Global Stagflation Concerns

Insights

Price pressures have been increasing markedly over the past few months – a trend that has been observed globally, as supply chain disruptions continue to sweep over some of the largest economies in the world. At the same time, while economic growth is recovering from historically low levels in 2020 brought on by the pandemic, it remains greatly uneven among countries and continues to be fraught by a high degree of uncertainty given the nature of this particular shock. Fiscal stimulus has played a major role in underpinning economies since the onset of COVID-19 and as these large injections into the economy expire or are scaled back, investors are becoming increasingly nervous about the true strength of the global economic recovery, especially as cases of COVID and variants continue to surge. There is now concern about the possibility of stagflation – which is essentially a situation of strong inflationary pressures alongside low economic growth – a disastrous combination for policymakers everywhere. The term ‘stagflation’ was coined subsequent to the 1970’s oil market crash which saw high levels of joblessness together with weak economic growth. Concurrently, inflation ran high and interest rates were in double-digit territory.

Sources of Inflationary Pressure Currently

A combination of factors has been driving prices higher in the global space, including higher energy prices, rising food prices, a shortage of semiconductors or chips as well as shipping and production bottlenecks. Many analysts still believe that the sources of inflation may be short-term due to the reopening of economies, the normalization of demand and temporary supply issues coming out of the pandemic. The initial plunge in demand caused by COVID-19, followed by its rapid increase affected supply chains and has caused tremendous volatility in prices. In many of the advanced economies, inflation rates have overshot central bank targets. In August 2021, the US FED announced a change in its policy to allow inflation to run higher than its 2% target while deferring interest rate hikes to support the labour market and the overall economic recovery in the US. This suggests that the economic recovery is still perceived to be ambiguous with considerable headwinds.

Table 1: Advanced Economies Inflation Rates (%)

| Consumer Price Index (YoY % change) | |||

| Jan 2021 | Latest | Central Bank Target Inflation Rate | |

| Canada | 1.0% | 4.1% | 1% – 3% |

| Germany | 1.0% | 4.1% | 2% |

| United Kingdom | 0.7% | 3.2% | 2% |

| United States | 1.4% | 5.3% | 2% |

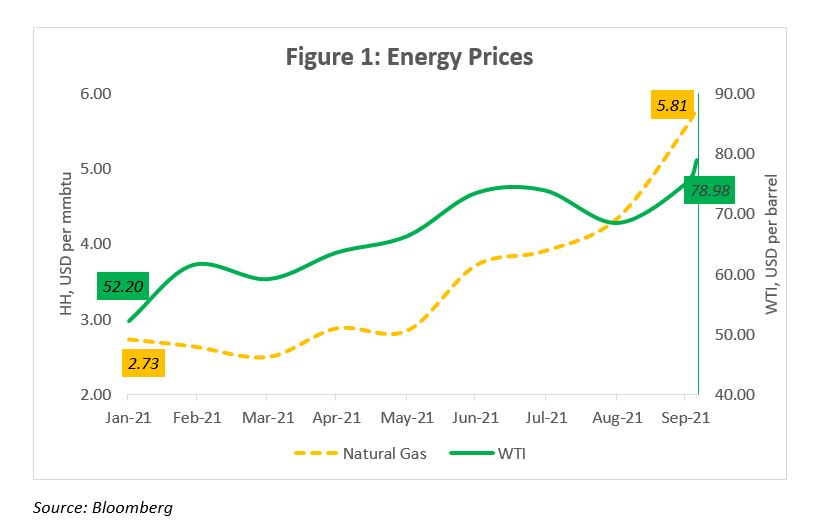

Oil prices have pushed past USD70 per barrel, getting very close to USD80 per barrel on 5 October. Prices have consistently increased since hitting a low of USD47.62 per barrel back in early January 2021 and is currently well above its year to date average of USD65.00. This compares to its 2019 and 2020 average prices of USD57.00 and USD39.00 per barrel respectively. Further, gas prices have increased sharply in European countries as well as in in the US. Year to date, oil price, as measured by WTI is up by 63%, while natural gas price as measured by Henry Hub is up by a substantial 144%! These higher costs will undoubtedly filter through to transportation costs as well as other overhead costs.

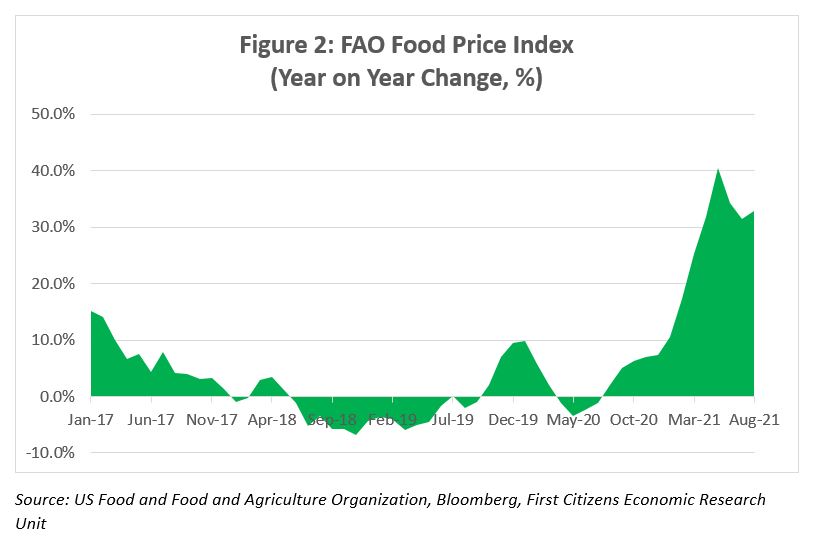

In August 2021, global food prices as measured by the UN Food and Agriculture Organization (FAO) Food Price Index rose 3.1% month on month and a significant 32.9% on a year on year basis. The sharper increase was driven largely by gains in international price for sugar, wheat and vegetable oils. Brazil is the world’s largest sugar exporter and there were concerns about damage to crops which fuelled supply concerns, while vegetable oil prices rose on account of historic high international palm oil price due to ‘protracted concerns over below-potential production’. World wheat prices also increased by 8.8% (month on month) due to reduced harvest expectations in some of the major exporters. Even before the pandemic, global food prices were on the rise, especially so during the US – China trade disputes which saw introduction of import tariffs on various food items.

The current chip supply shortage is also heavily impacting end markets such as automotive as well as technology. Apple Inc. and Samsung are both expecting large revenue losses as a result of component shortages, while automakers have announced plant shutdowns and billions in losses as factories remain idle due to the shortages, consequently, car prices have increased particularly in the US. There are mixed views about how long the semiconductor chip shortage will persist with some suggesting that the inflationary impact from the shortage will possibly run until 2022, as supply normalizes. According to a report done by the European Central Bank, the shortage is expected to continue in the near term. The Bank noted that “while the major global chip manufacturing firms plan to expand capacity and boost their capital expenditure by almost 74%, which is largely planned to be implemented by end-2021, both the complexity and the time required to build new plants is such that the industry’s headwinds are likely to remain throughout this year”.

Shipping and transportation costs have also skyrocketed year to date. The Baltic Dry Index, which provides a gauge of the cost to ship raw materials on approximately 50 shipping routes, has increased dramatically over the past few months. Based on data from Bloomberg, the index has climbed sharply by 123% year to date and is currently at its highest level since June 2008. Meanwhile, global transportation costs have increased due to higher average retail gas prices as well as the surge in demand as economies reopen.

Inconsistent Economic Recovery

While the global economy is forecasted to grow in 2021, there are significant risks that taint the outlook, including the impact of supply shocks across the world as well as lower demand due to the rapid spread of the Delta variant of Covid-19. There are concerns that the US economic growth may have peaked as fiscal stimulus programs diminish and data from China shows a sharp slowdown in Chinese manufacturing. Surveys which gauge manufacturing activity for major economies also hint at slowing pace of economic growth as businesses are less optimistic. Fed Chairman Powell noted in September that inflation in the US may ‘persist for longer than expected as reopening pressures and supply chain problems converge’, upending the view that price pressures are largely transitory. The culmination of weak growth together with strong price pressures will complicate policy decision and the timing of removing the substantial amount of accommodative and expansionary economic measures over the past 18 months. Contractionary monetary policies that will typically be deployed to restrain inflation, will likely further weaken labour market conditions and squeeze economic growth under a scenario of stagflation.

Domestic Prices Increase

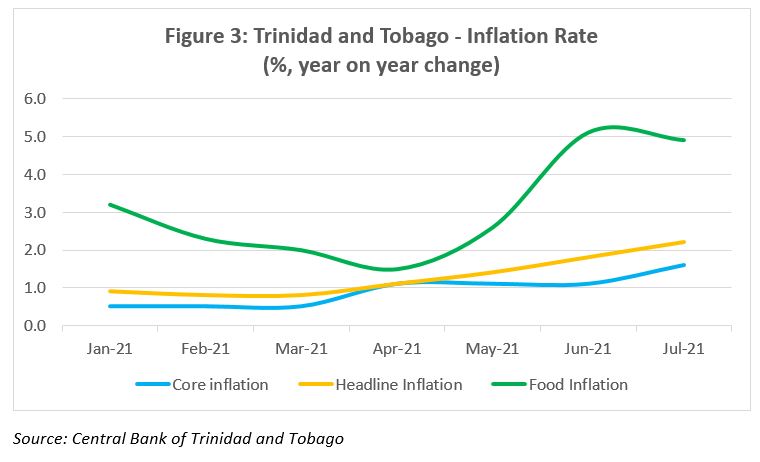

Recent data also indicates that domestic price pressures have increased notably. According to the Central Bank of Trinidad and Tobago (CBTT), the driving factors were similar to those aforementioned. Data shows that the food prices rose 4.9% in July 2021, compared to 3.2% at the start of the year, while core inflation which strips away the volatility of food prices was contained at 1.6% relative to 0.5% in January. Overall, headline inflation has crept up to 2.2%, well above its 2020 average of 0.6%. The last time inflation crossed the 2% level was back in the first quarter of 2017. The CBTT also highlighted the recent announcement of increases in transportation fares, which will likely cause headline inflation to rise further in the coming months. There were also publicly announced increases in some basic food items by local manufacturers, which cited increases in the cost of raw materials as well as higher shipping costs. In the National Budget for fiscal year 2021/ 2022, it was announced that effective 1 November 2021, value added tax (VAT) on basic food items will be removed to make these essential items more affordable.

The economic situation in T&T mirrors that of the global space, where there are nascent signs of an uptick in prices while at the same time, the T&T economy has been stagnant, averaging GDP growth of -0.3% since 2010, excluding the estimated 7.8% contraction in 2020. During the period 2010 – 2016, the average rate of GDP growth was around 1.2%, while at the same time headline inflation averaged 6.7%. However, over the past five years, growth averaged -3.5% as inflation moderated to an average of 1.5%. Standard and Poor’s projects that the T&T economy will contract by 1% in 2021 and will rebound to a growth of 3.9% in 2022, while inflation is expected to rise modestly to 1.1% and 1.5% in 2021 and 2022 respectively. But like the outlook for the global economy, risks are skewed to the downside.

The combination of supply chain disruptions, higher shipping and logistical costs, energy shortages across the UK, Europe and China with resulting rise in energy prices combined with the ongoing threat of the highly contagious Delta variant all seem to suggest that price pressures are likely to continue at least into the short-medium term. Global financial markets have pared gains as US stocks have declined as investors have generally become more risk averse as the threat of stagflation emerges. While a 1970’s style of stagflation is not the core view for the global economy, the growing threat of higher prices combined with the uncertainties associated with economic growth are a cause for concern, as it complicates policy decisions at a time when policy makers are contemplating unwinding stimulus programs.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.