Review of Equity Markets over the 2nd Quarter 2021

Insights

International Market Review

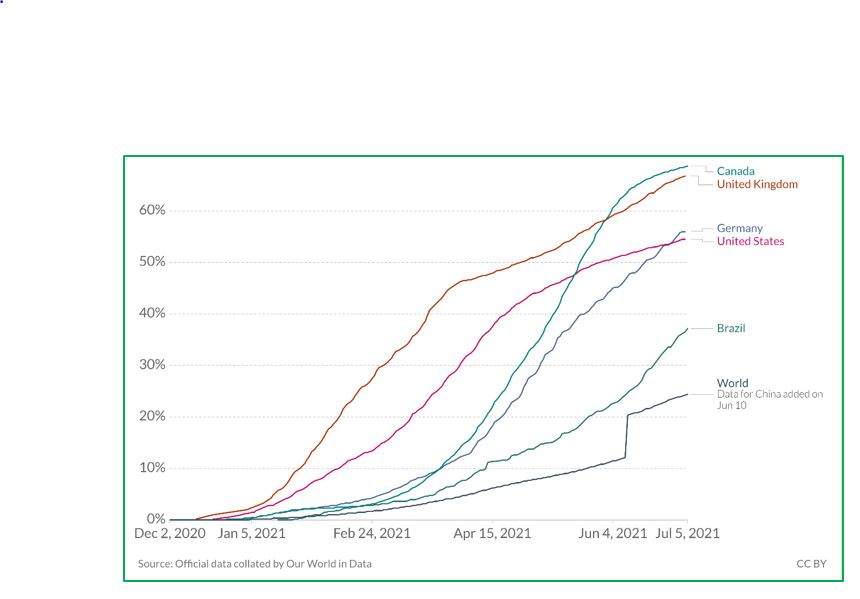

Global equities maintained its upward momentum in Q2 2021, supported by the accelerated roll-out of the COVID-19 vaccines across the world which facilitated the reopening of economies and a surge in economic growth. Based on the chart below, roughly 25% of the world’s population has received at least one dose of a COVID-19 vaccine, with rates exceeding 50% in the United Kingdom, Canada, Germany and the United States.

Chart 1: Percentage of Persons who received at least 1 dose of COVID-19 Vaccine

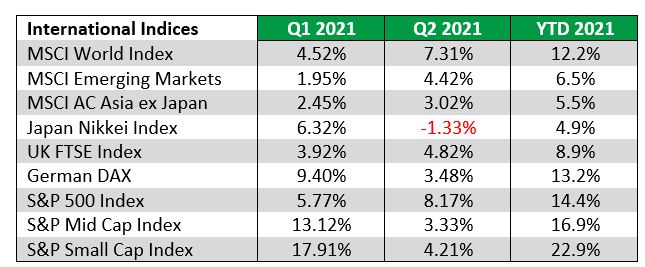

For the Q2 2021, the MSCI World Index, a benchmark for global equities, rallied 7.31 percent, up from 4.52 percent in the first quarter of the year. The momentum was driven by emerging market equities that registered a strong return of 4.42 percent, double the gain achieved in the prior quarter. Leading the performance was Brazil – the best performing market in the MSCI Emerging Markets Index, bolstered by currency gains and a tighter monetary stance in the face of rising inflation.

The MSCI AC Asia ex Japan posted modest gains in Q2 2021 of 3.02 percent, up from 2.45 percent in Q1 2021. Returns were tempered due to the resurgence of COVID-19 infections owing to low vaccination rates and the reimplementation of lockdown measures to curb the Delta variant. Japanese shares underperformed for the quarter with a loss of 1.33 percent compared with a 6.32 percent gain in Q1 2021. Investor optimism was negatively impacted by the slow roll-out of the vaccination program that resulted in a persistent increase in COVID-19 infections which led the government to delay the lifting of the state of emergency until 20 June.

In Europe, countries faced a similar challenge with the sharp uptick of the Delta variant of COVID-19 which pushed back re-opening efforts and lifting of social distancing laws by various governments. Consequently, the momentum seen in the prior quarter eased considerably in the second quarter of 2021, with UK and German stocks posting returns of 4.82 percent and 3.48 percent respectively.

US equities achieved strong gains in Q2 2021, as the S&P 500 Index reached an all-time high on the final day of June at 4,297.50. By market capitalization, Small and Medium cap stocks underperformed their large cap counterparts, with gains of 3.33 percent and 4.21 percent respectively, down from double digit returns in Q1 2021.

Table 1: International Equity Indices

US Sector Performance

On a sector level, nine out of the ten S&P 500 sectors posted positive returns over the quarter. Information Technology (11.3 percent), Telecommunications (10.5 percent) and Energy (10.1 percent) were the top performing sectors in Q2 2021 and outperformed the S&P 500 index. The sector laggards included Consumer Staples that registered a small gain of 3.2 percent while Utilities was the only sector to post a loss for the quarter.

Chart 2: US Sector Performance

Local Market Review

In the local stock market, the Composite Index picked up considerably in Q2 2021 with a return of 4.40 percent, up from 1.54 percent in Q1 2021. The expansion was bolstered by a sharp uptick in the All T&T index as it soared by 8.31 percent over the quarter compared with a loss of 0.43 percent in Q1 2021. Overall returns were tempered by the loss incurred by the cross listed stocks, as the Cross Listed Index declined by 4.30 percent in Q2 2021 compared with a 3.89 percent gain in the prior quarter.

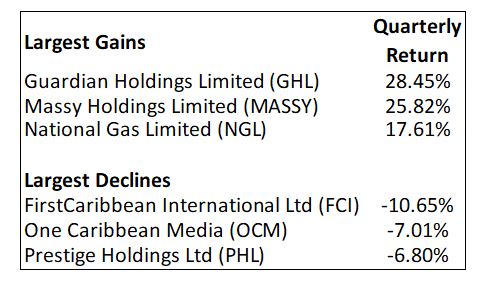

The stocks with the largest share price gains over the second quarter of 2021 were Guardian Holdings (GHL), Massy Holdings Limited (MASSY) and Trinidad & Tobago National Gas Limited (NGL) with returns of 28.5 percent, 25.8 percent and 17.6 percent respectively. Leading the declines were FirstCaribbean International Bank Limited (FCIB), One Caribbean Media (OCM) and Prestige Holdings Limited (PHL) down by 10.6 percent, 7.0 percent and 6.8 percent respectively.

On May 5 2021, GHL relisted its ordinary shares on the Jamaican Stock Exchange at a price of JMD582.46 (TTD25.51). With a market capitalization of JMD135bn and 232 mn ordinary shares, GHL is the third largest company on the exchange and trades using the same symbol GHL. Taking the cue from GHL, MASSY announced on May 6 their intentions to cross-list on the Jamaican Stock Exchange.

Trinidad & Tobago Stock Exchange Largest Gains and Declines: 31 March 2021 to 30 June 2021

Equity Markets Outlook

Global equities are expected to continue to perform for the rest of the year, supported by the post-vaccine economic recovery, robust earnings growth, stimulus measures and accommodative policies by central banks. The gains however will not be evenly distributed, with near term gains in sections of the market that are more heavily exposed to the reopening and recovery of the economy. Sectors such as energy, materials, industrials and consumer discretionary are better positioned to capture the ongoing pickup in activity. The financial services sector also stands to benefit and should experience reduced loan-loss provisions and credit growth as employment increases.

Despite this anticipated improvement, risks still exist including inflation, future policy of the US Federal Reserve and the pandemic. The combination of higher demand (from the reopening of economies and fiscal support), along with disruptions in supply chains have created inflationary pressures in many countries, as consumer prices exceeds the target rate of several central banks. While some central banks view the spike in inflation as transitory, others have already started hiking interest rates in an effort to temper rising prices. If the economic recovery is not entrenched, such action may be premature and thus may have a negative impact on the pace of the economic recovery.

The rapid spread of the infectious COVID variants may delay the reopening momentum, and may even stall such plans altogether. Many countries including India, China, Australia and South Africa were forced to re-implement local lockdown measures due to rising cases of the Delta variant. There is the possibility that a new COVID-19 variant may appear and render Covid-19 vaccines less effective.

Locally, sourcing foreign currency continues to be a challenge for several businesses and may contribute to rising prices. In addition, the staggered vaccination roll out and possible delays in the receipt of the vaccines, despite the recent uptick in vaccine availability, could give rise to a resurgence in cases and defer reopening efforts. To guard against possible volatility or negative sentiment, a well-diversified portfolio should be maintained and dips in the stock market can be utilized to rebalance into securities or sectors that are underrepresented.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.