2023 Outlook for Big Tech

Insights

‘Big Tech’ refers to the most dominant companies in the Information Technology industry and include the likes of Facebook (aka Meta), Amazon, Apple, Microsoft and Google (aka Alphabet). They are dominant players in their respective areas of technology, such as e-commerce, artificial intelligence, cloud computing and online advertising, to name a few. They are also among the most valuable public companies with a combined market capitalization of over USD6.4 trillion as at 12 January 2023.

Digital Acceleration During the Pandemic

When the pandemic began more than two years ago, many sectors in the economy were battered, however technology companies prevailed. The lockdown measures that were implemented during the pandemic across the globe in an effort to curb the infection rate, bolstered the demand for digital services and products worldwide to facilitate working from home and online schooling. As such, technology stocks drove the returns in the US stock market in 2020, with the S&P 500 Information Technology sector increasing by 41.5%, significantly outperforming the 16.26% gain on the S&P 500 Index.

The COVID-19 pandemic was the catalyst for the escalation on digitalization, which is the use of digital technologies in a firm’s value-chain activities, as organizations, schools and governments were forced to implement IT solutions to facilitate working from home and remote learning.

Data centres expanded capacity to handle a surge in internet traffic and laptop sales soared to accommodate at-home work and school. This change in trend was also evident in the retail sector, with several retailers moving into the e-commerce space, selling their goods and services online. The healthcare sector saw the proliferation of telehealth care services while the banking industry expedited moves toward digital banking.

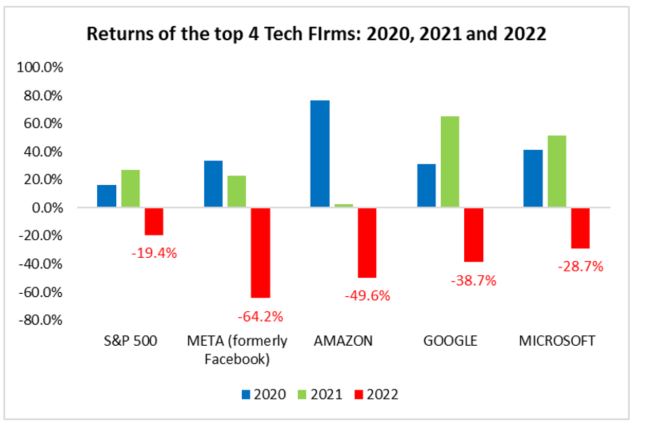

The upward momentum of technology stocks continued into 2021. In 2022 however, technology stocks failed to repeat their winning streak.

Change in Tide in 2022

In 2022, global economies were faced with several challenges including rising consumer prices and food insecurity, exacerbated by Russia’s invasion of Ukraine and continued supply chain disruptions, particularly due to the strict lockdowns in China for the greater part of 2022. To combat the inflationary pressures, central banks around the world adopted a tighter monetary policy and increased their key benchmark rates.

Consequently, global growth prospects were dampened as consumers’ purchasing power was eroded by inflation and higher borrowing cost. Demand for discretionary items including tech products and services were negatively impacted as consumers faced higher prices for food and utilities.

The technology sector was also faced with widespread return to physical work and school as the pandemic-induced measures were wound up, which adversely affected demand for IT-related services. These companies were also coping with volatile currency markets, due to the surging US dollar which dented international earnings, exacerbated supply chain issues and regulatory hindrances.

Supply-chain bottlenecks hampered Apple’s ability to meet iPhone demand while the Federal Trade Commission’s (FTC) attempted to block Microsoft’s USD69 billion Activision Blizzard deal. In an attempt to preserve profit margins, several international tech companies downsized their workforce. For example, Meta, in November 2022, cut 11,000 jobs (approximately 13% of their workforce) and announced a hiring freeze. Amazon also reduced its workforce, laying off 10,000 employees in corporate and technology roles.

In 2022, the four largest US tech stocks lost nearly USD3.8 trillion in market capitalization to end the year at USD6.9 trillion, down from USD10.7 trillion at the end of 2021 – levels last witnessed in July 2020. In terms of dollar value, Amazon lost the most among the six companies of USD788 billion, followed by Alphabet with USD714 billion.

As it pertains to share price performance, Meta Platforms was the worst performer, down 64.2% in 2022, led by concerns about the company’s cash-intensive strategy to become a metaverse leader. Coupled with these concerns were recessionary fears that negatively impacted advertising revenue. Meta also faced legal issues with the European Union for failing to comply with data privacy rules.

2023 Outlook

The technology industry is forecasted to decelerate in 2023 as economic growth wanes. Business investment and consumer spending on technology will be further impacted with further monetary policy tightening to moderate inflationary pressure due to the higher borrowing cost.

Additional risks can also arise from geopolitical friction between the US and China which will directly impact the technology sector, global financial instability due to the synchronized monetary tightening cycles and an escalation of the conflict in the Ukraine. Any of these events can create volatility in commodities markets, stoke inflationary pressures and negatively impact consumer and business sentiment.

Despite such headwinds, the US technology sector is projected to grow by 6.4% in 2023, supported by the US policy to promote supply chain resilience and develop their advanced domestic chip fabrication and supercomputing capacity.

As fears of a global recession for 2023 increases, it is always prudent to have a well-diversified investment portfolio and exposure to the technology sector remains relevant. Some of the largest technology companies demonstrate superior earnings, strong balance sheets and growth and thus are well anchored to navigate the economic tailwinds. Market volatility is expected in 2023 however, further declines in share prices can be viewed as opportunities to purchase such blue-chip companies at affordable prices or lower the average acquisition cost.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.