacity to respond effectively to hurricanes, protecting credit ratings, and nurturing a future that shines resilient and bright which will promote economic growth.

Post-Hurricane Recovery and Credit Rating Restoration

In the aftermath of hurricanes, Caribbean nations should prioritise post-hurricane recovery activities and proactively focus on maintaining resilience and fiscal management. Immediate infrastructure repair and the implementation of resilience-enhancing policies are critical steps in instilling confidence in investors and credit rating agencies alike. Collaborative measures, such as the Caribbean Development Bank (CDB) and international partnerships, are crucial in terms of giving financial assistance, speeding the rebuilding process, and restoring critical services necessary for economic regeneration. Transparent fiscal management and dialogue with credit rating agencies and investors are critical for communicating progress on resilience indicators.

In conclusion, the vulnerability of the Caribbean region to hurricanes necessitates proactive measures to safeguard overall economic stability. Through regional initiatives, risk assessment, insurance coverage, and government policies, the region can mitigate the economic repercussions of hurricanes. Embracing comprehensive recovery efforts, the Caribbean endeavours to embrace resilience and secure a brighter economic future despite the challenges posed by hurricane season as well as the heightened risks associated with climate change. By prioritising preparedness, coordination, and long-term strategies, the Caribbean can build a more resilient foundation that stands strong against the impact of nature’s fury.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment, or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.