Inflation Expectation For The Remainder Of 2022

Insights

Rising inflationary pressures have been a challenge for many governments and central banks around the world. Since 2021, global prices have risen faster and more persistently than expected, driven by shortages arising from global supply-chain challenges, largely caused by the Covid-19 pandemic. At the start of 2022, inflationary pressures were further fuelled by high energy and commodity prices following Russia’s invasion of Ukraine.

According to the International Monetary Fund (IMF) in its World Economic Outlook for October 2022, inflation in advanced economies has hit its highest rate since 1982. In the US, inflation as measured by the Consumer Price Index (CPI), peaked at 9.1% in June 2022, but has since decelerated to 8.2% as at September 2022. In the Euro Area, inflation is estimated at 10.7% in October 2022, up from 9.9% in September 2022, led by higher energy prices. The UK’s annual inflation rate rose to a 40-year high of 10.1% in September 2022, up from 9.9% in August 2022, bolstered by higher food prices.

Central Banks’ Policy Action To Control Inflation

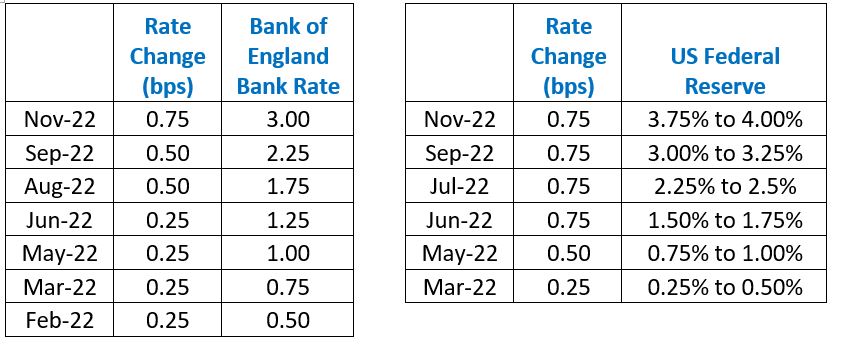

To temper the rise in consumer prices, several central banks adopted a tighter monetary policy posture with the objective of taming overall demand. The US Federal Reserve (FED) started to hike interest rates in March 2022 and has implemented six rate hikes thus far. In its last four meetings held in June, July, September and November 2022, the Fed has raised its key interest rate – the federal funds rate by 75 bps at each meeting, increasing the rate to a range between 3.75% and 4.00%. For 2022 thus far, the Fed Funds rate has increased by a cumulative 375 bps.

In the Euro Area, the European Central Bank (ECB) raised the three key ECB interest rates – the main refinancing operations, the deposit facility and the marginal lending facility, three times thus far for 2022. The key interest rates increased by 50 bps in July and 75 bps each in September and October 2022. The ECB Governing Council indicated that further rate hikes will follow to ensure the timely return of inflation to its 2% medium-term inflation target. They also expect inflation to stay above the target for an extended period and should return closer to the 2% target in 2024.

The Bank of England (BOE) also increased its benchmark interest rate known as the Bank Rate seven times during 2022, so far, bringing the rate to 3.00% as at November 2022. In an effort to rein in energy prices and inflation, the UK government implemented an Energy Price Guarantee scheme that creates a cap on the price of a unit of gas and electricity from October 2022 to April 2023. The BOE expects the rate of inflation to peak at 11% in October and then remain above 10% for a few months before starting to trend down.

Bank of England and US Federal Reserve Interest Rate Hikes 2022

The Black Sea Grain Initiative

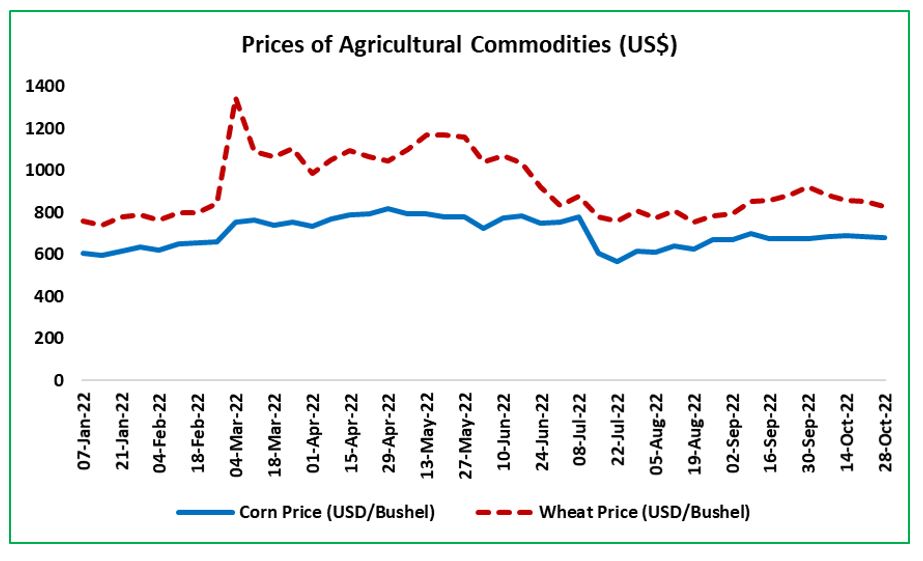

Since Russia invaded Ukraine on 24 February 2002, grain exports from Ukraine (wheat, barley, corn and sunflower) along with food and fertilizers from Russia have been significantly disrupted. Consequently, grain and other key export prices have risen sharply and have contributed to a global food crisis in low to middle-income countries.

In an attempt to resume vital exports from Ukraine – one of the world’s largest grain exporters, Russia and Ukraine reached an agreement in July 2022. These discussions were led by the United Nations (UN) and Turkey. The initiative allows exports from Ukraine to resume through a safe maritime corridor from three (3) key Ukrainian ports. Under the initiative, roughly nine million tonnes of grain had left Ukraine, easing some of the global market supply constraints.

However, on 29 October 2022, Russia reneged on the terms and conditions of the deal, citing drone attacks on the Crimean city of Sevastopol as the reason. Following this announcement, the prices of wheat and corn on the global commodities market increased by 8.1% and 1.68%, respectively on 1 November 2022 as compared to the week before. On 2 November 2022, Russia announced that it was re-joining the initiative which may help ease concerns about global food supplies that were raised following the earlier announcement. This uncertainty surrounding the Black Sea Grain Initiative between Russia and Ukraine could put upward pressures on the prices of key staples which may also drive-up inflation globally.

Energy Prices

The war between Russia and Ukraine further disrupted an already volatile situation in which energy prices were increasing, due to strong energy demand following the reopening of economies globally. Several Western countries have implemented sanctions on Russia – a major energy player. The EU announced that it will ban imports of Russian oil brought in by sea from December 2022 and all imports of refined oil products from Russia in February 2023. The US announced a ban on all Russian oil and gas imports and the UK stated that it will phase out Russian oil by the end of 2022.

Following the high energy prices experienced globally, the Biden Administration authorized the Department of Energy (DOE) to release up to 180 million barrels of crude oil from its Strategic Petroleum Reserve (SPR), in an attempt to reduce fuel prices in the US. In September 2022, the DOE announced that up to 10 million barrels of crude will be released in November 2022. So far this year, the DOE has released about 165 million barrels of crude from the SPR, out of the 180 million expected.

In October 2022, OPEC+ announced that it will slash oil production by two million barrels per day starting in November, in light of the uncertainty surrounding the global economic and energy market outlook. This move has threatened to push up fuel prices mere weeks before the US midterm elections, and could potentially drive up headline inflation in the coming months.

Europe also faces the risk of higher natural gas prices as Russia has retaliated by cutting supplies following EU sanctions. As the winter season is fast approaching, higher demand for natural gas for heating and electricity generation is expected to put upward pressures on natural gas prices, which could drive up inflation within the EU.

What To Expect

The IMF projects global inflation to rise to 8.8% in 2022, reflecting higher energy and food prices, supply chain disruptions and tight labour markets. Energy prices may increase over the next few months, given the production cutback to be implemented by OPEC+. As the winter season approaches, demand for natural gas for heating will also drive up energy prices. The uncertainty experienced with the Russian withdrawal and subsequent re-joining of the Black Sea Grain Initiative may add volatility in the commodity markets. In an attempt to secure critical food supplies, countries can increase their purchase of such goods, thus driving up the demand for such commodities and in turn, prices.

With inflationary pressures expected to remain elevated for the rest of the year, maintaining a diversified investment portfolio containing a combination of real assets, variable rate bonds and equities can aid in effectively managing inflation risk.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.