Credit Default Swaps

By Rochelle Parris Investment Analyst, Research & Analytics

Insights

What is a Credit Default Swap and How Does It Work?

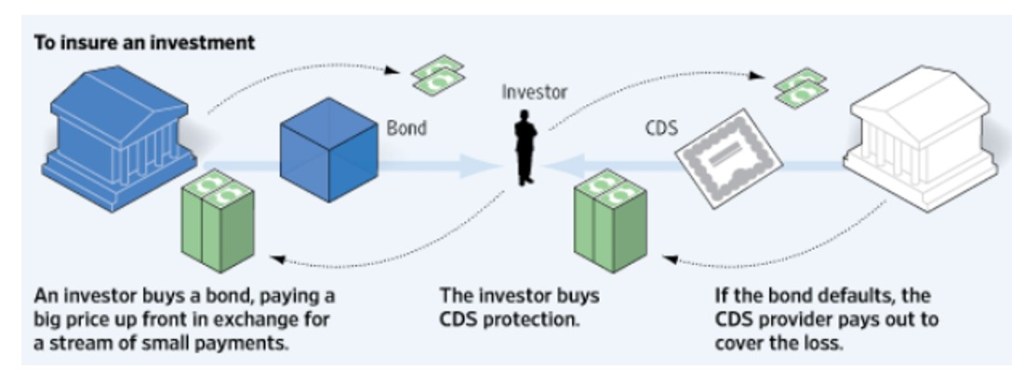

Credit default swaps (CDS) are financial contracts between two parties, the buyer and the seller. The buyer pays a premium to the seller in exchange for protection against the risk of default on a specific debt instrument, such as a bond or loan. In the event of a credit event, such as a default or bankruptcy, the seller compensates the buyer for the loss incurred.

In a standard CDS contract, the ‘protection buyer’ agrees to make periodic payments (premiums) over a predetermined period to the ‘protection seller’ in exchange for a payment from the protection seller in the event of default or other credit event by the reference entity. The periodic payments tend to occur quarterly and extends until the maturity date or until a credit event is triggered. The CDS contract matures generally within one to ten years, with the five-year maturity being mostly common. Additionally, the maturity for the CDS is not necessarily the same as for the reference entity.

Like any financial asset, CDSs are actively traded and can also be employed by investors who do not own the asset but want to profit by holding a position in it. Such an agreement is called a naked credit default swap.

CDSs were originally made to provide banks with the means to transfer credit risk exposure and free up regulatory capital by offloading a particular credit risk, and not being required to hold as much capital in reserve against the risk of default. The CDS market has since grown and has become an active portfolio management tool.

Credit Default Swap – An Example

Let’s assume a bank gave a company, XYZ Ltd., a USD4.8bn loan. Instead of bearing the burden of the risk of non-payment, the bank then transferred the credit risk to a third party (ABC). As a result, the bank agreed to pay a premium to ABC and in turn, ABC would make a payout to the bank if XYZ Ltd. defaulted. Should a default occur, ABC would become liable for the difference between the face value of the debt obligations issued by XYZ Ltd. and their recovery value. For instance, assuming that the recovery rate on XYZ Ltd.’s debt was 75%, then the CDS payout would be about USD1.2bn (25% of USD4.8bn)

Source: Wall Street Journal

History of Credit Default Swaps

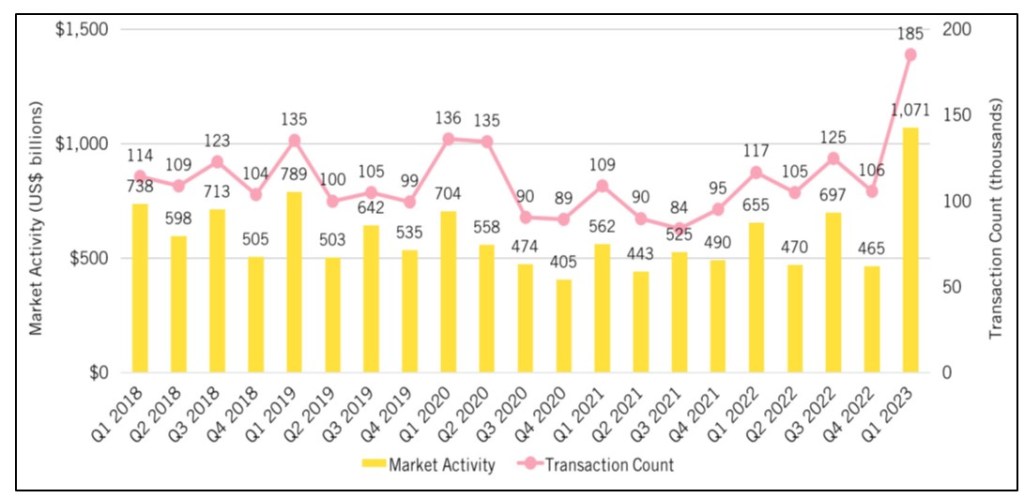

CDSs have existed since the early 1990s and has grown in popularity. J.P. Morgan & Co. and economist Blythe Masters are widely credited with creating the modern CDS in 1994. By the end of 2007, the outstanding CDSs value stood at USD62.2 trillion. The use of CDS to reduce the risks of investing in mortgage-backed securities and fixed income products significantly contributed to the financial crisis in 2008. Many of the companies selling CDSs were undercapitalized and consequently, when debtors defaulted on their loans, they were not able to make payouts, and the CDS market collapsed. By 2010 the CDS market dropped to USD26.3 trillion and then USD25.5 trillion by 2012. At the onset of COVID-19 in 2020 and through 2022, single-name CDS market activity rose, particularly in the first quarter of 2023, when trading reached a five-year peak of about USD1.1 trillion.

Figure 1: Single-Name CDS Market Growth

Source: International Swaps and Derivatives Association (ISDA)

Main Uses & Role in the Credit Risk Market

As with any other derivative instrument, CDSs can be used to either avoid or take on risk, particularly credit risk and can be used in numerous ways including risk management or hedging. Investors can also use credit default swaps as a means of speculation by betting on the credit quality of a particular issuer. For example, if an investor believes that a company is likely to default on its debt, they can buy a CDS contract to profit from the company’s default.

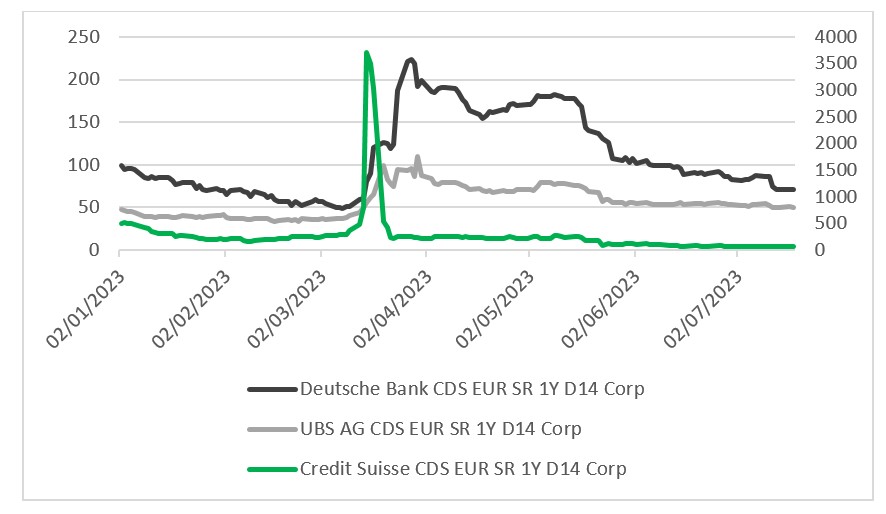

Pricing information of CDSs are widely used by market participants and non-participants as indicators of market sentiment regarding specific reference entities and credit risk in general. When credit default swaps are in the news, it’s usually a sign that something has gone haywire in the markets.

Most people refer to volatility products like the Chicago Board Options Exchange (CBOE) Volatility Index (VIX) to gauge fear in the financial markets. However, CDSs are another important indicator, with pricing reflective of market uncertainty.

In March 2023, turmoil in the banking industry sent the price to insure the debt of banks of all sizes surging, as more investors sought to protect themselves against the possibility of a default of a financial company. One example is Credit Suisse, where quotes for one-year CDSs were considerably more expensive than the offers for longer durations as lenders tried to give themselves a near-term shield from their exposure to the lender.

Figure 2: Demand Surge for Credit Suisse Default Insurance

Benefits

Credit Default Swaps can be a very useful tool for investors. The primary benefit of CDS is the risk protection they offer to buyers. In entering into a CDS contract, the buyer is transferring risk to the seller and thus protects themselves against potential credit events. With CDSs being such an effective hedge against credit risk, investors who hold a portfolio of corporate bonds from various issuers can purchase CDS contracts on the respective reference entities. In the event of a credit event, such as a default, the investor would receive compensation through the CDS contract, offsetting potential losses on the bonds held in the portfolio.

The use of credit default swaps creates a certain degree of flexibility for investors in the circumstance of a sizeable exposure to a particular borrower. In the event that an investor holds a significant position in a particular corporate bond but becomes concerned about the issuer’s creditworthiness, a CDS contract can be purchased on the reference entity. If the credit quality deteriorates, resulting in a credit event, the investor will receive compensation through the CDS contract, partially offsetting potential losses on the bond. It must be noted that credit default swaps are the domain of institutional investors, such as hedge funds or banks. However, retail investors can also invest in swaps through exchange-traded funds (ETFs) and mutual funds.

In addition to exposure management, credit default swaps also provide enhanced liquidity as well as an exit strategy for investors. Some bond issuers are more illiquid than others, as such investors may experience difficulty in selling the bonds. In an attempt to improve liquidity and facilitate a sale, the investor can enter into CDS contracts on the reference entities of the bonds, allowing potential buyers protection against credit events, making the bonds more attractive in the secondary market

Risks Associated with Credit Default Swaps

While CDSs can be used to mitigate risk, both the protection buyer and seller face certain risks that could leave them without the expected income or protection. One such risk is counterparty risk. CDS contracts are bilateral agreements between the buyer and the seller. There is a risk that the protection seller may default on its obligation to pay in the event of a credit event. If the protection seller fails to honour its contractual obligations, the buyer may not receive the compensation they expect, exacerbating potential financial losses because the counterparty who has been paid defaults and the underlying credit also does.

Investors may also be exposed to liquidity risk as CDS markets can experience periods of reduced liquidity. CDS markets at times may experience fluctuations in liquidity due to factors such as market conditions, economic events, or changes in investor sentiment. During periods of market stress or heightened uncertainty, liquidity in CDS contracts can significantly deteriorate, making it more challenging for investors to enter and exit CDS positions at favourable prices.

The prevailing macroeconomic conditions, characterised by high interest rates that effectively increases the cost of borrowing, along with slowing economic growth across many countries supports the use of credit default swaps. However, investors must be aware of risks associated with credit default swaps and should strive to fully understand and assess all the risks involved before investing in such instruments.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.