The United States Debt Ceiling

By Rochelle Parris – Investment Analyst, Research & Analytics

Insights

The United States (US) government does not run a balanced budget. In fact, in most instances, its expenses exceed the revenue it generates. To cover the gap, the government borrows money in the form of issuing bonds (US Treasuries) to individuals, professional investors, other countries and federal agencies. The government’s financial commitments include Social Security and Medicare benefits, tax refunds, wages and salaries and interest on national debt, to name a few.

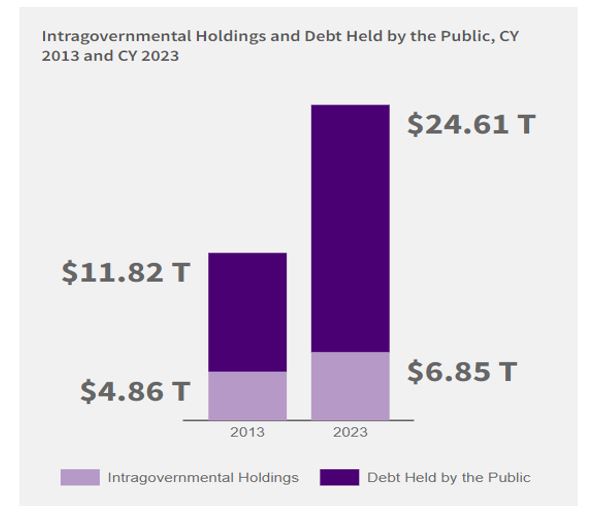

There are two types of US debt. The first is what the government owes to itself, most of which includes the Social Security Trust Fund and federal employee retirement funds. This is known as intragovernmental debt. The debt that is owed to everyone else is known as public debt, which covers the majority of all debts in the US.

Figure 1: US National Debt by Calendar Year as at February 28 2023

There is a maximum amount of debt that the government can issue to meet its financial obligations, and this is known as the Debt Ceiling or debt limit. When this ceiling is reached, the US Treasury cannot issue any more bills, bonds or notes to finance its activities. It is at this time, the government can only pay ongoing federal expenses as it receives tax revenues. In an effort to avoid defaulting on their loan obligations, the Treasury Department usually uses “extraordinary measures”, such as suspending some investments, in order to delay any default for as long as possible.

To avoid such a circumstance, Congress must first pass legislation to raise or suspend the debt limit. When the US government raises the debt ceiling, it essentially allows the government to borrow more money to finance its operations and pay its obligations. A suspension of the debt ceiling means temporarily allowing the Treasury to supersede the debt limit, rather than raise it by a specific amount.

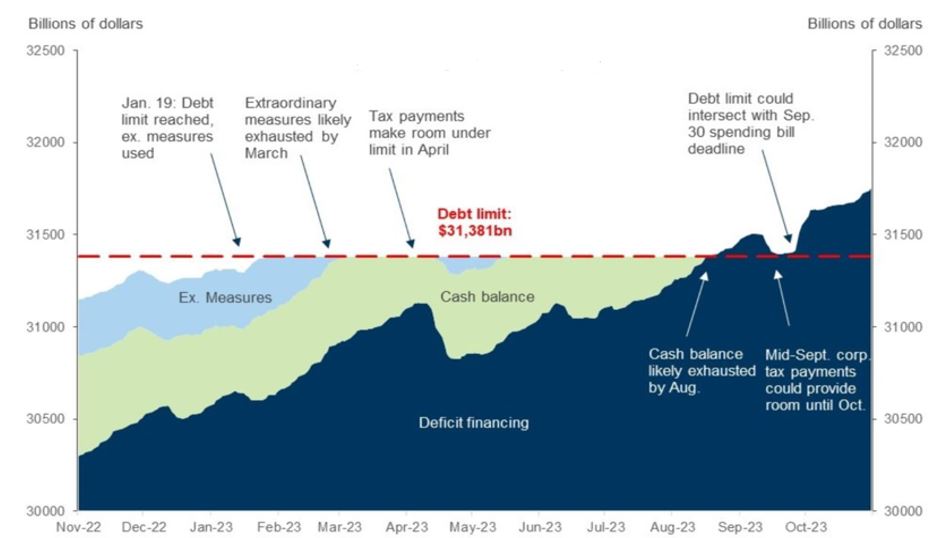

The US national debt reached the current debt ceiling of USD31.4 trillion on January 19 2023 and the Treasury Secretary, Janet Yellen, initiated the “extraordinary measures”. The Congressional Budget Office (CBO) said in a statement in February 2023, that if the debt limit remains unchanged, the Treasury will exhaust its emergency measures to prevent a debt default sometime between July and September 2023, unless Congress raises the debt limit. The latest projection noted that the final date will be determined by tax revenues received by the Internal Revenue Service (IRS) in April 2023. If those revenues are significantly less than estimated by the CBO, the aforementioned measures could be exhausted sooner.

Figure 2: Public Debt Subject to the Debt Limit

History of the Debt Ceiling

Congress created the debt ceiling in the Second Liberty Bond Act of 1917. Before then, there was no debt ceiling, instead parliamentary procedural limitations on the amount of debt that could be issued by the government were utilized. The original 1917 legislation was meant to give the Treasury some autonomy over borrowing, by allowing it to issue debt up to the ceiling without congressional approval for each issuance.

According to the US Department of Treasury, between 1960 and 2021, Congress acted 78 separate times to permanently raise, temporarily extend, or revise the debt ceiling. While the ceiling is raised from time to time, the process of doing so have often led to disagreement between Congress and the White House, resulting in a government shutdown. This happened in 2013 and 2018.

To Lift or Suspend?

When federal borrowing reaches the debt ceiling, the two most common solutions are to raise the debt ceiling or suspend it. The onus lies on Congress and is determined by a majority vote in both the House and Senate. Since the Republicans now control the House following the midterm elections in 2022, raising the ceiling has become more difficult as the Republicans demand any increase be accompanied by deep spending cuts. On the other hand, President Biden has stated that he will oppose any attempt to tie spending cuts to raising the debt ceiling, increasing the likelihood of a prolonged standoff.

Many past debt ceiling standoffs have been resolved without significant market fallout, but that has not always been the case. For example, in 2011, there was a protracted deadlock between then President, Barack Obama and congressional Republicans on the debt ceiling. The ceiling was eventually raised by Congress just two days before the date that the Treasury estimated funds would have expired. The political gridlock triggered the most volatile week for US stocks since the 2008 financial crisis. Additionally, the credit rating agency, Standard & Poor’s (S&P) downgraded the US from AAA to AA+ for the first and only time ever. The Government Accountability Office estimated that the delay in reaching a deal increased US borrowing costs by USD1.3 billion that year.

Impact on Financial Markets

a) Suspension of Debt Ceiling

A suspension would likely have various effects on bond and equity markets. In the bond market, suspending the debt ceiling would mean that the US government would be able to continue borrowing money and as a result, lead to an increase in the supply of government bonds. This, in turn, could put downward pressure on bond prices and upward pressure on bond yields.

In the equity market, a suspension of the debt ceiling could have positive effects in the short term, as it would remove the risk of a potential default by the US government. However, in the longer term, an increase in government borrowing, could cause crowding out (rising public sector spending driving down private sector spending) forcing interest rates higher. These higher rates could have a negative impact on corporate earnings and by extension, the stock market.

b) Raising the Debt Ceiling

An increase in the debt limit can potentially serve to increase bond yields. Some investors may also be concerned about the long-term sustainability of US government debt levels, which could lead to higher bond yields, as investors would demand more in exchange for the increased risk involved in investing in these assets. The scale of these effects would depend on different factors, including investor sentiment, the size of the debt issuances, and the overall demand for the government bonds.

An increase in the debt ceiling could have a mixed impact in the equity market. On one hand, it could lead to concerns about higher inflation, higher interest rates, and slower economic growth, which could weigh on stock prices. On the other hand, it could signal that the government is taking steps to support economic growth and stability, which could boost investor confidence and lead to higher stock prices as investors may feel more comfortable taking on risk and investing in the stock market.

Default Risk

Failure to raise the debt ceiling could lead to the US government defaulting on its debt obligations, which could have significant effects on the US as well as global financial markets. However, continuing to raise the debt limit puts the US further into debt. Interest payments grow as the national debt increases, so as the government allocates more funds towards paying off interest, areas such as education or infrastructure could be side-lined.

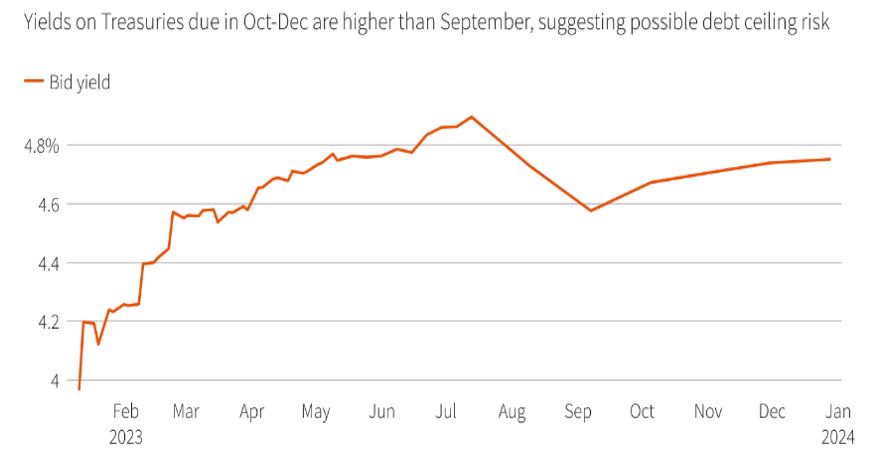

Some Treasury bills maturing in the second half of the year are already featuring a premium in their yields that may be tied to an elevated default risk during that window, according to some analysts.

Figure 3: US Treasury Bill 2023 Curve

It should be noted that a failure to raise the debt ceiling and a subsequent default on the US government’s debt is considered to be a very unlikely scenario as there would be significant political and economic consequences that both major parties are likely to want to avoid. Policymakers have generally been able to come to a compromise and raise the debt ceiling before it becomes a crisis.

Ongoing Debt Limit Debate

The debt ceiling debate has created uncertainty and market volatility, affecting investor sentiment and confidence in the US government’s ability to manage its finances effectively. Goldman Sachs said in a note in January 2023, that while debt limit debates typically have had “limited” impact on the broad market, stocks exposed to government spending have commonly lagged in the weeks prior to the debt ceiling deadline.

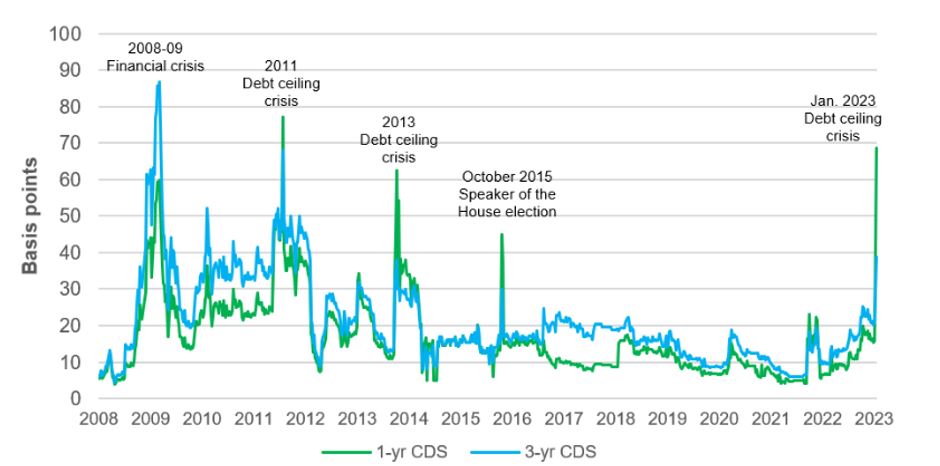

The current political discord is also raising the cost of issuing public goods and increasing financial stress as evidenced by the one and three-year credit default swaps (CDS) which have spiked similar to previous financial and political crises.

Figure 4: US 1-Year and 3-Year Credit Default Swaps

The CDS market is a vehicle for passing the increased risk of corporate default onto another party more willing to take on that risk. The cost of the one-year CDS is substantially higher than the three-year contract, implying a greater risk of default within the next year than in the next three years.

As the debt ceiling debate continues in the US, investors can expect increased volatility in capital markets and having a well-diversified portfolio should serve to buffer swings in equity and bond markets.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.