China’s Reopening

By Nicketa Rattan Investment Analyst, Research & Analytics

Insights

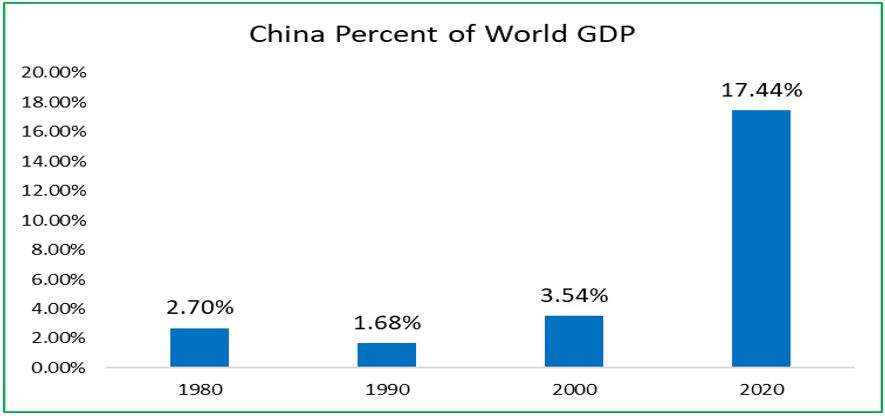

According to the World Bank, as of 2022, China was the second-largest economy in the world as measured by Gross Domestic Product (GDP), which was recorded at USD17.73 trillion, behind the United States with USD23.32 trillion. China’s transformation from a minor economy in the 1970s to a global economic power was aided by economic reforms and entry into the World Trade Organization (WTO) that facilitated international trade and investments with Western nations.

China’s rapid economic development multiplied the country’s significance in the global economy over the years, becoming the world’s manufacturing hub, the largest goods exporter and a leading assembler of foreign electronics. Given China’s importance to the world economy, the COVID-19 pandemic and the resulting restrictions had a devastating impact on world trade.

Figure 1: China’s Share of World GDP

Source: IMF World Economic Database 2022

The virus was first detected in Wuhan, China, in December 2019 and it was the first country to experience its impact. The number of cases surged in the early months of 2020 and China recorded the highest number of cases globally. The rapid spread of the virus led to the government implementing a zero-tolerance policy to keep cases as close to zero as possible. This was achieved through the implementation of mass testing, strict quarantine measures and stringent lockdowns that usually spanned entire cities and provinces. The first outbreak that occurred in December 2019 led China to lockdown the entire city of Wuhan, confining more than 11 million residents.

After nearly three years closed off to the world, China abandoned its zero COVID policy in January 2023 and slowly reopened its economy. This decision is significant and will likely have many ramifications on the global economy.

Impact on the Global Economy

The lockdown of China’s economy had a significant impact on global trade. With China being the world’s largest exporter, stringent restrictions led to a decline in exports, which in turn affected the supply chains of many industries. China’s exports are dominated by manufactured goods, notably information and communications technology equipment, industrial machinery, clothing, and other textiles. Many factories in China had to close temporarily, disrupting supply chains and causing shortages of critical goods such as medical supplies and electronics. According to the WTO, global trade declined by 5.3% in 2020 due to the pandemic, with China’s lockdown being a major contributing factor.

China’s reopening is expected to boost the world’s economic recovery as the country is the second largest importer of goods worldwide and is a significant trading partner with most countries in the world, notably to emerging markets including Asia and Latin America. Core demand for goods and services from China is expected to rise as restrictive measures are rolled back, which may increase import demand. As such, China’s trading partners may experience higher growth.

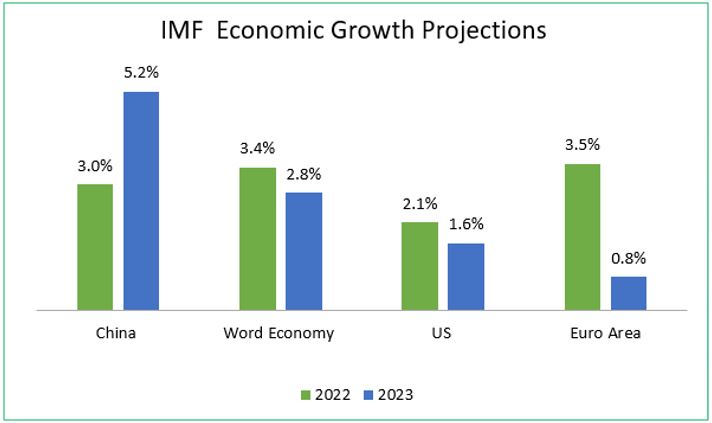

In its April 2023 World Economic Outlook, the IMF forecasts an expansion of 5.2% in 2023, compared to growth of 3% in 2022. The IMF says China will account for about one-third of overall growth in the global economy this year, with the U.S. and Europe expected to slow.

Figure 2: IMF Economic Growth Projections

Source: IMF World Economic Outlook April 2023

Impact on Commodities Market

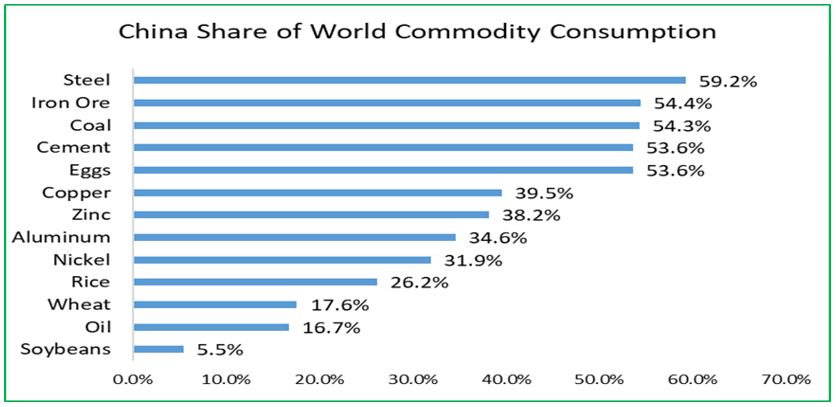

China’s economy is largely comprised of investments that account for roughly 40% of GDP and is reflected by the economy’s rapid industrialization. As a result, there was a surge in the urban population and a construction boom. The rapid pace of economic expansion resulted in China becoming a net consumer of commodities and is the world’s largest importer of several commodities including copper, zinc, iron ore and oil.

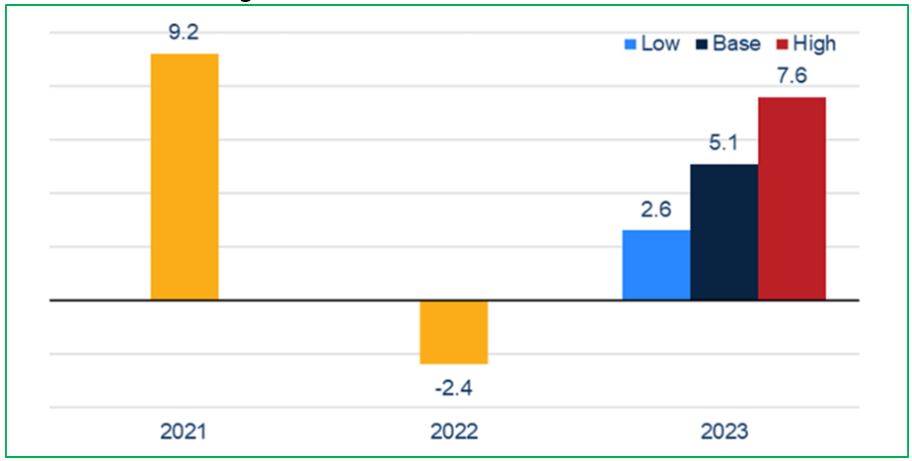

According to the International Energy Agency (IEA), global oil demand declined by 8.6 million barrels per day in 2020 due to the pandemic, a decline from 10.1 million barrels per day in 2019, with China’s lockdown being a significant contributor. Manufacturing industries are the most intensive users of oil in the Chinese economy, accounting for 36% of oil demand in 2020.

The country’s reopening can lead to an increased demand for commodities, which may positively impact price, particularly oil. Goldman Sachs’ commodities strategists estimate that Chinese oil demand could recover by at least 1.6 million barrels per day, potentially increasing oil prices to USD100 per barrel in 2023.

However, the anticipated surge in the commodities market may be negatively impacted by China’s property crisis as demand for commodities used in the construction of property like iron, aluminium and steel may be tempered. The property sector contributes roughly 25% of China’s GDP and has been a drag on overall growth since 2020, following the tightening of lending standards in the sector as the authorities sought to reduce developers’ high reliance on debt. The country’s most-indebted developer, Evergrande, defaulted in 2022.

In the last quarter of 2022, the Chinese government provided support to high-quality developers and first / second-time homebuyers by easing the restrictions on financing. If such measures fail to spur the property market and private investment activity, the anticipated boost in demand for commodities may not materialize.

Figure 3: China’s share of global commodity consumption

Source: The Geography of Transport Systems

Figure 4: China: Oil Demand Growth Scenarios

Source: The US Conference Board

Impact on Global Inflation

Since 2021, global prices have risen faster and more persistently than expected, driven by global supply-chain challenges, largely caused by the COVID-19 pandemic. At the start of 2022, inflationary pressures were further fuelled by high energy and commodity prices following Russia’s invasion of Ukraine. After peaking in the second and third quarter of 2022, consumer prices began to slow due to the tighter monetary stance adopted by several central banks and the subsequent deceleration in economic activity that impacted overall demand.

While inflation has trended downwards from its peak in mid-2022, there remains a risk that consumer prices may remain elevated. In addition to the recent production cut by OPEC of 1.2 million barrels per day (b/d) through the end of 2023, pent-up consumer spending from China will likely fuel inflation further. A rebound in economic activity in China as businesses are fully opened, is likely to lead to greater demand and higher prices for goods and services. While slowing growth in many Western economies, cooling effects of monetary policy tightening and weaker overseas demand are expected to temper global inflation, a strong rebound in China’s economy may stoke inflationary pressures.

What this means for investors?

Investors were greatly affected by the lockdown of China’s economy which led to a decline in investor confidence as well as a decline in investments in many industries, including tourism and hospitality. The IMF reported that global economic growth declined by 3.5% in 2020 due to the pandemic, with China’s lockdown being a major factor.

China’s reopening would present numerous investment opportunities for investors worldwide. The country has a large consumer market and is the home of several multinational corporations. Strategically placed in China, such companies will directly benefit from the rise in consumer spending. In addition, companies and countries who are trading partners with China stand to benefit as demand normalizes.

In addition, China’s government has announced plans to increase investment in technology and innovation, bolstering the sector. China is already a leader in areas such as 5G, artificial intelligence, and e-commerce, and the reopening of the economy is expected to accelerate growth in these sectors.

In order to fully benefit from China’s reopening, investors should seek to maintain a diversified portfolio in terms of geography and asset class. With the anticipation of slower growth in the advanced economies, alongside higher growth in the emerging markets, exposure to more than one country will prove beneficial.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment, or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.