The Federal Reserve’s Aggressive Rate Hiking Cycle and its Potential Implications

Insights

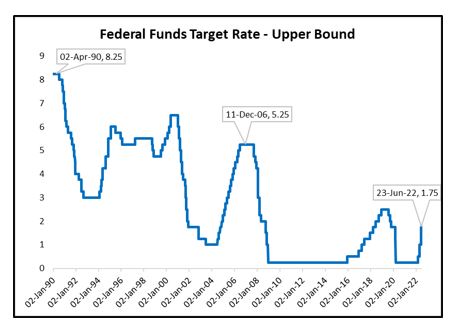

The United States Federal Reserve (the Fed), which is the central bank of the US, at its June 2022 meeting, approved a rate increase of 75 basis points, representing the largest increase in 28 years. The Fed also signalled that it would continue lifting rates in 2022 at the most rapid pace in decades as it races to slow the economy in order to combat inflation that is running at a 40 year high.

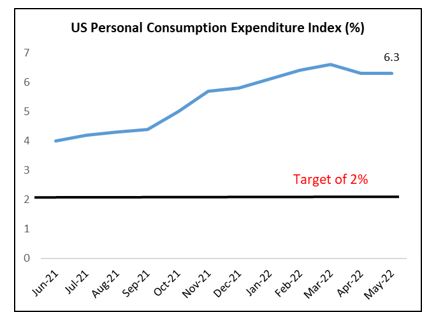

The US Personal Consumption Expenditure Price Index (PCE) which is the Federal Reserve’s preferred inflation measure, remains elevated and stood at 6.3% in May 2022, above the long-run target of 2%. Inflationary pressures have been mainly driven by higher energy prices which have increased significantly during the year owing to the Russia and Ukraine conflict.

In addition to rising energy prices, inflation is also being stoked by a surge in demand for both goods and services following the reopening of economies around the world due to the widespread availability of vaccines and the reduction in COVID-19 infection rates.

The global supply chain also encountered several disruptions owing to the closure of several ports and distribution mediums due to the COVID-19 pandemic. As a result, there were bottlenecks and global shortages of key inputs including electronic chips and shipping containers. This situation was further exacerbated with the sharp uptick in consumer demand and energy prices, which led to a rise in procurement and logistics cost.

Figure 1: Federal Funds Target Rate

Figure 2: US Personal Consumption Expenditure Index

The Impact of Rising Rates on Capital Markets

Rising interest rates tend to have a general negative impact on stocks. For leveraged firms, higher borrowing cost will increase their finance expense, creating downward pressure on profit margins, earnings and dividend payments. A reduction in earnings and dividends may adversely impact investor sentiment and may result in a reduction in share prices as investors may opt for securities with a more stable income flow such as bonds.

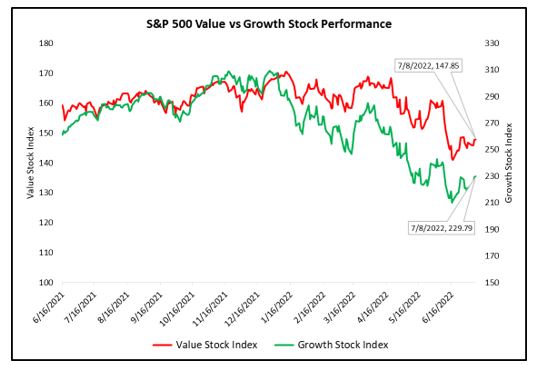

When comparing growth stocks and value stocks, the former may be more adversely impacted by the rising interest rate environment. Companies who are focused on growing aggressively usually use a lot of debt to fund their expansion, so high borrowing cost will have a more adverse impact on their profits and earnings. As a result, growth stocks appear less attractive and may experience a reduction in investor sentiment and share price.

On the other hand, increasing interest rates may provide upside for other corporations, who rely less heavily on debt financing and tend to grow organically. Value stocks represent fundamentally solid companies that are currently undervalued with an opportunity for upside. As a result, given the current interest rate environment, investor sentiment may be skewed towards these stocks.

With regard to fixed income assets, particularly bonds, there is an inverse relationship between bond prices and interest rates. As interest rates rise, bond prices fall and vice versa. The longer the maturity of the bond, the more it fluctuates in accordance to changes in the interest rate. The interest rate environment changed dramatically in 2022. The benchmark 10-year U.S Treasury note yielded 1.5% at the end of 2021, but quickly moved higher as it doubled to 3% by May 2022. This steady climb in interest rates does not auger well for bond investors as the subsequent rise in yields will cause bond prices to fall. As long as the Federal Reserve persists with its aggressive interest rate policy, it is likely that bond prices will continue to be challenged.

The rising interest rate can cause the economy to slow, thereby increasing the probability of default for riskier borrowers. Consequently, investors who are of the view that the risks of not being repaid have increased will demand a higher yield for bonds of a lower credit quality. As a result, bonds deemed of lower quality may experience a sharper rise in yields and investors who hold such bonds may incur a more acute drop in bond prices.

Figure 3: Value vs Growth Stock Performance

Potential Implications for Trinidad and Tobago

The Central Bank of Trinidad and Tobago (CBTT), much like the Federal Reserve, is tasked with managing the interest rate environment through the use of the Repo rate in order to influence the rate of borrowing in the economy. In March 2020, during the height of the pandemic the CBTT reduced the repo rate to 3.5% from 5%.

In the Central Bank’s most recent monetary policy announcement in June 2022, the Monetary Policy Committee agreed to maintain the repo rate at 3.50%. The committee however did indicate that headline inflation rose to 5.1% (year on Year) in April 2022 while Food Inflation increased by 8.7%, driven by higher import prices.

As result, the CBTT may have to consider adjusting its monetary policy strategy going forward, particularly with regard to the changing global economic environment. Additionally, continued increases in the US federal funds rate projected for 2022 and 2023 may encourage the CBTT to increase the repo rate at some point in an effort to maintain the interest rate differential between the two countries. This may be warranted as the higher US interest rates may attract local investors and could result in capital flight.

Investing in a High Interest Rate Environment

Federal Reserve officials at their June 2022 meeting said another interest rate increase of 50 or 75 basis points is likely at the July 2022 meeting. Officials have indicated a series of increases that would take the rate to 3.5% at the end of 2022. As a result, it is vital that investors position their portfolios with the expectation of further interest rate increases by the Fed in the coming months.

Diversification across asset classes, industries and geographies will prove vital during these uncertain and volatile times as each react differently to changes in market conditions. Bond investors can decrease the volatility in their portfolios during rising interest rate cycles by investing in bonds that have short-term maturity dates. Short term bonds are less sensitive to rate increases.

Investors can also seek to purchase floating rate bonds rather than fixed rate bonds. The coupon rate on floating rate bonds are variable and are benchmarked to market rates. Thus, as interest rates rises, so does the coupon rate thereby reducing the price sensitivity.

For equities, mature companies who are already established and tend to pay dividends (value stocks) are more attractive than growth stocks compared to companies who are focused on growing aggressively (growth stocks).

Investors may also be able to capture more stable returns from the traditional defensive sectors such as healthcare and utilities as opposed to the more cyclical discretionary sectors which may experience some decline if the rapid rate hikes lead to an economic downturn.

While the main intention of interest rate increases is to reduce inflation and create price stability, it is likely that the Federal Reserve’s aggressive approach may lead to continued volatility in financial markets. As a result, the strategic positioning and diversification of investment portfolios given these expectations is critical in order to effectively manage portfolio volatility.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.