The Future is Electric

Insights

What is an EV (Electric Vehicle)

An EV is an acronym for an electric vehicle. EVs are vehicles that are either partially or fully powered by electric power. Electric vehicles have low running costs as they have fewer moving parts for maintenance and most importantly are very environmentally friendly as they use little or no fossil fuels (petrol or diesel). While some EV’s used lead-acid or nickel-metal hydride batteries, the standard for modern battery electric vehicles are now considered to be lithium-ion batteries as they have greater longevity and are excellent at retaining energy.

There are two main types of electric vehicles, these are fully electric and plug-in hybrids. Fully electric vehicles also known as battery electric vehicles (BEV) rely solely on battery power and have approximately 99% fewer moving parts that need maintenance. Additionally, these vehicles do not contain an exhaust system as they are not powered by fossil fuels. Plug-in hybrid electric vehicles (PHEV) offer a mixture of battery and petrol (or diesel) power and as a result the disadvantages that apply to combustion engine vehicles also apply to PHEVs. These disadvantages include the need for more maintenance, engine noise, carbon emissions and the cost of petrol.

Electric vehicles can be charged at home overnight, providing enough range for average journeys. However, longer journeys may require charging before you reach your destination. The typical charging time for an electric car can range from 30 minutes to more than 12 hours depending on the speed of the charging station and the size of the battery.

Electric Vehicle penetration

In the past few years, the auto Industry’s transformation has accelerated around the world. The road to a fully electric future has gained momentum as most countries now seek to reduce their C02 emission levels in an effort to combat climate change. Over the past year there has been a proliferation of countries setting goals to reach net-zero emissions by the year 2050. As a result, most countries have implemented policies that would encourage the gradual movement away from combustion engines into more environmentally friendly fully electric vehicles.

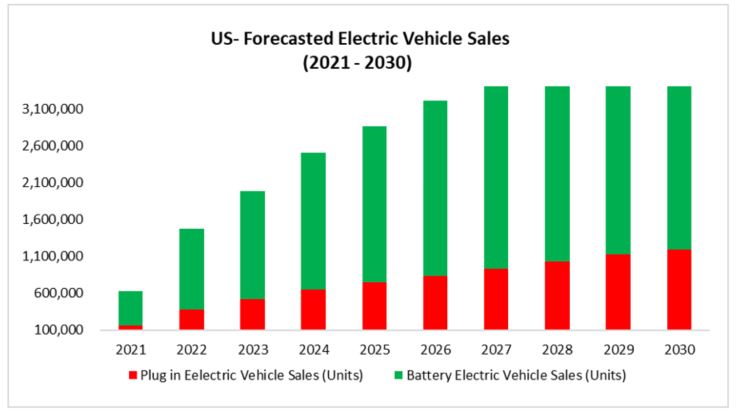

Electric vehicle penetration in the United States is steadily rising as major US auto manufacturers such as General Motors and Ford have undertaken significant investments to revamp their production to more environmentally friendly electric vehicles. Adding to this momentum is the US government’s support for the electrification process. Several states within the US have implemented financial incentives, including tax credits, rebates and registration fee reductions designed to promote EV adoption. Additionally, major infrastructural changes are being put in place in order to facilitate the transition to a fully electric vehicle+ population.

Over the past three years, the European Union (EU) has heightened its focus on combatting climate change with new plans to bolster the European Green Deal. In late 2019 members of the European Council agreed on the goal of achieving a climate-neutral EU by 2050. To support this, the European Commission announced plans for its clean energy strategy including the electrification of the automotive sector. Its plans call for 1 million EV charging ports and the use of clean fuels such as renewable hydrogen. Additionally, in response to the economic fallout from COVID-19, European central governments have initiated stimulus programs to help boost recovery and accelerate the adoption of energy-efficient vehicles. Countries such as Germany, France, Spain and Italy have provided subsidies and other financial incentives to promote the transition to electric vehicle adoption.

In an effort to reduce its high greenhouse gas emissions and growing dependence on oil imports, China intends to mandate that a certain percentage of all vehicles sold by manufacturers each year must be battery powered. To avoid financial penalties each year, manufacturers must earn a stipulated number of points that are awarded for each EV produced based on a complex formula that takes into account range, energy efficiency, performance, and more. The goal of this policy is to ensure that EVs make up 40% of all car sales by 2030.

In Trinidad and Tobago, the Minister of Finance in his budget presentation on 4 October 2021, announced the government’s intention to remove customs duties, motor vehicle tax and value-added tax on the importation of battery-powered electric vehicles. The intention of this policy is to increase the adoption of electric vehicles in keeping with the country’s commitments to promote a green economy and reduce the country’s carbon footprint.

Challenges of EV adoption

Infrastructure represents an important input that will drive the pace of global EV adoption. Significant investment in charging stations as well as utility upgrades would be required in order to facilitate increased EV demand. This places significant financial pressure on Governments especially those belonging to developing nations whose economies would have been adversely affected by the pandemic. As a result, the pace of adoption in these countries may be slower than that of more developed nations.

Another major challenge of EV adoption is the higher cost of electric vehicles when compared to internal combustion engines. While EVs offer consumers lower maintenance and fuel cost, in the long run, the initial outlay of cash needed to purchase such vehicles is significantly higher than vehicles powered by fossil fuels. This is mainly due to the high production cost of batteries used to power EVs. It is possible however that this cost may be reduced in the future as more efficient and cost effective ways of producing batteries are developed.

Sector Impact of the EV transition

The transition to electric vehicles will have a major impact on many sectors which may ultimately impact investor sentiment. There are certain sectors that stand to be transformed as EVs gain momentum.

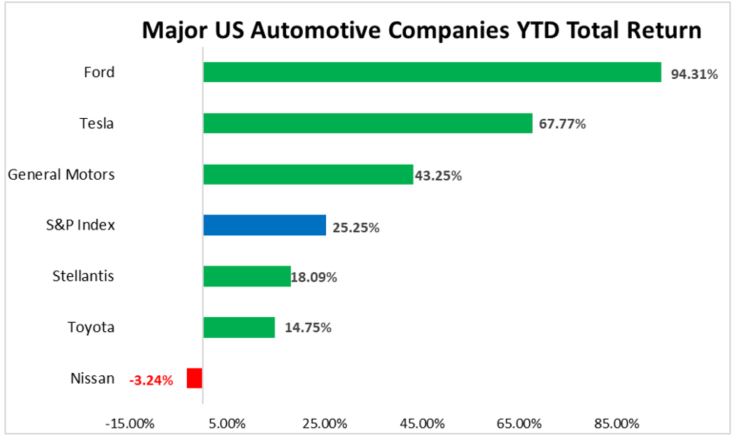

The automotive sector in particular will be transformed as EV demand gains traction. The auto manufacturers that are able to smoothly and quickly navigate the transition into EVs stand to benefit most from increased consumer demand as well as positive investor sentiment. US automaker General Motors has committed approximately USD27 billion over the next five years towards capital expenditure related to the manufacture of electric vehicles. Ford has also committed USD22 billion towards the electrification process. Tesla continues to lead the US market in terms of overall electric vehicle manufacture and stands to further benefit from increased EV demand.

The Energy sector is also anticipated to be impacted as more countries move away from combustion engines into more environmentally friendly EVs. The projected increase in EVs has the potential to slow overall growth in oil demand. In addition to EVs, more stringent fuel efficiency standards and ride sharing trends are forces that stand to reduce overall oil consumption in the years ahead.

The Material and Industrial sectors will play a major role in the development and manufacture of EVs and related infrastructure. With regard to the materials sector, the demand for copper is anticipated to increase as more EVs are brought into the market. An electric vehicle requires approximately three times more copper than a traditional petrol powered vehicle. Additionally, a major component of the batteries used to power EVs is lithium. As global EV adoption increases so will the demand for this material. The Industrial sector also stands to benefit from the electrification process as significant infrastructural development for example charging stations and more automated manufacturing production plants would be required as EV production gradually increases.

Investing in EV growth and adoption

The massive global shift to electric vehicles serves as a substantial opportunity for those seeking to invest in innovation and environmentally friendly technology. While the cost of EV adoption will have to be taken into consideration given current global economic conditions, there are potential growth opportunities for EV related stocks as well as the industries that support the advancement of the technology.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.