Global Macro Outlook: Weaker Conditions to Persist

Insights

In its latest World Economic Outlook for October 2022, the International Monetary Fund (IMF) cut its world growth forecast for 2023. It left the 2022 growth forecast unchanged at 3.2%, which, it should be noted, represents little over half of the 6% growth estimated for 2021. However, the Fund lowered its 2023 projection of global real GDP growth to 2.7%, down from a forecast of 2.9% made in its July update. The gloomier outlook for 2023 is a clear indicator that the macroeconomic challenges that rocked the world in 2022 – namely skyrocketing food and commodity prices intensified by the ongoing war in Ukraine, weakened supply chains, and recessionary economic conditions induced by counter-inflationary monetary tightening – are due to persist for the foreseeable future. In this article, we will break down the global macroeconomic outlook by region, looking especially at the major advanced economies as well as the implications for Caribbean economies.

US Slowdown Evident

The combination of heavy fiscal stimulus and intense supply constraints in the US economy since 2021 was combined with the chaotic commodity price environment resulting from the Russia-Ukraine war in early 2022, to generate inflationary conditions in the US not seen in the last forty years, hitting 8.2% year-on-year in September 2022. In response, the Federal Reserve has raised its policy interest rate, the Federal Funds rate by 325 bps between March and September 2022 in an attempt to bring inflation back to its target of 2%. Thus far however, inflation remains stubbornly high, while a slowdown in the US economy is becoming overwhelmingly evident.

In October 2022, the IMF slashed its outlook for US real GDP growth to 1.6%, compared to the 3.7% growth it had projected in April, and forecasts only 1% growth for 2023. Even more pessimistically, model predictions from Bloomberg Economics forecast a 100% probability of a recession in the US within the next 12 months (to October 2023), a significant upward revision from 65% in its previous update. Moreover, Bloomberg’s monthly survey of economists for October 2022 suggests the probability of a recession within one year at 60%, also up from 50% a month previously. The tightening monetary and financial conditions, persistent inflation and future expectations of hawkish policy by the Fed (with further rate hikes expected in November likely in the 75bps range) are contributors to the worsened outlook. From a global perspective, the rapid rate hike cycle employed by the Fed has also contributed to a strong US dollar (USD), which has appreciated by 13% compared to the 2021 average. The appreciation of the USD has further contributed to a slowing of economic growth, due to the dollar’s dominant role in international trade and the pass-through of the rising value of the dollar to prices in countries outside of the US.

China Lockdowns, Policy Stance Imperil Short-Term Growth

Despite being one of the fastest-growing economies in the world over the past several decades, China has been in the midst of a short-term economic slowdown in 2022. Several factors have contributed to the slowdown, including a series of severe lockdowns in major cities as part of its “zero COVID” policy and the collapse of the real estate sector which represents roughly 20% of the economy. As a result, the IMF has slashed its growth forecast for the Chinese economy to 3.2% (down from 4.6% forecasted in April) after estimating 8.1% growth last year, with a projection of 4.4% for 2023. While the 3.2% growth figure appears impressive when compared to the advanced economies such as the US, Japan and Europe, it represents the lowest growth rate in more than 40 years for China.

According to the IMF, however, the cooling of Chinese aggregate demand has had a marginally positive impact globally, as it has helped to ease global core inflation (excluding food and energy prices). Q22022 was especially difficult in China, as the COVID-19 lockdowns affected economic hubs such as Shanghai and Shenzhen, leading to a manufacturing capacity utilisation rate of 76%, a level only seen during the depths of the pandemic in 2020. These restrictions have also contributed significantly to the clogging of logistics and supply chains experienced globally throughout 2022. With China showing sensitivity to the weakened macroeconomic environment, especially in the real estate sector which has been in decline since December 2021, the country has not pursued monetary tightening or other forms of contractionary economic policy, as inflation has also been significantly lower than in the other major regions.

Europe Still Dealing with Ukraine War Fallout

Outside of the main theatre of conflict, the region most economically destabilised by Russia’s invasion of Ukraine has been the European Union (EU). In particular, it has been wrecked by an energy and cost-of-living crisis, whereby gas prices have risen by over 300% since 2021 and food prices have also skyrocketed. On 21 October, the EU agreed to a new package of measures to deal with the energy crisis, including a temporary price cap on natural gas, and using its joint purchasing power as a bloc in negotiating with global gas suppliers. Previously, the EU had already agreed a voluntary 15% gas consumption cut target. The IMF’s forecast for growth in the EU remains at 3.2% for 2022, though only 0.7% growth is anticipated for 2023, a full 1.8% lower than its previous forecast published in April. The European Central Bank has been slower to act than the Fed regarding interest rate hikes, as it too is sensitive to the impact of monetary tightening on a fragile economic recovery.

While traditionally Germany has been the engine of European growth, its heavy reliance on Russian gas to power its manufacturing sector has exposed it to a significant fallout from the crisis and a scramble to secure alternative gas supplies as a combination of Western sanctions and strategic Russian cutbacks have significantly dented availability of the fuel. In contrast, southern European countries have seen relatively benign outcomes as well as a strong rise in tourism-related activities. Italy is one of the few countries around the world with an improved IMF projection (now forecasted to grow 3.2% in 2022 compared to a 2.3% forecast in April).

Outside of the EU, but within Europe, the United Kingdom (UK) has endured significant political and economic turmoil within recent months. Onto its third prime minister of 2022, the UK recorded 10% year-on-year inflation in September after a 9.9% increase in August, just short of a 40-year record. The latest forecasts suggest that interest rates will rise from 2.25% currently to 5% and that GDP will fall by 2%. The IMF projects UK inflation to remain higher than almost all other advanced economies at 6.3% forecasted for the end of 2023.

Caribbean Economies: Still on a Recovery Path

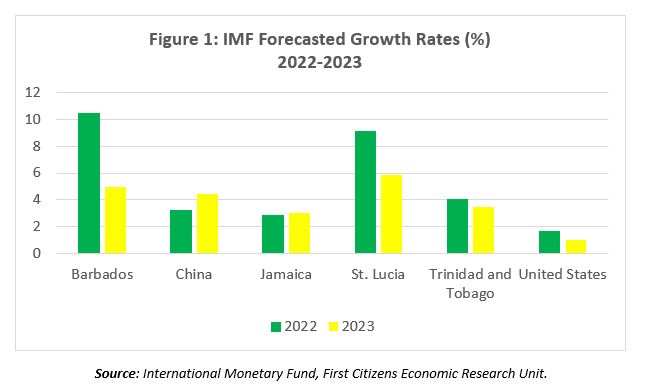

Having suffered immensely during the COVID-19 pandemic, the Caribbean economic recovery remains precarious as the region struggles to recover to 2019 levels. On the other hand, and despite the major turbulence currently afflicting global markets, the region’s growth rate for 2021 was estimated to be 5.1% while the IMF’s latest projection is for 12.4% growth in 2022 and 7.3% in 2023. The strong growth figures are surely pulled upwards by Guyana, whose emergence as an energy commodity performer has been unabated by the pandemic and subsequent global volatility. The IMF estimates 2021 growth for Guyana at 23.7%, revised upwards from 20.4%, and adjusted its forecast for 2022 growth upwards to 57.8%. Guyana’s projected 2022 growth rate has it set to be the world’s fastest-growing economy this year, as it was in 2020 (it stood at third in 2021). The conflict in Eastern Europe may have also helped its fortunes, as so far in 2022, 49% of Guyana’s total oil exports have headed for Europe, up from 16% in 2021. A tourism-led recovery in countries such as Barbados (10.5% growth projected in 2022, 5% in 2023), Saint Lucia (9.1% in 2022, 5.8% in 2023) and Saint Kitts and Nevis (9.8% in 2022, 4.8% in 2023) all aid in the relatively upbeat outlook.

After a long period of economic contraction that in fact preceded but was exacerbated by the COVID-19 pandemic, Trinidad and Tobago is expected to see moderate economic growth in 2022. According to the IMF, negative growth was recorded in each of the previous six years (2016-2021), but 4% growth is projected for 2022 (down from the April forecast of 5.5%) with 3.5% growth anticipated for 2023. In contrast to that somewhat rosy outlook, data for Q12022 from the Central Statistical Office (CSO) indicates that real GDP fell by 0.1% y-o-y. However, over the course of 2022, the economic situation is expected to improve, as energy prices have risen and remained very strong, and the start-up of several upstream projects by then should contribute to sustained or slightly improved energy output. Because of the tentative nature of the economic recovery, the Central Bank of Trinidad and Tobago has been cautious about implementing any monetary tightening to curb rising inflation (measured at 4.9% in July 2022). As a result, the repo rate has remained at 3.5%, where it has been since March 2020.

Conclusion

Going forward, the IMF’s assessment of the global economy is blunt: “…the United States, the European Union, and China—will continue to stall. In short, the worst is yet to come, and for many people, 2023 will feel like a recession.” The key factors that could improve or worsen the outlook for the coming year are: the evolution of monetary policy stances in response to the wave of inflation, the impact of the Russia-Ukraine war, and new developments in respect of the COVID-19 pandemic as well as associated restrictions or supply chain disruptions. As individual countries and as a group of small, open economies, the Caribbean is not immune to the effects of any of these factors. As a result, regional policymakers must maintain a keen eye on global macroeconomic events and design appropriate interventions to weather highly uncertain and volatile times.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.